GBP/JPY 15-Min Momentum Robot

with Roulette TRADER Money Management

An Automated Expert Advisor (EA)

For the MetaTrader4 Trading Platform

Only $59 for current Robot customers!

Log in to show the $59 buy button.

PERFORMANCE GUARANTEE

Robot Performance Guarantee: If you purchase this GBP/JPY robot as a $99 single-robot purchase, I will refund 100% of your purchase price if this robot does not make at least 125 pips net profit within 60 days of your purchase using a 250 pip stop-loss and 125 pip profit target. You do not need to be trading this robot on your account to qualify. Just contact me with your receipt and a quick look at the robot's 60-day performance will confirm if you qualify or not. However, please be aware that your robot will be permanently disabled if you receive a refund.

See the bottom of this page for the multi-robot guarantee.

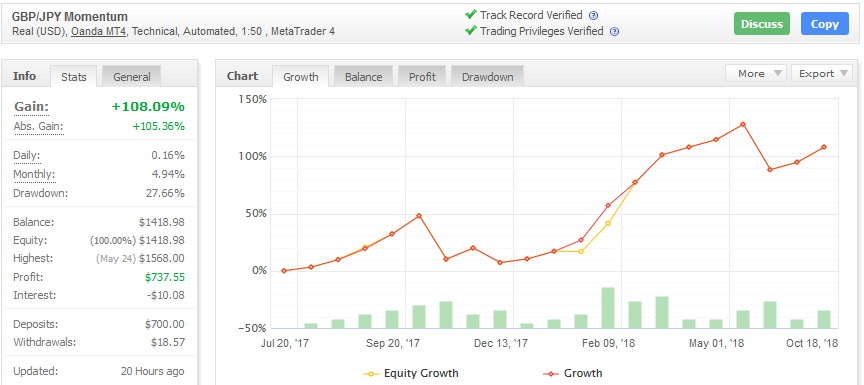

SEE A LIVE ACCOUNT Tracking This Robot!

System Details

This GBP/JPY Momentum Robot is optimized for the 15-minute candlestick chart and uses similar logic to the GBP/JPY 15-Min Trend-Following Robot. However, there are several differences between them. The most significant difference is that this robot requires the minimum trend strength to be 50% stronger and it uses larger profit targets. It also uses cumulative wins money management, a 1-step trailing stop, and has independent trend-strength settings for buys and sells so they can be independently optimized.

One of the benefits of requiring a 50% stronger trend than the 15-Min trend-following robot means it executes fewer trades in choppy market conditions and does not eagerly jump back into the market after closing a trade. This means the robot can sometimes sit idle for weeks, preserving your capital when market volatility is low, but when the market springs to life, so does this robot, capitalizing on the momentum of the large moves that GBP/JPY is so famous for.

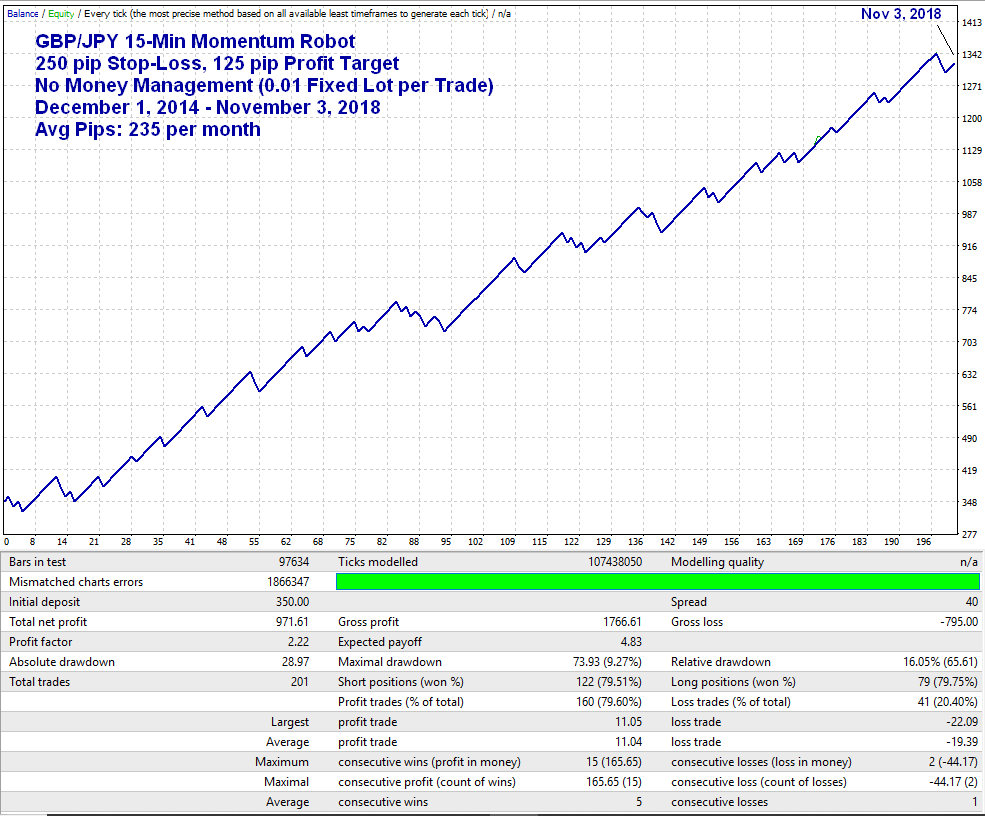

The equity curve below shows the raw trade signals with no money management applied (a fixed lot setting) since December 1st, 2014. To use this EA with a fixed lot setting, change "Roulette Trader Money Management" to false in the Expert Properties and use the "Fixed Lot" setting to set your lot size for every trade. If running this EA in Fixed Lot mode, you should allocate at least $150 margin per 0.01 per lot for aggressive trading.

Raw Trade Signal Results (No Money Management Applied)

For US Citizens: Please note that US forex brokers do NOT allow hedged positions on the same currency pair so anyone trading at a regulated US broker should trade each GBP/JPY robot on a separate MT4 platform and sub-account to avoid conflicting signals and attempted hedging. One exception you may consider is to trade this robot with the GBP/JPY 15-Min Trend-Following robot. Due to their similar signal logic, conflicting signals do not occur often, but for best results, trade them on separate accounts if your broker does not allow hedging.

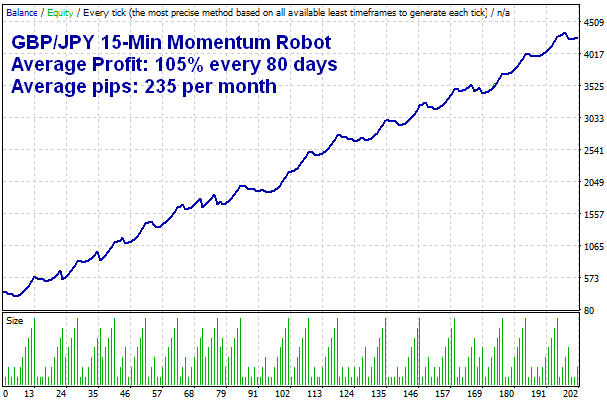

Using "Cumulative Wins" Money Management...

Cumulative Wins Money Management

with a 7 Unit Cycle Target

(250 pip Stop-Loss, 125 pip Profit Target)

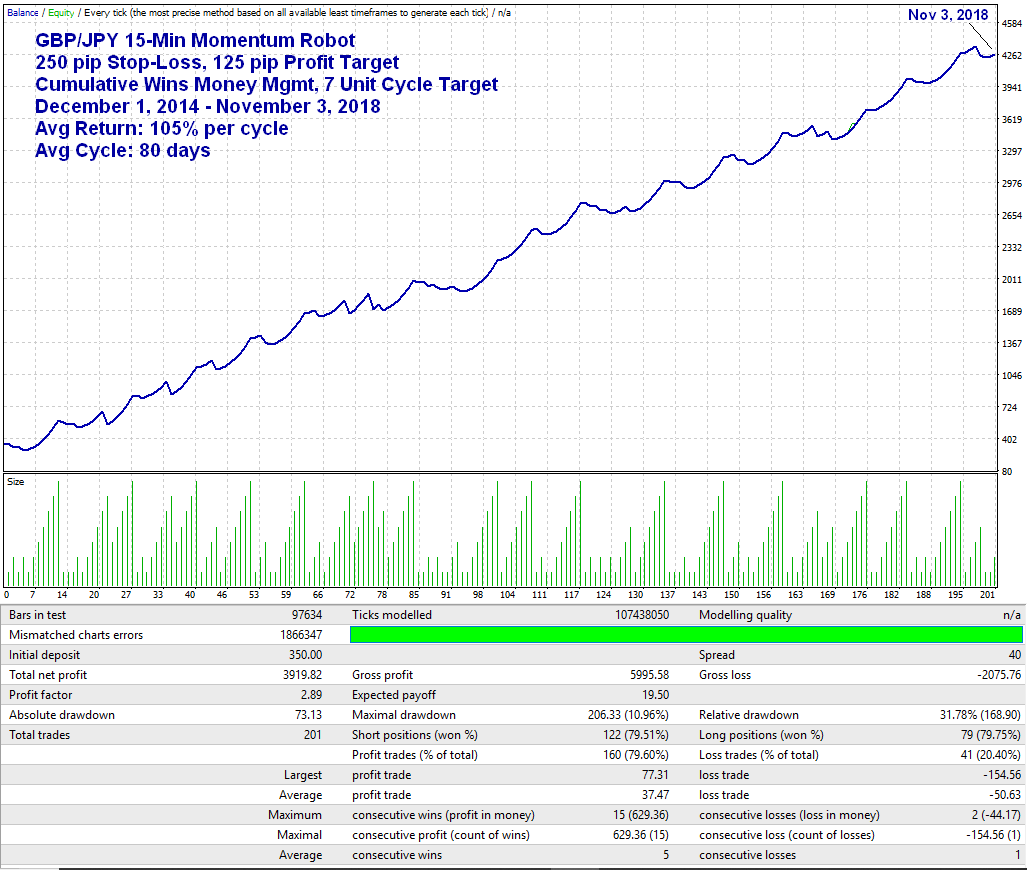

This version of the robot uses "Cumulative" Wins Money Management with a 7 unit cycle profit target. Read my eBook if you don't know what that means. This model uses a Break Even Trailing Stop and subtracts 3 units after each loss despite the stop-loss being only 2x larger than the profit target. This means it reduces the lot size following losses more aggressively than statistically necessary (according to the rules of the RT Money Management system) but it helps protect your capital by keeping the cycle draw-downs very small during losing streaks or periods of frequent losses. Since the size of your cycle draw-downs determines how aggressively you can leverage, the small cycle draw-downs mean you can more safely trade this robot at higher leverage than the GBP/JPY 15-Min trend-following robot with returns up to 130% per cycle, assuming your broker allows leverage higher than 50:1 (details below). Even if you are already trading the GBP/JPY 15-Min Trend-Following robot, this robot makes a great addition to your portfolio for another level of diversification without diluting your profit potential.

On average, this model hits a 7-unit cycle profit target every 70 days at an average profit of 104% profit per cycle when traded at my maximum recommended leverage of 0.01 unit per $250 margin. BUT... see my "Compounding Tip" below for a way to increase that to 130% profit per cycle by changing the way you compound your profits to reduce your cycle draw-downs. While the largest peak-to-valley draw-down in the test shown below is $207, the largest "cycle" draw-down is only $112. If you compound your profits only after a loss, the cycle draw-down is reduced to only $90 in the model shown below. There's more details about that under the compounding tip further below.

IMPORTANT NOTE ON LEVERAGE: To trade this robot at 0.01 minimum lot and unit per $250 margin, your broker must allow at least 100:1 leverage. If you are trading at a broker offering only 50:1 leverage (all regulated US brokers), your maximum leverage should not exceed 0.01 unit per $350 margin to stay within their margin requirements, which will reduce your average return to 75% per cycle. Also note that most brokers require nearly twice as much margin for GBP/JPY as they do for currency pairs like EUR/USD and the required margin varies with the pip value of GBP/JPY. See the Money Management Settings further below.

Cumulative Wins Money Management, 7 Unit Cycle Target

Cycle to Cycle Compounding Models

Cumulative Wins Money Management, 7 Unit Cycle Target

$250 Margin per 0.01 Unit Size, Avg 105% profit per Cycle

44% Max Cycle Draw-down since Dec 2014 (Requires at least 100:1 broker leverage) * This is a hypothetical compounding model for illustration purposes only.

* This is a hypothetical compounding model for illustration purposes only.

Past Performance is not indicative of future results. Individual results will vary.

Cumulative Wins Money Management, 7 Unit Cycle Target

$350 Margin per 0.01 Unit Size, Avg 75% profit per Cycle

31% Max Cycle Draw-down since Dec 2014 (Requires at least 50:1 broker leverage) * This is a hypothetical compounding model for illustration purposes only.

* This is a hypothetical compounding model for illustration purposes only.

Past Performance is not indicative of future results. Individual results will vary.

MONEY MANAGEMENT SETTINGS, 7 UNIT CYCLE TARGET:

To copy this trading model, use the following as a guide for the money management settings:

Minimum Lot: 0.01 (Minimum $250 margin per 0.01 lot w/100:1 broker leverage or $350 margin per 0.01 w/50:1 leverage)

Unit Size: 0.01 (Set equal to your Minimum Lot setting above)

Max Lots/Cycle Target: 0.07 (Set to 7x your Unit Size setting, assuming both settings above are equal in size)

NOTE: The leverage settings given above are my MAXIMUM recommended leverage and is designed to keep typical cycle draw-downs below 50% based on the historical performance period shown above but it's always possible to have larger cycle draw-downs in the future. Therefore, I recommend decreasing your leverage once you have reached a comfortable average return per cycle and use this model as a guide to calculate the leverage for your own risk tolerance. For example, if your risk tolerance is only a 25% cycle draw-down, then the settings above would be appropriate for a $500 account balance and the average cycle would return about 52% profit. If your cycle draw-down (not peak-to-valley) ever exceeds 50%, either reduce the lot sizes based on the current balance or deposit more funds to cover the loss and complete the cycle without changing the lot sizes. Therefore, it would be wise to only trade at my maximum recommended leverage when you can comfortably afford to cover a 50% cycle draw-down or you are willing and diligent to decrease lots if and when such a draw-down occurs. Each cycle can double your account so don't hesitate to decrease lot sizes when necessary and don't try to "get lucky". Remember... you need to stay in the game to win it and don't trade money you can't afford to lose!

Compounding Tip: To further reduce your draw-downs and/or trade at even higher leverage (only at brokers offering 100:1 leverage or more), use this strategy for compounding your cycle profits. In my ebook, the strategy for compounding profits is to increase your lot sizes immediately after each cycle target is hit. However, if you wait for the first loss to occur (after a cycle target is hit), and THEN increase your lot sizes to compound your profits, your cycle draw-downs will be even smaller and that first loss can be made back quicker due to the new, larger lot sizes. The only potential downside is that if you ever have 14 consecutive wins, you will miss the opportunity to compound your profits in the next cycle. But this will be a rare occurrance and the additional profit potential makes it well worth it. In the test period and model displayed above, this technique reduces the maximum cycle draw-down from 44.8% to 35.6% (assuming you are compounding at each opportunity). This means this model could be traded with as little as $200 margin per 0.01 unit and average 130% profit per cycle without ever reaching a 50% cycle draw-down during the test period shown. This won't always be the case but if you have some risk capital that you want to trade very aggressively for a few cycles, this is a strategy you might want to consider for maximum growth potential. Think of it this way... If you consider each cycle like it's an individual trade with a threshold for a 50% cycle draw-down, you are risking 50% to make 130% on each cycle with an incredibly high success rate. What trader would not like those odds?

Using "Negative Progression" Money Management...

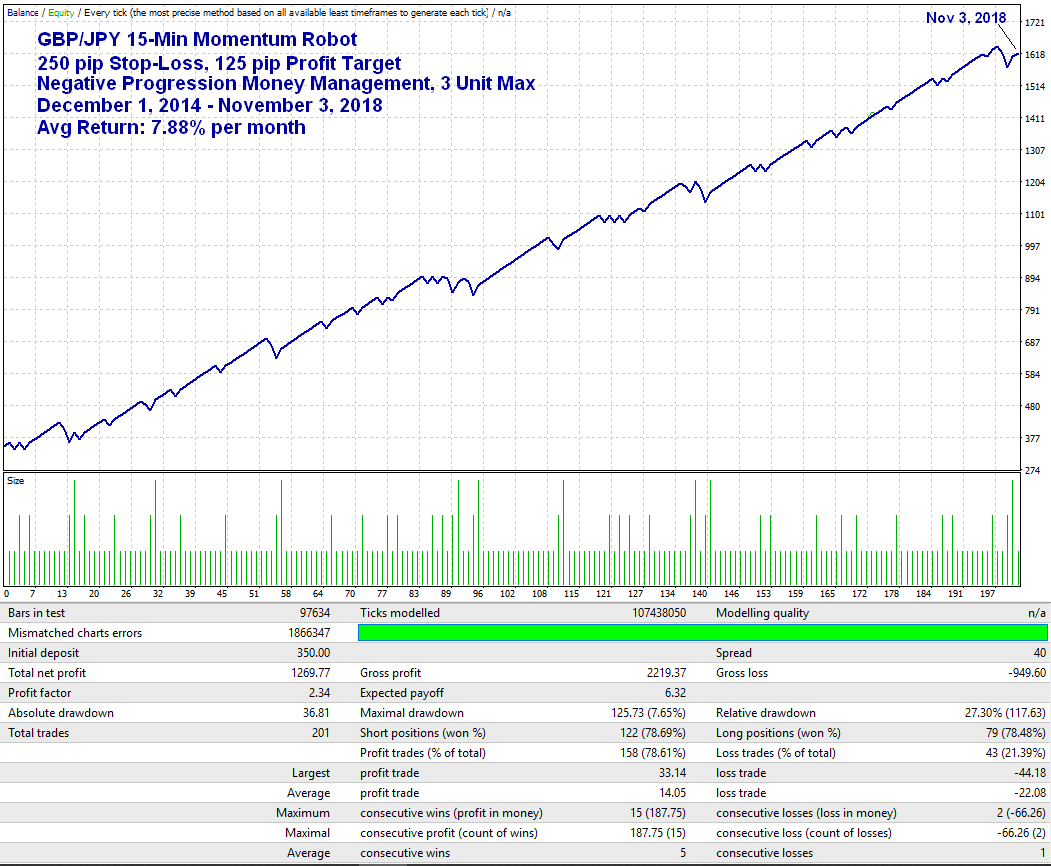

Negative Progression Money Management

with a 3 Unit Max Lot

This version of the robot uses "Negative Progression" Money Management with a 3 unit Max Lot. Read my eBook if you don't know what Negative Progression Money Managment is.

Negative Progression money management provides a much smoother equity curve with more consistent profit highs but is it more risky so it must be traded a lower leverage than the "7-Unit Cumulative Wins" version detailed above. In Negative Progression Money Management, lot sizes are increased following losses to make back the losses more quickly. What makes it more risky is that losses can quickly snowball when they occur consecutively so you must have a strategy with a high win rate that does not have many consecutive losses.

The minimum margin I recommend for this version of the robot is $350 USD per 0.01 Minimum Lot and Unit Size with a 3 unit maximum (0.03). At this leverage, the average profit is 7.88% per month since December 2014. For safer trading, allocate $400 or more per 0.01 unit size or use the positive progression Cumulative Wins version of the EA above. Both versions of the EA are included with your purchase.

Negative Progression Money Management, 3 Unit Maximum

NEGATIVE PROGRESSION MONEY MANAGEMENT SETTINGS, 3 UNIT MAX LOT:

To copy this trading model, use the following as a guide for the money management settings:

Minimum Lot: 0.01 (Minimum $350 margin per 0.01 lot)

Unit Size: 0.01 (Set equal to your Minimum Lot setting above)

Max Lot: 0.03 (Set to 3x your Minimum Lot setting)

NOTE: The leverage settings shown above are my MAXIMUM recommended leverage and is designed to keep the largest 4-year draw-down under 36%. If this is too much risk for you, simply allocate more than $350 per 0.01 Minimum Lot and Unit Size. For example, if your risk tolerance is only an 18% draw-down, then allocate $700 per 0.01 Minimum Lot and 0.01 Unit Size. It is always possible to have a larger draw-down in the future so adjust your lot sizes down accordingly if your balance ever drops below your risk threshold. Likewise, you should also increase your lot sizes to compound profits as the account reaches new profit highs or make lot monthly adjustments to based on the new balance. Remember... you need to stay in the game to win it and don't trade money you can't afford to lose!

_____________________________________________________

TRADING HOURS:

Both versions of this robot are programmed by default to trade between 8:47 and 7:47 (military time) Jerusalem time (a 23 hour trading window). This is the most common time zone used by forex brokers for their price feed. If the time zone of your price feed is NOT on Jerusalem time, you will need to correlate the StartHour and EndHour settings accordingly. The time on your charts has no relation to your computer or VPS local time. Your charts will reflect the time of the price server providing the data. To check the time of your charts, place the cross hair tool over a current 1 minute bar and the time will appear at the bottom of the cross hair. If your chart's time zone is on London time, use StartHour: 6, EndHour: 5. If your chart time matches Jerusalem (as Oanda's v20 Live server does), the settings will be: StartHour 8, EndHour 7. Do not change the minute settings. Trading hours are in military time (0-23 hours). You may use the World Clock to calculate the difference in time zones at: www.timeanddate.com/worldclock/

Start Hour: 8 (Set to 1 for New York, 6 for London, 8 for Jerusalem/Oanda's v20 server)

End Hour: 7 (Set to 0 for New York, 5 for London, 7 for Jerusalem/Oanda's v20 server)

Start Minute: 47

End Minute: 47

An Automated Expert Advisor (EA)

For the MetaTrader4 Trading Platform

Only $59 for current Robot customers!

Log in to show the $59 buy button.

Risk Disclosure: This website does not guarantee income at any time, nor success of the product beyond the specific 60-day performance guarantees for each product. There are many factors that can effect each person's individual results. Examples shown in this presentation do not represent an indication of future success or earnings but merely hypothetical historical performance based on specific trading models. Past performance is not indicative of future results and individual results will vary. The company declares the information shared is true and accurate.

U.S. Government Required Disclosure - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN