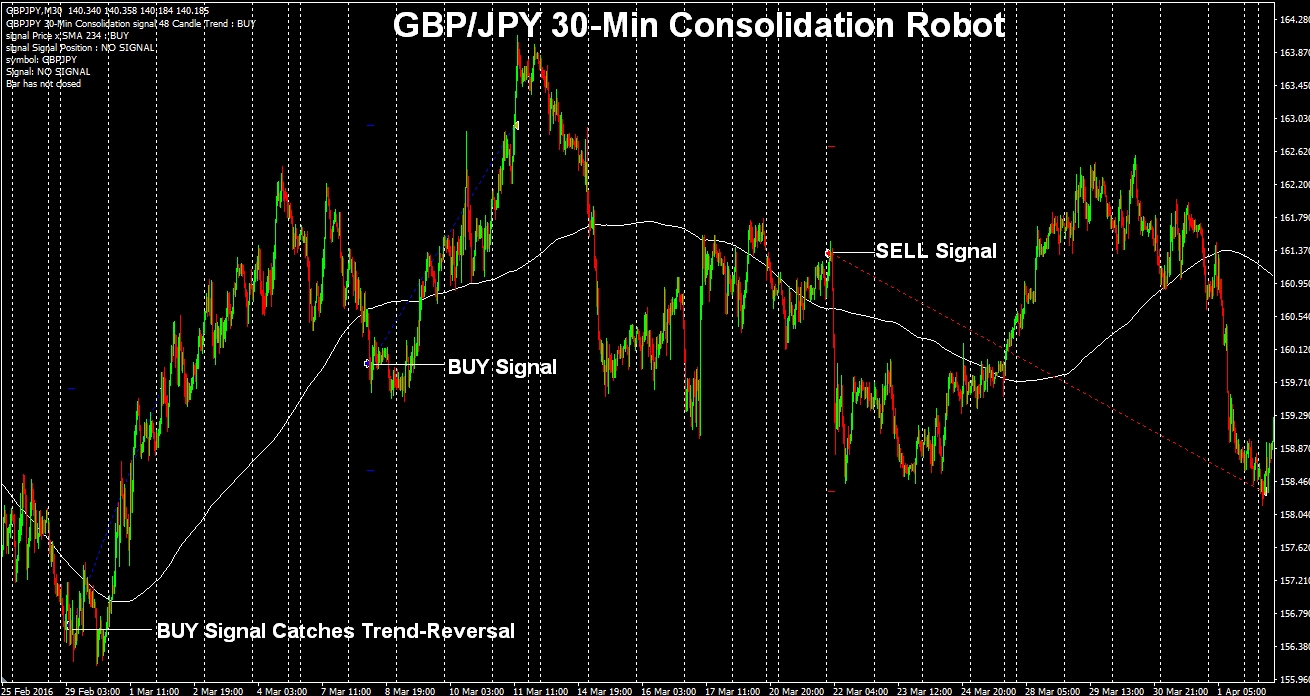

GBP/JPY 30-Minute Consolidation Robot

with Roulette TRADER Money Management

An Automated Expert Advisor (EA)

For the MetaTrader4 Trading Platform

Only $69 for current Robot customers!

Log in to show the $69 buy button.

SINGLE ROBOT PERFORMANCE GUARANTEE

$99 Single Robot Purchase Guarantee: If you purchase this GBP/JPY 30-Min Consolidation robot as a $99 single-robot purchase, I will refund 100% of your purchase price if this robot does not make at least 150 pips net profit within 60 days of your purchase. You do not need to be trading this robot on your account to qualify. Just contact me with your receipt and a quick look at the robot's 60-day performance on my LIVE Model Account will confirm if you qualify or not. However, please be aware that your robots will be permanently disabled if you receive a refund.

See the bottom of this page for the multi-robot guarantee

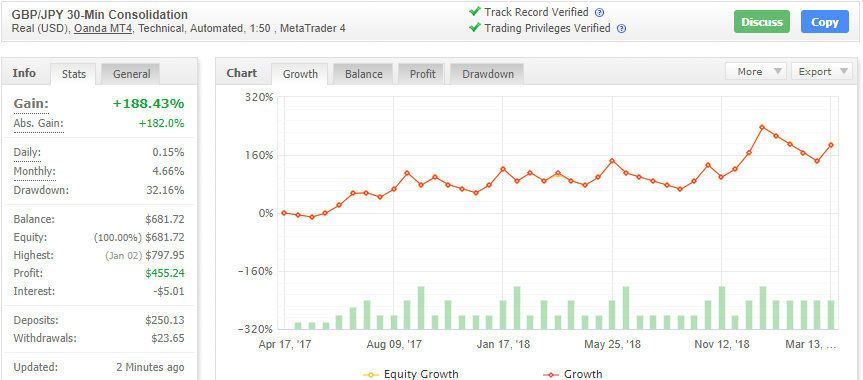

CLICK HERE TO SEE A LIVE ACCOUNT Tracking This Robot!

System Details

This is a GBP/JPY Consolidation Trading Robot that runs on the 30-Minute candlestick chart. This MT4 robot was specifically designed to do well during the draw-down periods of the GBP/JPY Trend-Following Robots, and more specifically that of the GBP/JPY 15-Min Trend-Following robot.

It primarily enters trades on deep counter-trend moves that often stop out the trend-following robots. It also tends to avoid trading against sustained trends and occasionally predicts trend-reversals. As a result, combining this robot with the trend-following robots should help smooth your draw-downs and provide a more consistent combined equity curve.

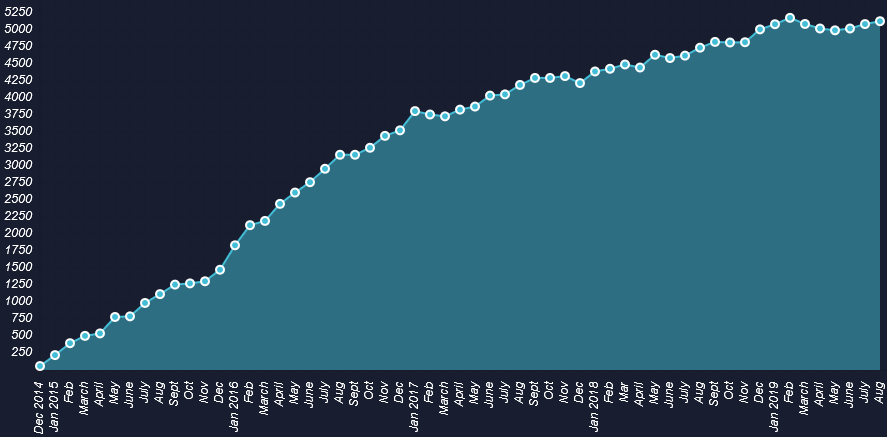

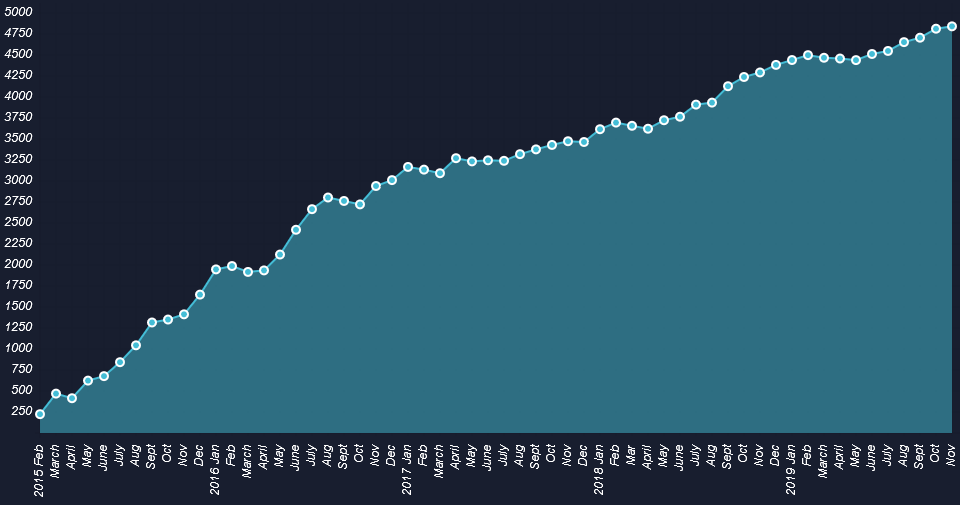

The equity curve below shows the raw trade signals without any money management applied using a 10k fixed lot per trade.

Raw Trade Signal Results (No Money Management Applied)

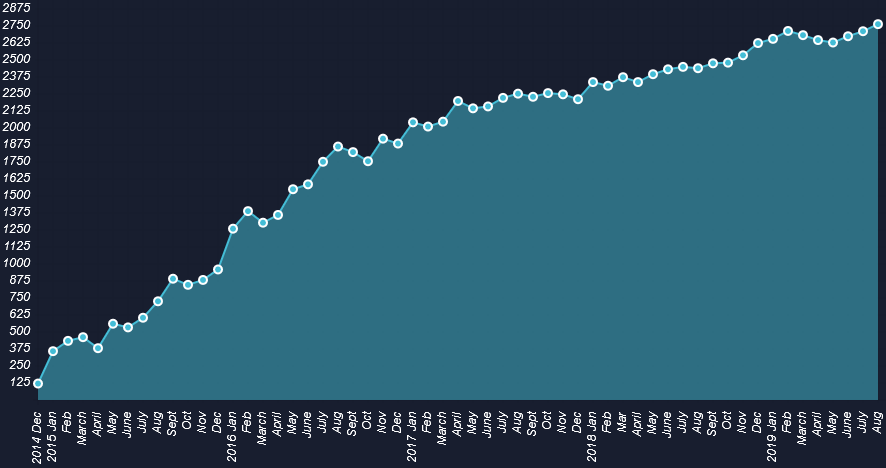

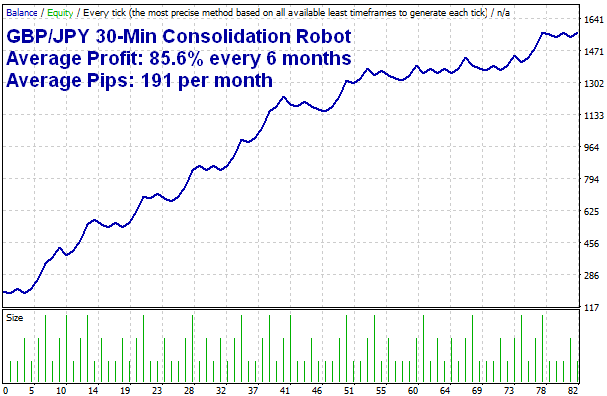

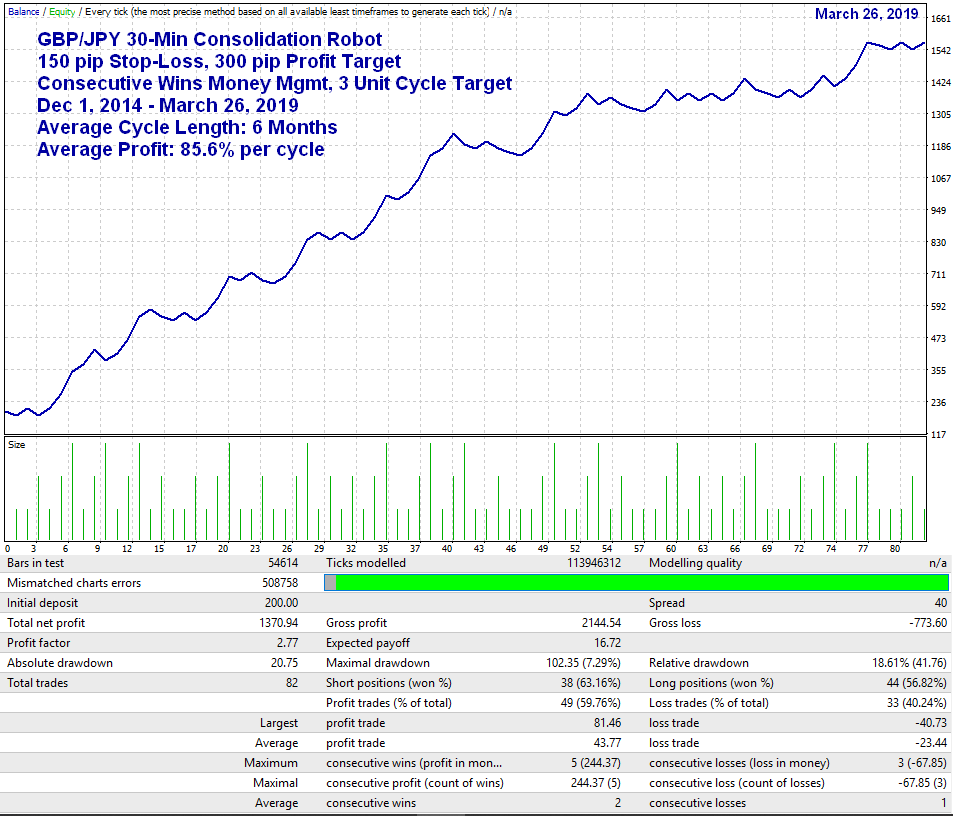

Using "Consecutive Wins" Money Management...

Consecutive Wins Money Management

with a 3 Unit Cycle Target

With a profit target that is twice the size of the stop-loss, this robot was NOT designed to generate long winning streaks; however, short winning streaks do occur and profits snowball quickly when they do. The strategy shown below is the Consecutive Wins strategy with a short 3-Unit Cycle Target. The model shown below is the default settings for this robot. See the recommended settings below the illustration.

MONEY MANAGEMENT SETTINGS:

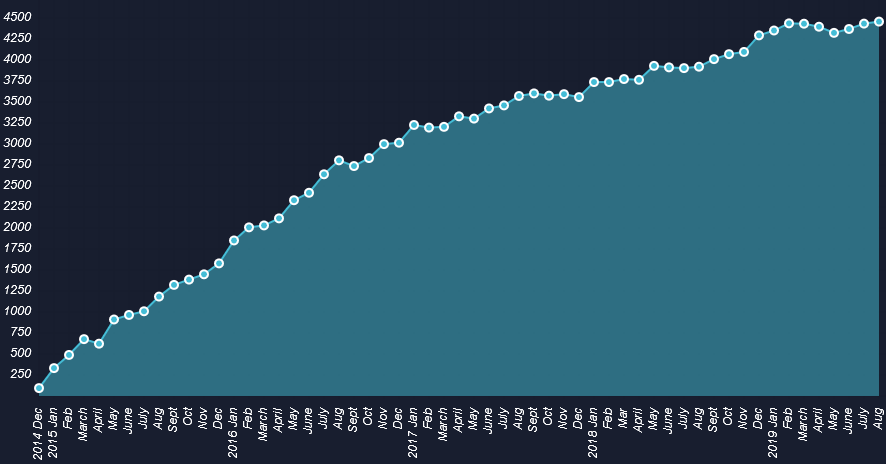

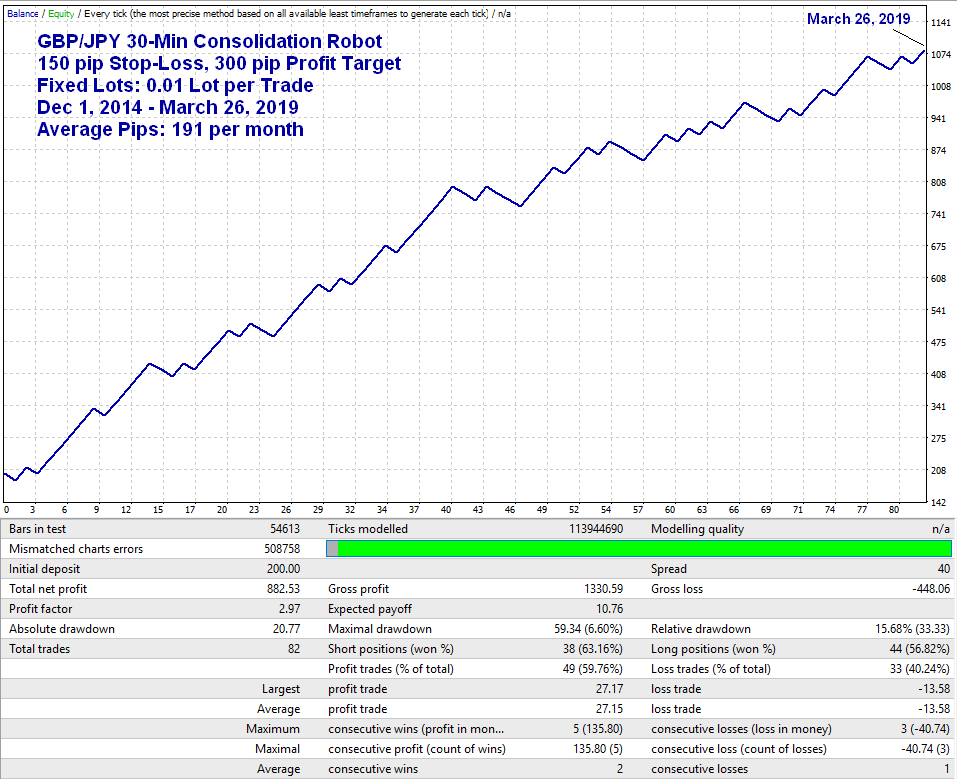

This robot was designed to be traded with the GBP/JPY Trend-Following robot for the purpose of reducing the draw-downs of the more profitable Trend-Following robot. See Portfolio-1 for the best settings on each of these EAs when traded together. Here are the default Money Management settings, which were used in the model above:

Minimum Lot: 0.01 (Recommended at least $200 margin per 0.01 lot here)

Unit Size: 0.01 (Set EQUAL to your Minimum Lot setting)

Max Lot/Cycle Target: 0.03 (Set to 3 times your Unit Size setting for a 3 unit cycle target)

Stop Loss: 150 (your stop-loss in pips)

Take Profit: 300 (your profit target in pips. Settings from 250 to 300 test well)

Trading Hours:

This robot does not use the trading hours feature. Keep the Trading Hours settings at 0 to remain disabled.

Trailing Stops:

This robot does not use Trailing Stops. Keep the Trailing Stops settings at 0 to remain disabled.

Recommended Robot Combinations...

PERFORMANCE GUARANTEES

$149 3-Robot Package Guarantee: My 3-robot package guarantee is based on the combined performance of the GBP/JPY 15-Min Trend-Following Robot and the GBP/JPY 30-Minute Consolidation Robot. If these 2 robots do not make at least 500 pips in combined net profit within 60 days of your purchase, I will refund 100% of your purchase price whether you were trading these robots on your own account or not. Just contact me with your receipt and a quick look at these robots' 60-day performance on my LIVE Model Accounts (tracked by MyFXBook.com) will confirm if you qualify or not. Therefore, you do not need to be trading them on your own account to qualify. However, please be aware that your robots will be permanently disabled if you receive a refund.

$99 Single Robot Purchase Guarantee: I offer a money-back performance guarantee for most robots when purchased separately. The terms of these individual guarantees are detailed on each robot's sales page, where applicable.

Risk Disclosure

This website does not guarantee income or success of the product beyond the specific 60-day performance guarantees for each product. There are many factors that can effect each person's individual results. Examples shown in this presentation do not represent an indication of future success or earnings but merely historical performance based on specific trading models, some of which is hypothetical. Past performance is not indicative of future results. The company declares the information shared is true and accurate.

U.S. Government Required Disclaimer - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.