Trend-Following Trading Robot

with Roulette TRADER Money Management

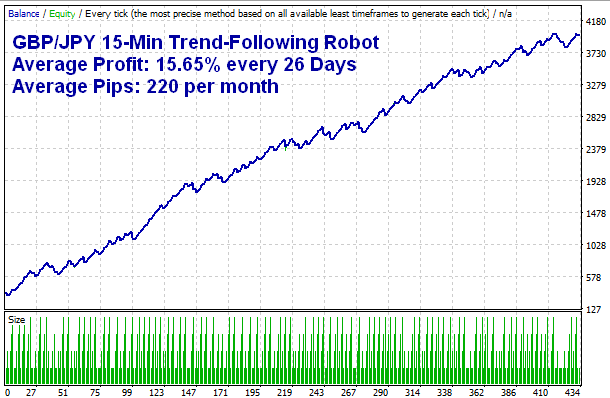

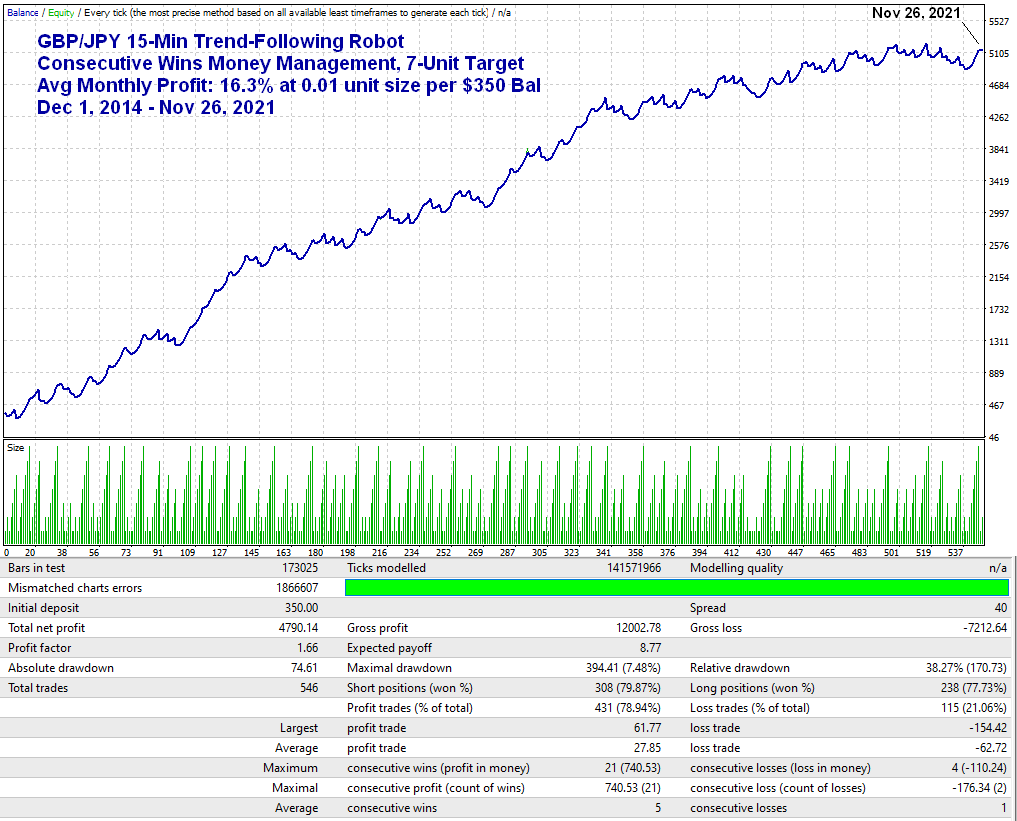

GBP/JPY 15-Min Trend-Following Robot

with Roulette TRADER Money Management

An Automated Expert Advisor (EA)

for the MetaTrader4 Trading Platform

Lifetime License, Source Code File Included

Only $69 for current Robot customers!

Log in to show the $69 buy button.

Contact Don to pay by Crypto, Skrill or Neteller

PERFORMANCE GUARANTEE

Purchase Guarantee: If you purchase this GBP/JPY 15-Min robot as a $99 single-robot purchase, I will refund 100% of your purchase price if this robot does not make at least 400 pips net profit within 60 days of your purchase. Just contact me with your receipt and a quick look at the robot's 60-day performance on my LIVE Model Account will confirm if you qualify or not. Therefore, you do not need to be trading this robot on your account to qualify. But please be aware that your robot will be permanently disabled if you receive a refund. It's only fair!

CLICK HERE to see a LIVE ACCOUNT Trading This Robot!

RECENT LIVE TRADES... Please note that this live model account is currently running 2 versions of this robot simultaneously so it opens and closes 2 positions at a time. Each version uses a different cycle target (4 units and 7 units) in the money management system so they lock in profit at different points in winning streaks, as you'll see in the models shown below. 3 versions of the EA are included in your purchase for different cycle targets. CLICK HERE to see LIVE results (updated every 30 minutes).

Please note that this live model account is currently running 2 versions of this robot simultaneously so it opens and closes 2 positions at a time. Each version uses a different cycle target (4 units and 7 units) in the money management system so they lock in profit at different points in winning streaks, as you'll see in the models shown below. 3 versions of the EA are included in your purchase for different cycle targets. CLICK HERE to see LIVE results (updated every 30 minutes).

System Details

This is a GBP/JPY Trend-Following Trading System that runs on the 15-minute candlestick chart. This is a time-tested MT4 robot that was created in May 2015 and has been running live since then with solid performance. It is designed to do well in "STRONG" short-term trends, which is common with the GBP/JPY currency pair. It does not hedge and is FIFO compliant for US accounts. It only opens ONE trade at a time and holds the position until either the stop-loss or profit target is hit. During choppy sideways market conditions, it trades less often and sometimes stays out of the market completely while it waits patiently for higher volatility when trend direction is more clear. This helps prevent whipsaws in choppy conditions, which is a typical weak spot for most trend-following robots on the market.

The best part about this system is that the wins and losses are very well grouped together, and that suits our money management system beautifully! In order to understand my proprietary money management system, please read the Roulette Trader ebook, which is included FREE with the purchase of any robot.

There are 3 versions of this robot featured on this page and they all use the same signal strategy. The only difference is the cycle targets used in the money management system (3, 4 and 7 units). You will receive a copy of all 3 versions of this robot with your purchase. You can run 1, 2 or all 3 versions simultaneously for diversification in the money management so they each lock in profit at different points in the winning streaks. Just attach each EA to a different GBP/JPY 15-Min chart with a different Magic number in the settings so each instance of the EA knows which trades it opened.

Below is a screenshot of these trend-following signals on a chart where it caught the trend going both directions. The sell signals caught the move down and then it wasted no time jumping back in long to ride the trend back up. The red arrows with red dotted lines are the sell signals. The blue arrows with blue dotted lines are the buy signals.

GBP/JPY 15-Min Trend-Following Signals

Using a 3 Unit" Cycle Target

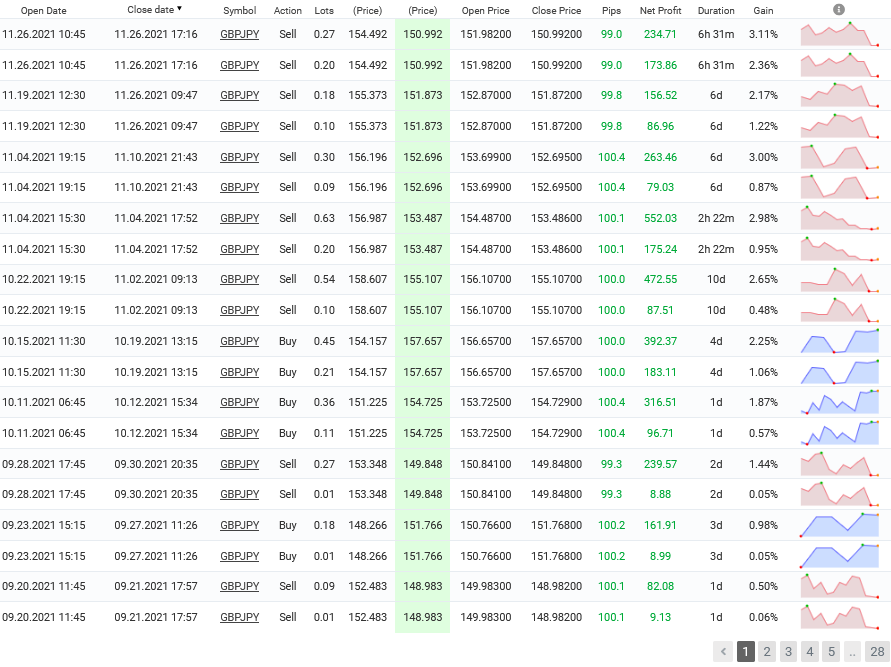

Consecutive Wins Money Management

with a 3 Unit Cycle Target

This 3-Unit version of the robot is currently averaging 7.7% profit per month at my minimum recommended balance of $350 per 0.01 unit size. This is assuming you compounded your profits monthly or at the end of each 3 unit cycle profit target (3 consecutive winning trades).

Consecutive Wins, 3 Unit Cycle Target (Avg 7.7% per month)

MONEY MANAGEMENT SETTINGS, 3 UNIT CYCLE TARGET:

To copy this model (for a goal of 7.7% average profit per cycle) use the following as a guide for the money management settings (the settings shown are for $350 allocated balance, the absolute minimum margin recommended to properly trade this EA and money management model. 3-Unit preset files are included with this EA for various account sizes.

Minimum Lot: 0.01 (Minimum $350 allocated balance per .01 Minimum Lot)

Unit Size: 0.01 (Set equal to your Minimum Lot setting)

Max Lot/Cycle Target: 0.03 (Set to 3x your Unit Size setting, assuming both settings above are equal in size)

StopLoss: 250 (pips)

TakeProfit: 100 (pips)

NOTE: The leverage settings suggested above are my MAXIMUM recommended aggressiveness designed to keep typical cycle draw-downs below 50% based on the historical performance period shown above but it's always possible to have larger cycle draw-downs in the future. Therefore, I recommend decreasing your leverage once you have reached a comfortable monthly return and use this model as a guide to calculate the leverage for your own risk tolerance. For example, if your risk tolerance is only a 25% cycle draw-down, then the settings above would be appropriate for a $700 account balance and the average cycle would return about 25% profit. If your cycle draw-down (not peak-to-valley) ever exceeds 50%, either reduce lot sizes based on the current balance or deposit more funds to your account to complete the cycle at your current sized lots. You need to stay in the game to win it.

Using a 4 Unit Target...

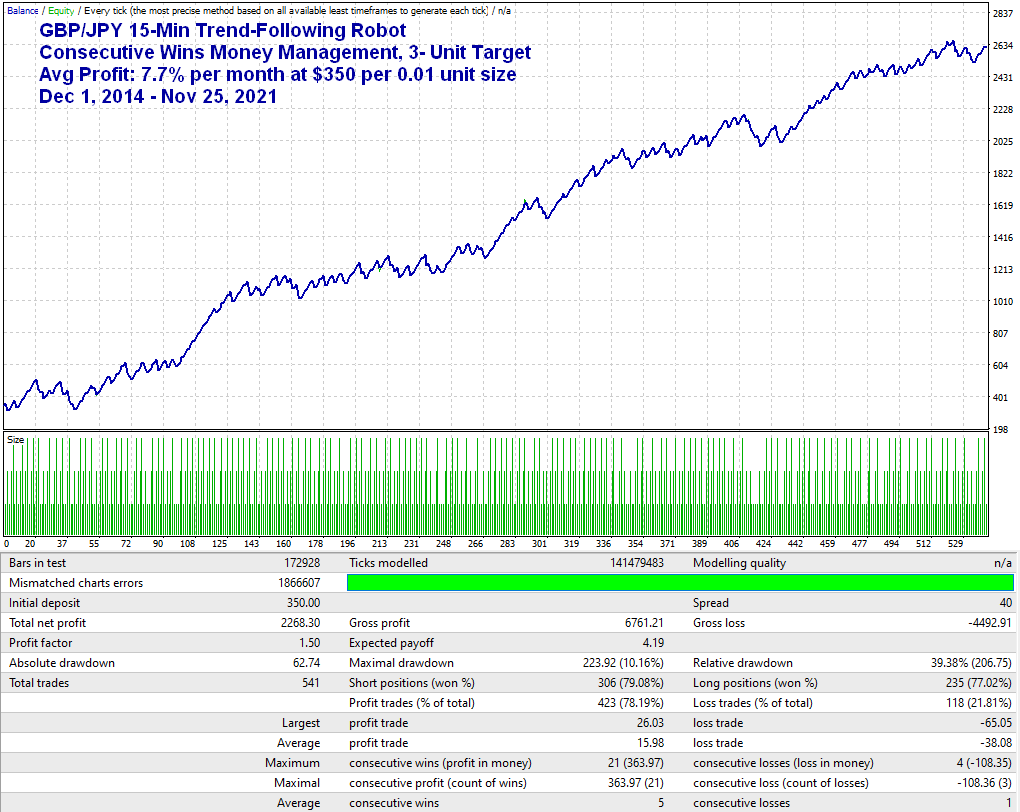

Consecutive Wins Money Management

with a 4 Unit Cycle Target

This version of the robot uses "Consecutive" Wins Money Management but with a 4 unit cycle profit target (attempting 4 consecutive wins to complete a money management cycle). Read my eBook if you don't know what a cycle target is. I typically prefer larger cycle targets to get more power out of the money management system but a 4 unit cycle target seems to fit the rhythm of GBP/JPY very nicely with this signal strategy and it provides the smoothest equity curve. A 4 unit cycle target is a great option for someone who would like to withdraw profits each month since withdrawals should only be made following a cycle target when trading at high leverage.

On average, a 4-unit cycle target is hit every 25 days including weekends. The average monthly return over the past 6 years is $52.70 for each 0.01 unit size. That's a 15% monthly average if you're allocating $350 per 0.01 unit in the money management system. See the Money Management Settings further below for more details.

To get the most out of the compounding factor, you should check your account daily and compound profits (increase the lot sizes in your money management settings) each time a 4 unit cycle target is hit (4 consecutive wins) and you have accumulated at least $350 in profit since your last lot increase ($350 profit is the minimum I recommend to increase your unit size by 0.01 lot). This 4-Unit version of the robot is included with your purchase.

Consecutive Wins Money Management, 4 Unit Cycle Target

MONEY MANAGEMENT SETTINGS, 4 UNIT CYCLE TARGET:

To copy this model, use the following as a guide for the money management settings (the settings shown are for $350 allocated balance, the absolute minimum margin recommended to trade this EA.

Minimum Lot: 0.01 (Minimum $350 balance per 0.01 Minimum Lot)

Unit Size: 0.01 (Set equal to your Minimum Lot setting)

Max Lot/Cycle Target: 0.04 (Set to 4x your Unit Size setting, assuming both settings above are equal in size)

Stop Loss: 250 (pips)

Take Profit: 100 (pips)

NOTE: The leverage settings suggested above are my MAXIMUM recommended aggressiveness designed to keep typical cycle draw-downs below 50% based on the historical performance period shown above but it's always possible to have larger cycle draw-downs in the future. Therefore, I recommend decreasing your leverage once you have reached a comfortable monthly return and use this model as a guide to calculate the leverage for your own risk tolerance. For example, if your risk tolerance is only a 25% cycle draw-down, then the settings above would be appropriate for a $700 account balance and the average cycle would return about 25% profit. If your cycle draw-down (not peak-to-valley) ever exceeds 50%, either reduce lot sizes based on the current balance or deposit more funds to your account to complete the cycle at your current sized lots. You need to stay in the game to win it.

Using a 7 Unit Cycle Target...

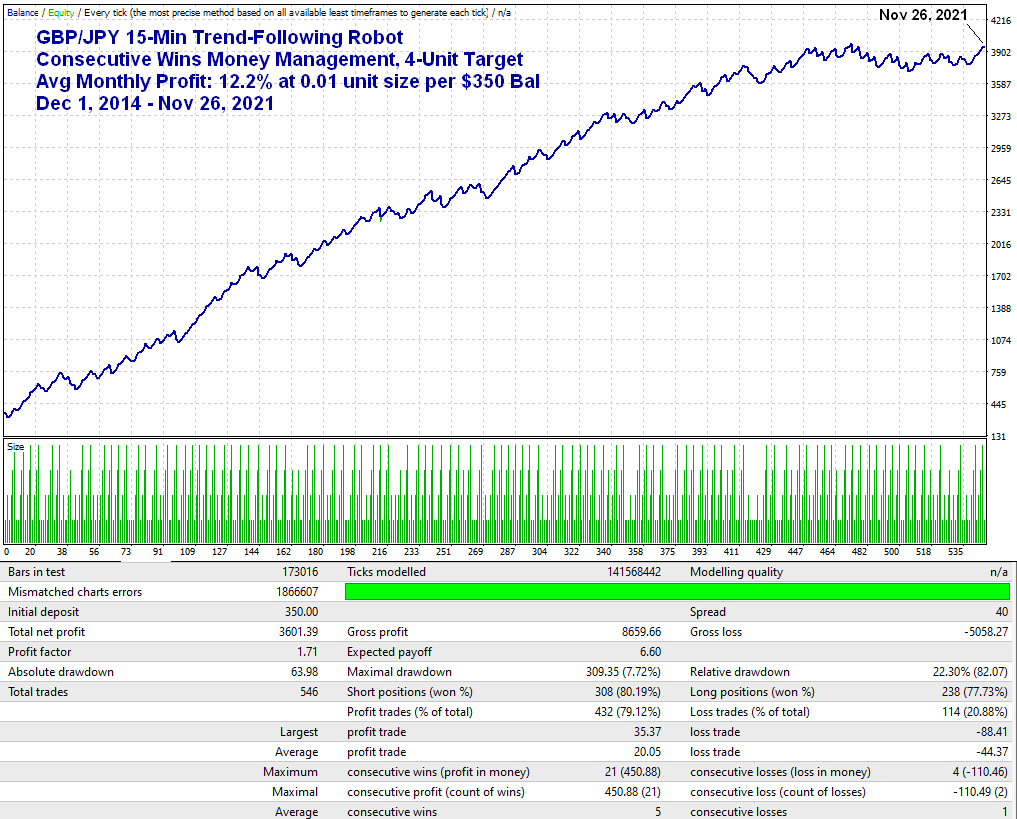

Consecutive Wins Money Management

with a 7 Unit Cycle Target

This version of the robot also uses "Consecutive" Wins Money Management with a 7 unit cycle profit target. Read my eBook if you don't know what that means. On average, a 7-unit cycle target is hit every 2.4 months at an average profit of 50% profit per cycle if you were to compound your profits at the end of each cycle at my maximum recommended leverage (0.01 Minimum Lot and Unit Size per $350 margin). See the Money Management Settings further below for more details. This version of the robot is included with your purchase.

Consecutive Wins, 7 Unit Cycle Target

The backtest above does NOT include cycle-to-cycle compounding of profits but the graph below shows how a $1000 account could have potentially grown if you had compounded your profits at the end of each cycle in the historical performance above (allocating $350 balance per 0.01 unit size).

Cycle-to-Cycle Compounding Model using

Consecutive Wins Money Management, 7 Unit Cycle Target * This is a hypothetical compounding model based on 0.01 unit size per $350 balance.

* This is a hypothetical compounding model based on 0.01 unit size per $350 balance.

Past Performance is not indicative of future results. Individual results will vary.

MONEY MANAGEMENT SETTINGS, 7 UNIT CYCLE TARGET:

To copy this model (for a goal of 50% average profit per cycle) use the following as a guide for the money management settings (the settings shown are for $350 allocated balance, the absolute minimum margin recommended to properly trade this EA and money management model.

Minimum Lot: 0.01 (Minimum $350 allocated balance per .01 Minimum Lot)

Unit Size: 0.01 (Set equal to your Minimum Lot setting)

Max Lot/Cycle Target: 0.07 (Set to 7x your Unit Size setting, assuming both settings above are equal in size)

StopLoss: 250 (pips)

TakeProfit: 100 (pips)

NOTE: The leverage settings suggested above are my MAXIMUM recommended aggressiveness designed to keep typical cycle draw-downs below 50% based on the historical performance period shown above but it's always possible to have larger cycle draw-downs in the future. Therefore, I recommend decreasing your leverage once you have reached a comfortable monthly return and use this model as a guide to calculate the leverage for your own risk tolerance. For example, if your risk tolerance is only a 25% cycle draw-down, then the settings above would be appropriate for a $700 account balance and the average cycle would return about 25% profit. If your cycle draw-down (not peak-to-valley) ever exceeds 50%, either reduce lot sizes based on the current balance or deposit more funds to your account to complete the cycle at your current sized lots. You need to stay in the game to win it.

HOW TO CUSTOMIZE YOUR TRADING HOURS...

TRADING HOURS:

This robot does best in a 23 hour trading window between 8:47 and 7:47 AM Jerusalem Time (GMT+2 or GMT+3, depending on the time of year). If the time zone of your MT4 PRICE FEED is NOT on this time zone, you will need to adjust the StartHour and EndHour settings in the EA properties. There are preset files included for Jerusalem and London time zones. PLEASE NOTE: The time on your charts has no relation to your local time. Your charts will reflect the time of your broker's price feed server providing the data. To check the time of your charts, place the cross hair tool over a current 1 minute bar and the time will appear at the bottom of the cross hair. GMT+2 (Jerusalem) is the time zone most commonly used by brokers for their price servers. Do not change the minute settings. Trading hours are in military time (0-23 hours). The default settings of the EA are in bold font...

Start Time: 8:47 (Set to 6:47 for GMT (London), 8 for GMT+2/3 (Jerusalem)

End Hour: 7:47 (Set to 5:47 for GMT (London), 7 for GMT+2/+3 (Jerusalem)

TRADING HOURS:

This robot does best in a 23 hour trading window between 00:15 and 23:45 AM Jerusalem Time (GMT+3). If the time zone of your MT4 PRICE FEED is NOT on this time zone, you will need to adjust the StartHour and EndHour settings in the EA properties. The preset files included for the GMT+3 time zone. PLEASE NOTE: The time on your charts has no relation to your local time. Your charts will reflect the time of your broker's price feed server providing the data. To check the time of your charts, place the cross hair tool over a current 1 minute bar and the time will appear at the bottom of the cross hair. GMT+3 (Jerusalem) is the time zone most commonly used by brokers for their price servers. Do not change the minute settings. Trading hours are in military time (0-23 hours). The default settings of the EA are in bold font...

Start Time: 00:15 (Set to 00:47 for GMT (London) chart time zone.

End Hour: 23:45 (Set to 22:45 for GMT (London) chart time zone.

The EA includes preset files for GMT+3 time zone (Jerusalem time). If your current chart time does not match this and you're not sure what StartTime and EndTime settings to use, please contact me so we can figure it out. You may use the World Clock to calculate the difference in time zones at: www.timeanddate.com/worldclock/

UTC/GMT time is located below all the city times on the World Clock (link above).

WATCH A BACKTEST VIDEO...

Watch me in action!

Watch the 8-Unit Consecutive Wins Robot in Action!

I recorded this video in September 2016 and the EA is still doing well over 5 years later with no adjustments or re-optimization. Some statistics have changed since this video was made but the EA and settings are still the same.

Have you learned my Money Management system yet?

CLICK HERE to download my eBook so you have a complete understanding of the Roulette TRADER money management system. You'll need to know it to properly use the trading robots. PLEASE CONTACT ME if you have any questions.