Welcome to the Roulette TRADER eBook Web Version

No Need to Download!

Simply scroll down to read the

eBook on this page.

Or... Download on Amazon.com for $2.99

and keep a permanent copy for yourself.

Use Roulette TRADER Money Management to

Dominate Casino Games and ANY Financial Market

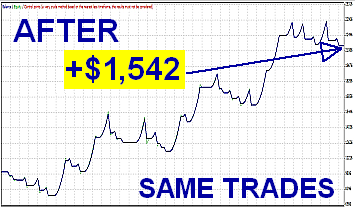

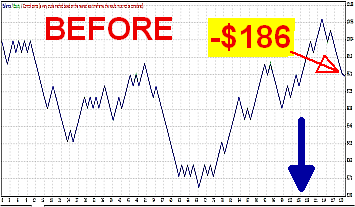

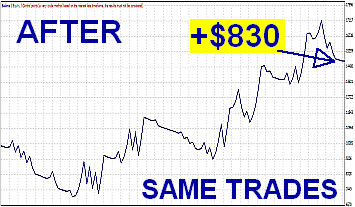

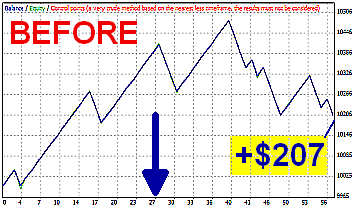

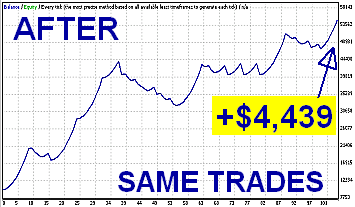

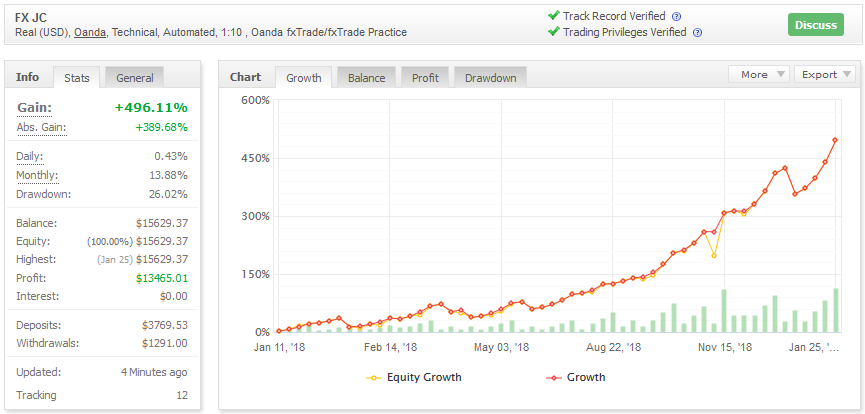

And turn small losses

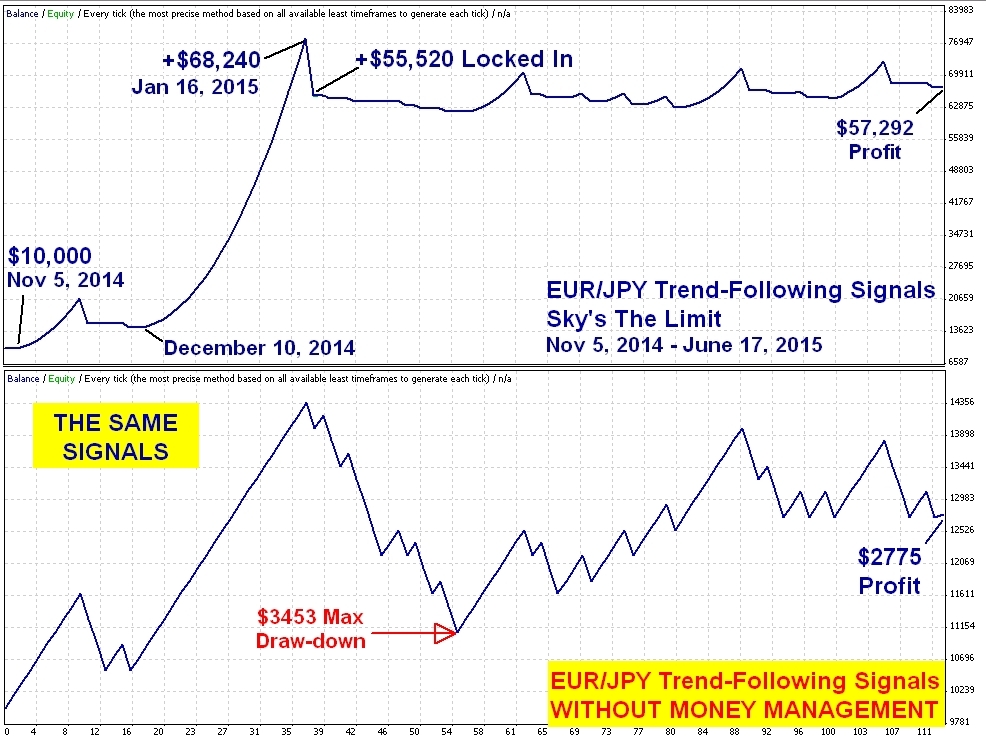

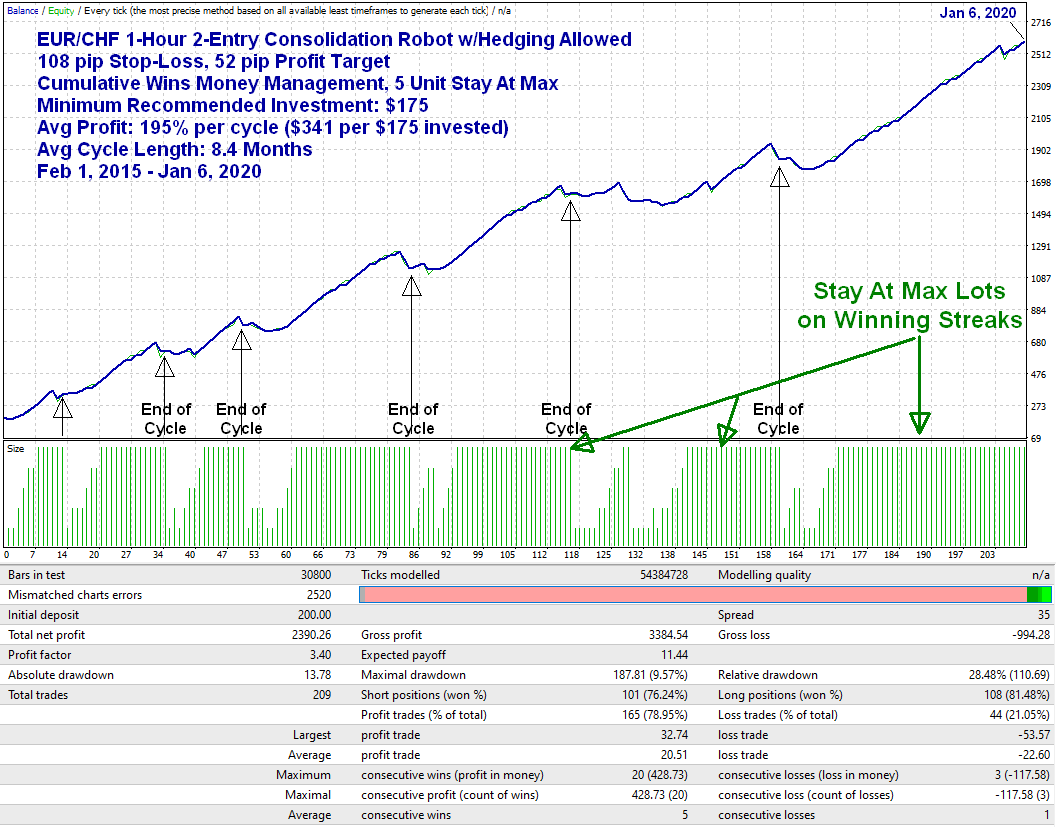

into NICE PROFITS like these...

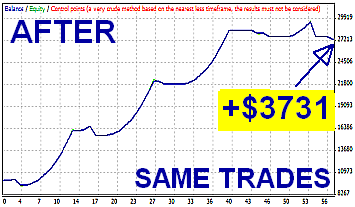

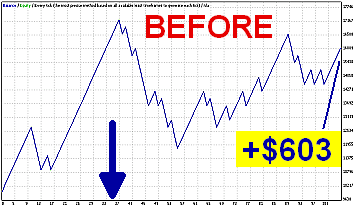

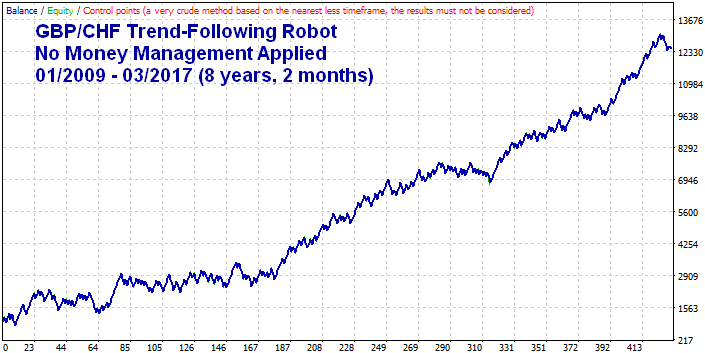

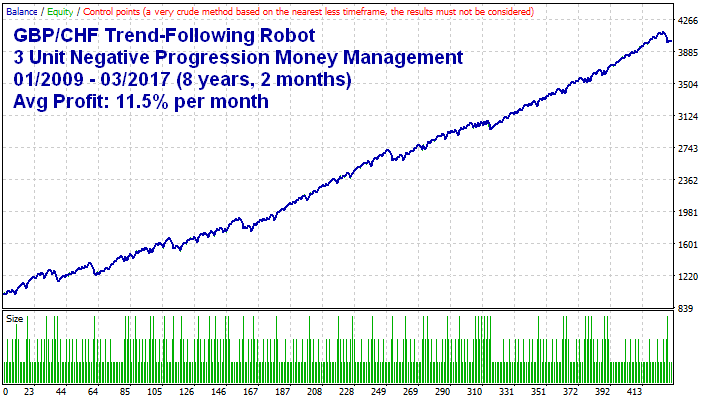

And Turn Ordinary Profits into

EXTRAORDINARY PROFITS...

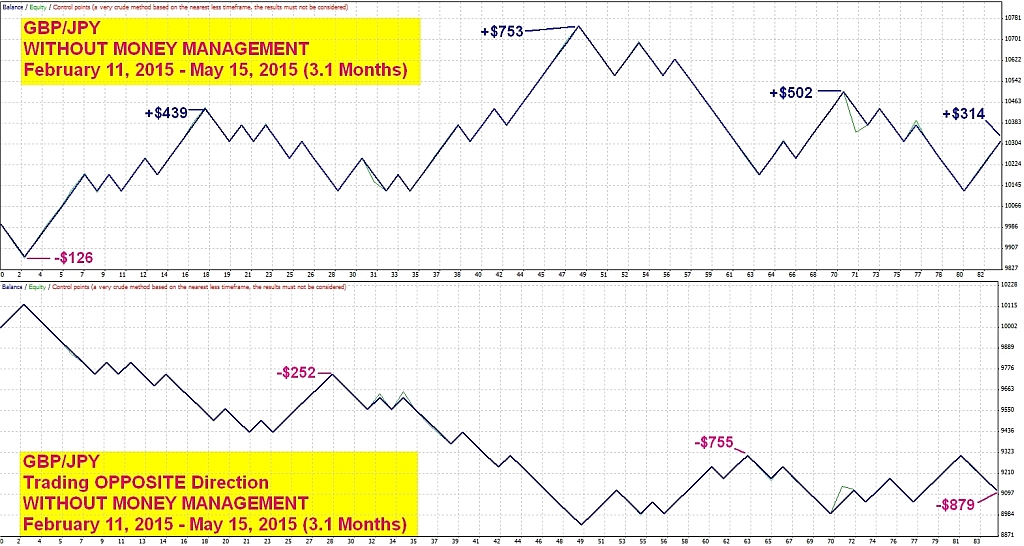

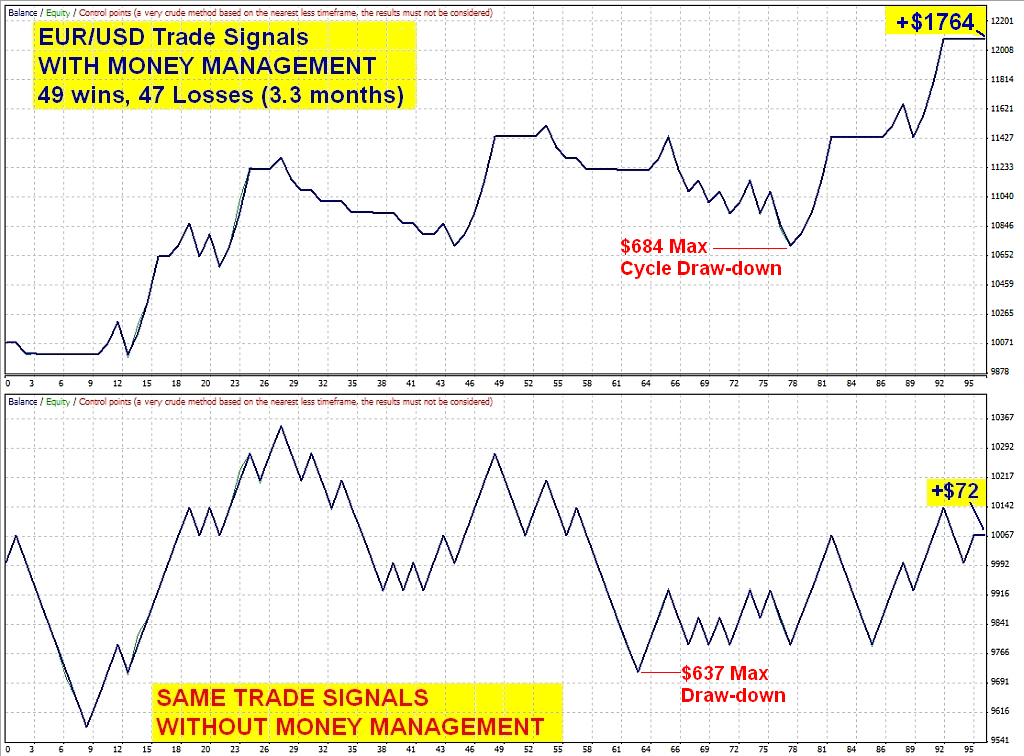

The equity curve comparisons above show how my money management system effects trade results when applied to the same trade signals. The key thing to note is how the draw-downs (periods of losses) are much smaller when my money management system is applied in the "After" images, yet periods of profit are much larger! Past performance is not indicative of future results. Please read the risk disclosure at the bottom of this page.

Dear friend,

Thank you for investing in ROULETTE TRADER! If you have any interest in trading or gambling (and I'm assuming you do), then this ebook may be the best investment you'll ever make and will likely change the way you trade forever!

Look... you don't need a crystal ball to be a highly profitable trader, and you certainly don't need to risk a lot to make a lot either! You just need a great money management system! And I'm not talking about the industry norm of risking 2% per trade. That will get you nowhere fast!

But before I get into the details of how the system works, let me first tell you the story of how I discovered the raw version of this system by accident. If you want to jump straight to the mechanics of it, then go to page 13. But once you read my story, the question of “why” it works will make a lot more sense to you. It literally goes against what seems like the logical thing to do, and that is exactly why so many traders and gamblers can never REALLY win big, and instead, usually end up losing.

When it comes to casino betting systems, in one way or another, they all tell you to increase your bet (negative progression) to quickly win back your losses and "only play for a short period of time or the odds will catch up with you". In short, they risk their entire bankroll in hopes of consistently coming out a little ahead after a series of losses. Many traders have even incorporated this type of suicidal negative progression betting system into their trading and it almost always ends in disaster. It's really just a matter of time before their luck runs out.

Well, I have some good news for you! My system is about risking a little to MAKE A LOT, and the longer you play or trade, the more you'll ultimately make. After all, if you can't make a lot, then why bother putting your money at risk in the first place? But sometimes we need to learn the hard way and that leads me to my story...

Year 1999

In 1999, when I was in my late 20s, my best friend was telling me about a betting system he and his brother developed for playing Roulette on Nintendo. They made thousands of dollars every time they played the game and they even used the strategy to clean house on “Casino night” at my friend's work party. They played for tickets, which they redeemed for prizes at the end of the night. They were the champions of the night with their “magic” betting strategy and won an additional “Grand Prize” for having the most tickets at the end of the night. For months, they joked about how they were going to take their betting system to Las Vegas and get “black listed” at every casino for cleaning them out.

They were even talking about the disguises they would need to wear to sneak back into the casinos. These guys were a couple of clowns and often dressed in crazy disguises just to walk through the shopping malls to get funny looks. They said it was easier to meet girls that way. And strangely, it actually worked, but that's an entirely different story.

These goofball friends of mine had me so intrigued about their betting strategy that I quickly installed some casino software on my computer and began testing the system myself. To my amazement, it actually worked and never failed, and yet it was so simple I couldn't figure out why nobody else knew about it.

THE not-so MAGIC BETTING SYSTEM!

This incredible Roulette system was simply this: Start with a $10 bet on red and black (yes, we were actually betting against ourselves) and then double the losing bet until you win all your money back. And since we were betting on both red AND black, we were averaging $10 profit per spin. When one lost, the other won $10. Our only enemy seemed to be green, in which case, we would lose everything but then we'd simply double BOTH bets on red and black and we'd soon have all our losses back. It was flawless!

We tested this system for about a year on Nintendo and my computer, and never had a run of more than 5 or 6 consecutive red or black before we made our money back (with a profit). And these consecutive runs of red or black very rarely happened so we figured the same would be true in a real casino too. We were going to be rich and we were now planning a trip to Vegas, which was only a 5-hour drive from our homes in southern California.

At that time, I had managed to save up $2000 of hard-earned money from my part-time job so I was ready for the trip and ready to start my new life as a professional gambler. So off to Vegas we went!

I booked us a room at the Rio Hotel & Casino and as soon as we walked through the doors, I could feel my heart pounding with excitement & anxiety as I looked around at the roulette tables. Each table had a digital display above it showing the results of the last 10 spins. At just a glance, I could see that I would have been making money at nearly every roulette table in the casino. My confidence continued to build as I strutted through the casino, chest puffed out with a pocket full of cash. As we passed each roulette table, my friends would chant with excitement “THE SYSTEM IS IN EFFECT! THE SYSTEM IS IN EFFECT!”. I was going to be unstoppable!

We quickly went to our rooms and then grabbed a late lunch. I had butterflies in my stomach the entire time as I contemplated all the money I was going to make that night. Well, the time had finally come. I grabbed my $2000 in cash and made my way down to the roulette tables with my buddies. After walking the tables for 20 minutes or so, I found one I liked where the system was definitely “in effect” (or at least had been), and I sat myself down, surrounded by my best friends who were ready and eager to cheer me on into my new profession.

As planned, I started with a $10 bet on both red and black. Everything was going as it always had on Nintendo. I was up $100 after just 10 spins (as usual). But then the dealer noticed that I was betting against myself and she was trying to tell me not to, saying “You can't win if you bet against yourself. It doesn't make sense”. I was getting nervous and irritated by her because I didn't want to be noticed, but the dealer would NOT let it go. I finally said in a frustrated tone, “Look, I'm up $100. I know what I'm doing”.

That really baffled her but she backed off a bit, though she paid close attention to see what I was doing. I'm sure it's not every day that she sees people betting against themselves and turning a profit. After another spin or two, she went and got the pit boss to come watch me. I was thinking, “You've got to be kidding me! I haven't been there 30 minutes and I'm already about to get black listed!” Fortunately, the pit boss was not impressed by my $10 bets and quickly walked away.

Well, as fate would have it, the next 4 spins were red. This meant my next bet on black needed to be $320 and I was already down $310 on that run. I was out of chips so I had to buy more chips from the dealer. I could see the satisfaction on her face as I was starting to look like the stupid one betting against myself.

But I swallowed my pride knowing that I'd soon be the one laughing. So, I proceeded to pull out my wad of $100 bills to buy more chips. She then goes to get the pit boss again to witness the buy-in and whispers something to him while he's standing there. He then comes out of the pit area and stands behind me. I was trembling like a leaf and my “good friends” started to back away from the table, as if they didn't know me. I was on my own now but I had to win my money back so I acted as though nothing fishy was going on. I placed my $320 bet on black (plus $10 on red) and the dealer spins the wheel. Of course, it's FRICKING RED AGAIN!

Before I could even think about the giant knot developing in my stomach, the pit boss leans over my shoulder and asks me “Are you staying here?” I said “Yes, why?” He then asks “Are you being rated?” I had no idea what he was talking about so I said “No”. He then asked to see my driver's license. I thought, ok, I'm really screwed now but I just lost a lot of money so what could he have against me? So not wanting any confrontation with him, I gave him my license and he walked away with it and then gets on the phone in the pit area. My friends started saying “Dude, he's checking your ID against their black list” and “He's calling in the thugs to drag you into the back alley” and various comforting things like that.

Well, it was time for my next bet and guess what? I had to buy MORE chips because my next bet on black needed to be $640 and I only had a few chips left. So, I pulled out my wad of money again (what was left of it) and the same pit boss comes over again to witness the buy-in (holding my license in his hand). At this point, I was sick to my stomach but I knew I had to stick to the system in order to win. If this was Nintendo, there's no way I'd stop now, right? If I did, I would just lock in my loss. So, I reluctantly bit the bullet and placed my $640 bet.

Can you guess what happened next? I'll give you one guess...... drum roll please...... ok, enough suspense. I think you know what happened... It was FRICKING RED AGAIN!! Un-fricking-believable!!! I felt like I had just been shot in the stomach with a 12 gauge shotgun. I just lost over $1100 (half of my life's savings). And, of course, my awesome friends were keeled over in laughter saying things like “Dude, you could have gone to Hawaii for a week with that money!” and so on.

That was it! I didn't have enough money left to cover my next bet, which would need to be $1280 plus $10 on red but I only had about $900 of my savings left. So I was forced to sit out (completely sick to my stomach) but I watched the next few spins to see how long it would take to finally hit black and it actually went 2 more spins red. This means I would have needed a bank roll of about $15,300 to finally win my money back, all for a whopping average of $10 profit per spin! Who in the HELL made up this stupid system I was using???

But, I was determined to go home a winner. So, what did I do? Later that night (after a miserable night on the town with my so-called friends), I walked down to the casino (alone this time) to win my money back. My friends, who were going to bed, said “Don't do it! Cut your losses and call it a lesson!” but I had a dream and I was determined to make it come true (plus I didn't want them making fun of me the whole 5-hour drive home). I had to redeem myself! So off I went down to the casino with my remaining $900 and change. In order to make back my $1100, I needed to survive 110 spins of the Roulette wheel so I was prepared for a long night ahead with all fingers and toes crossed.

I quickly found an empty table so I sat down to get started. It was just myself and the dealer. He was a nice guy and didn't give me crap for betting against myself (although I'd hate to hear what he was thinking). Things were going great, at least until this big-bellied drunk Italian guy named Vinny sat down next to me. I know this sounds like something out of a movie and gets a little off topic, but it's the honest-to-God truth and I just can't leave this out. I thought I was being punked or on some hidden video show.

GOOD-LUCK-CHARM-VINNY

This wanna-be mobster guy with a thick New Jersey accent named Vinny sits down at my table next to me. He had an entourage of Italian goons surrounding him who cheered him on as loudly as they could to draw as much attention as possible. I have nothing against Italians, as I'm mostly Italian myself. But let me put this into better perspective. This guy Vinny was covered in thick gold chains around his neck with a huge gold medallion hanging just below his hairy man boobs, and shirt buttoned only half way so everyone could all see the huge medallion. This guy was right out of a Joe Pesci mafia movie!

Now if that wasn't enough, every time this idiot lost, he would start yelling at the dealer, as though it was his fault, saying “This is bullshit! Do you know who I am? Do you know who I am? Do you? Do you?” with his entourage behind him going “Yeah Vinny, You tell him Vinny, You don't take shit from no-one Vinny!”.

The dealer would just quietly reply “No sir, I'm afraid I don't know who you are”. And then Vinny would reply back “Well you ought to know! Do you know how much money I spend here? Do you? Do you? Where's your pit boss? Get me your fricking pit boss! This is ridiculous! I'm Vinny from such-and-such town New Jersey” as though nobody could tell where he was from.

I couldn't believe what I was seeing, and I was right in the middle of it, surrounded by these loud obnoxious wanna-be mobster goons in Vegas, all while I simply wanted to just make back my losses at a modest $10 per spin (for the next 110 spins). To put it lightly, the vibe at the table turned sour very quickly and as my luck would have it, I soon had another run of losses that started as soon as “good-luck-charm” Vinny sat down. I had now lost my entire $2000 life savings. I was now broke and sick to my stomach! I should have been the one screaming at the dealer, but I walked away quietly with my tail between my legs. Nobody even noticed my misery with the loud obnoxious Italians making such a scene. I should have left as soon as Vinny sat down. If good ol' Vinny wasn't a warning sign, then I don't know what is!

And as for the drive back home from Vegas... it was even worse than I imagined. My friends did not let up on me for the entire 5 hours! I've never heard about how many great things I could do with $2000 before, but they all came to the surface on that ride home. All I left Vegas with was empty pockets, a good story to tell, and an AMAZING betting system!

Yes, I actually said “Amazing” betting system. I know that sounds odd after what just happened to me, but on the drive home from Vegas (and every day following that dreadful trip) I thought to myself “if I had just done the exact opposite of what I was doing, I would have made over $1000 TWICE in one night and I would have only been down $100 at my worst point”.

I later found out that there was a name for the betting system I was using. It's actually no secret at all. It's called the Martingale system and it's very deadly, very quickly, as I experienced first-hand TWICE in the same night.

My Introduction to FOREX TRADING

It was right around this time that I was introduced to forex trading. After a couple years of taking trading courses and studying technical analysis, I decided to give the old Martingale betting system a try in the forex market. After all, it's not random like a roulette wheel and I actually had some control of my wins vs losses. Plus I could use leverage to increase my bets too. How could I possibly lose now?

So I deposited $1000 into my trading account and went for it. I studied the charts and placed a trade before I went to bed each night based on what my technical analysis was telling me. Well, it was just like good ol' Vinny sat down at my table again. I lost my first 7 trades and quickly wiped out my account. I was beginning to feel cursed! I was now down over $3000 from the stupid Martingale system! How could anyone be so unlucky with a system that mathematically puts the odds in your favor and works flawlessly on Nintendo? Every time I used it with real money, I immediately got my ass kicked! But I was determined to have a winning betting system so I went back to the drawing board with a vengeance!

Once again, I revisited my old thought about doing the opposite of what the Martingale system taught. So I opened a spreadsheet and started to reverse engineer the Martingale system. There must be something to it! When you really think about it, it's actually pretty insane to risk everything for a potential $10 profit per spin, but I'd be more than happy to risk $10 per spin to make THOUSANDS! So that made a great starting point for my research.

After a few years, I had developed some automated FOREX trading systems where I could quickly back-test my trade signals to get some real market scenarios from, but I couldn't automate the money management yet and I didn't have my money management system developed yet anyway. I was still working on it. To test hundreds of different betting strategies, I manually typed in the trade results from my automated trade signals into Excel spreadsheets to see what type of money management system would generate the highest profits with the lowest draw-downs.

I actually performed manual tests like this for many years and I have tons of “FULL” spreadsheets to prove it. I actually put so much data into these Excel spreadsheets that I would exceed the data limits for the file. I ran thousands of hypothetical tests using different trading systems and scenarios, including randomly computer-generated numbers too. Here are just a few screenshots of my spreadsheets so you can see I'm not BSing you! They are zoomed out to fit as much of the sheet as possible. I could fill this entire website with screenshots like this, and these are just the top left corner of 6 spreadsheets, but I think you get the idea.

I would back-test automated trade signals across many years of FOREX price data and then extract the worst parts of the trade results to enter on my spreadsheets because my primary focus was to limit my losses and protect my capital. I figured, if I can survive the worst periods without too much downside, then making profits the rest of the time would be easy! Through all these tests, there were two similar money management strategies that were consistent winners (the highest profits in relation to the size of the draw-downs) and they were similar to running the Martingale system IN REVERSE, just as I had imagined after my horrible experiences.

However, these 2 strategies were NOT exactly the Martingale system in reverse, as that proved to be too volatile. That was just a starting point to work from.

So to give you a thorough understanding of the logic behind my money management strategies, I'm going take you through my experience in reverse engineering the Martingale system. First I'm going to show you some examples of the traditional Martingale system through a winning streak and losing streak, and then compare them to what would happen if you did the Martingale system IN REVERSE. After that, I will introduce you to my two Roulette Trader strategies, which include my profit-locking & equity curve smoothing adjustments that would thrill any sophisticated investor.

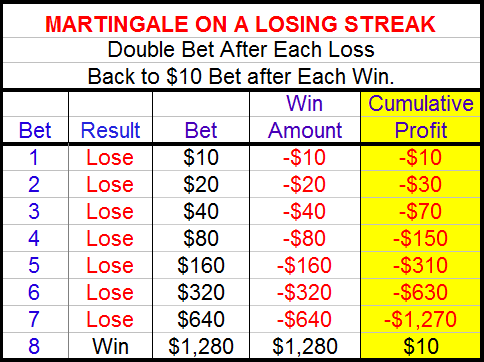

THE FATAL MARTINGALE SYSTEM

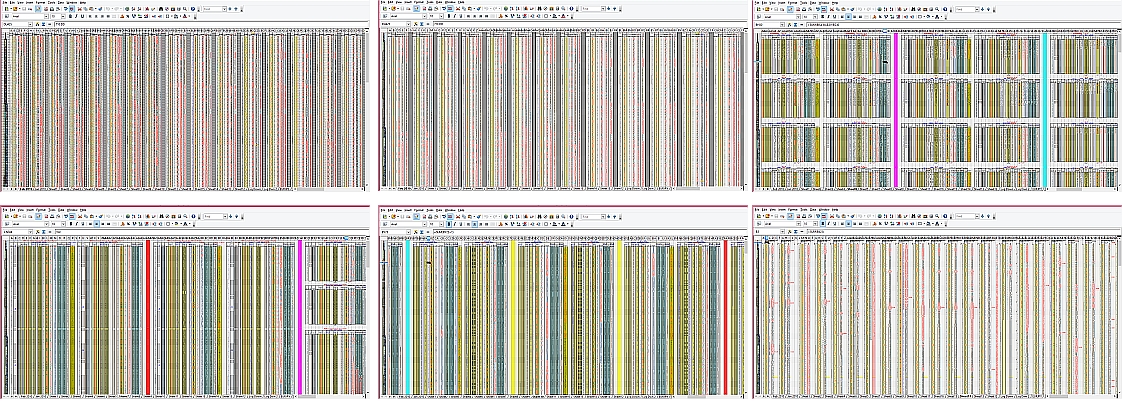

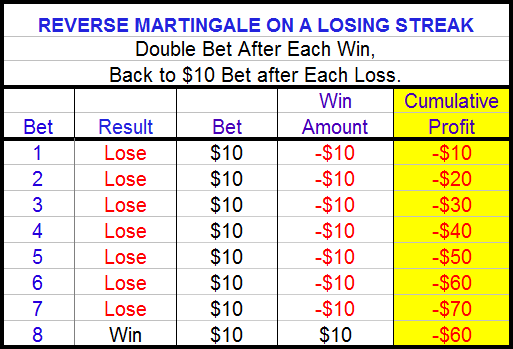

With the Martingale system, you are supposed to double your bet after each loss until you win. This means you would make back 100% of your losses (plus a small profit) with a single win. If you do win, your bet goes back to $10 and you stay at $10 until you have a loss. So on a run of 7 consecutive losses followed by a win on the 8th bet, your bets would look like this example below (for easier reference, I put the original Martingale examples in red headings while the Reverse Martingale examples further below are with blue headings):

Woohoo, you made a whopping $10 profit at the end of this losing streak and nearly had a cardiac arrest in the process! Was it worth nearly losing $2550 if you had lost that 8th bet? HELL NO! And how far are you willing to ride it out to finally win back your losses? Chances are, you would have given up after the 6th or 7th loss with no way to make it back without risking another $1000 - $2000. And keep in mind that most roulette tables have a $2000 maximum bet. The table limit works in the casino's favor because it prevents you from making back all your losses in scenarios like this. After the 8th loss, your cumulative losses essentially become locked in and the casino wins big time!

Now let's look at the Martingale system on a winning streak and see what happens...

No magic there, right? $70 cumulative profit -$10 loss on the 8th bet = a whopping $60 profit after an amazing winning streak.

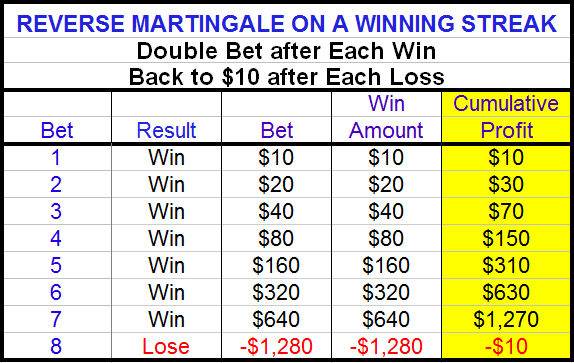

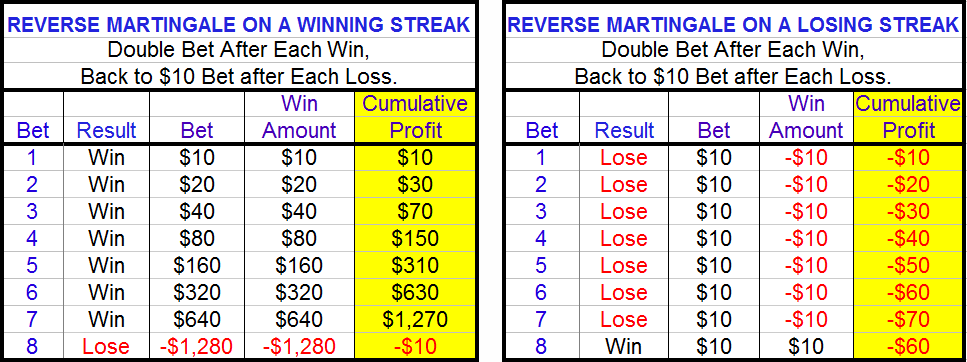

Now, if you had followed the exact OPPOSITE betting strategy in the 2 examples above, your bets would have looked like these 2 examples below...

At your worst point above, you were only down a cumulative total of -$70. No biggie, right? And that was on a horrible losing streak too. No cold sweats, no stomach aches, no cardiac arrest, or even a single heart palpitation. And if this were a roulette table, you'd be getting free drinks in the process so it's nearly a wash if you consider the price of drinks at a casino. Now let's look at the Reverse Martingale on a winning streak...

Now how is that for an exciting ride? Your cumulative profit quickly ran up to +$1270 before you lost it all on the 8th bet. However, you could have walked away after the 6th or 7th win with a very healthy $630 or $1270 profit. You only ended up with a small $10 loss because you kept going without locking in any profit for yourself. The casino wins again, but only $10 this time.

Now compare the best and worst points of the 2 Reverse Martingale examples (bet #7)...

After 7 consecutive wins, you were up $1270 at your best point. At the worst point, after 7 consecutive losses in the graph on the right, you were down a total of -$70. That's an absolutely HUGE difference from 2 identically opposite situations! This is where light bulbs really started to go off in my head because I knew I was onto something quite powerful, and this is where I first got the idea of running identically opposite trade signals in reverse of each other and letting the money management do the rest. One would have small losses while the other had HUGE profits! All you needed was an occasional winning/losing streak, which is extremely common in forex trading!

But after a lot of testing and tweaking different money management strategies, I found that this “Reverse Martingale” strategy was just too aggressive and too much of a wild ride for a long-term trading system but I was certainly on the right track. There would be large draw-downs and then massive spikes of profit but you would quickly lose it all with a single trade because it never locked in any profit during the winning streaks. Of course, you could walk away at any point with your cumulative profit, but if you didn't reach your goal of X number of consecutive wins, you ended up with a loss. So at what point should you end the cycle and lock in your cumulative profits? There was no way to know when the next loss would come, so I fine tuned the betting system to lock in some profits along the way but it would also let the profits continue to snowball too. It makes a nice compromise while keeping it all very simple. In fact, it's so simple that I overlooked it for many years.

THE PROFIT-LOCKING

ROULETTE TRADER STRATEGIES

With my Roulette TRADER Betting/Money Management strategies, instead of doubling your bet after each win, you simply break your bets into units and add 1 unit after each win. But there are different ways to add and subtract units and the best way depends on the following factors:

1. Your Win/Lose ratio

2. The size of your wins vs. losses (which usually effects your win/loss ratio)

3. How well your wins and losses occur in clusters of winning streaks & losing streaks

Unlike a random casino game, you can control all 3 of these factors when designing trading systems for financial markets. But for ease of understanding, let's focus on Roulette for now and then I'll show you how to apply these strategies to foreign currency trading.

Betting Strategies for ROULETTE

I have two betting strategies for where to place your bets and 2 different money management strategies. One capitalizes on consecutive wins and the other capitalizes on cumulative wins.

I'll carefully go over each strategy below so pay close attention. They're actually as simple as 1, 2, 3. The only difference is how you add and subtract and that's based on your Risk/Reward ratio and which system you're using.

EQUAL Risk/Reward

CONSECUTIVE Wins Strategy

1. CONSECUTIVE WINS Strategy (Equal Risk/Reward) betting RED & BLACK on Roulette

To win $500 the last time I was in Las Vegas, I started with $10 bets and followed the color of the previous spin (unless it was green). This way I was guaranteed to be on the right side of a color streak IF, and when, one happened. And it didn't take long. I can't remember how many times it hit the same color but my stack of chips was getting pretty large and it was drawing some attention. I had people stopping to watch, and then they actually started betting black (against me). I told them to “Go WITH the trend, not against it!” They ignored me and continued to increase their bets after each loss (typical gambler mentality). They eventually got upset and walked away BIG LOSERS! I knew what they were feeling but you can't imagine how good it felt to finally get some of my $2000 back from Las Vegas. If I had been using my original Martingale system, I would have lost my ass AGAIN! But 12 years later, I finally felt some redemption, and one day, I'll be back in Vegas to collect the balance.

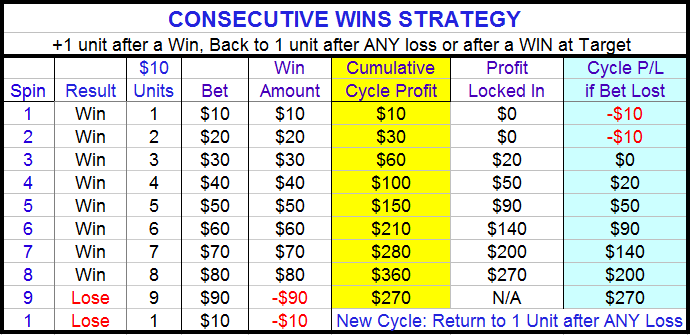

Ok, enough of my stories! My “Consecutive Wins” Money Management strategy is simply this: increase your bet by 1 unit after each win, then go back to 1 unit after ANY loss. This immediately locks in your profits at the first sign that the trend is changing. In this example, each unit is $10 but you can use any size unit you want. Simple, right? Here's an example of how 8 consecutive wins followed by 2 losses would go...

The beauty of this strategy is that the most you can possibly lose on any cycle is $10 but you can win hundreds, even thousands if you let it run. After your 2nd consecutive win, the rest of the cycle is RISK FREE!

CYCLE PROFIT TARGETS

Now look at the blue column in the chart above. With a loss on the 9th bet, you end up with $270 profit that was automatically locked in after the 8th win. However, after the 8th win, you could have walked away (ending your cycle early) with $360 profit (an extra $90) which is $10 more than if you had continued your cycle, won the 9th bet and then lost on the 10th bet. Likewise, if you had ended your cycle after the 7th win, you would have $10 more than if you had continued the cycle and lost on the 9th bet ($280 vs. $270). Therefore, I like to set a cycle target and end my cycle on a win instead of waiting for a loss (ending on a high note). As long as your cycle target isn't too difficult to reach, it will lock in a nice chunk of profit on a regular basis, smoothing your equity curve.

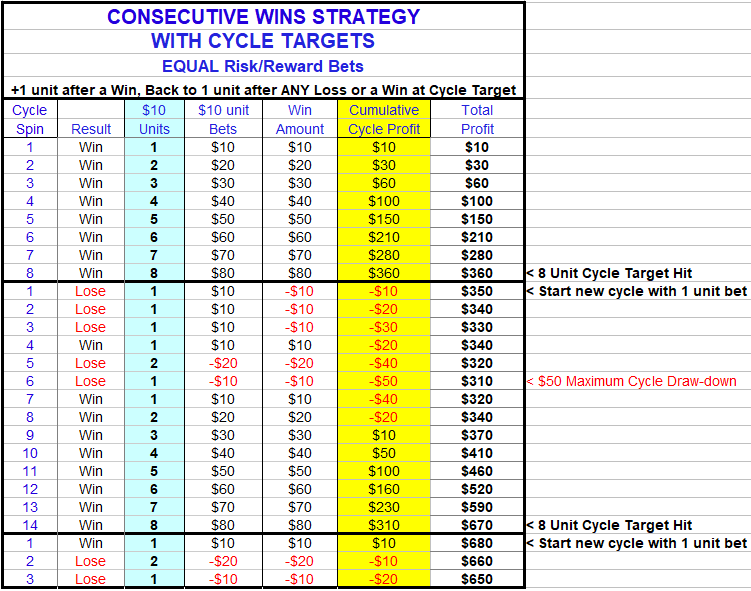

Let's say you have a cycle target of 8 units (which is 8 consecutive wins with the Consective Wins strategy). When you get a win at your cycle profit target (8 consecutive wins), then you would start a new cycle with a 1 unit bet, thus locking in your cumulative profit at that point and the casino (or broker) can only win that money back from you through a long series of losing cycles.

The following diagram shows how the previous example plays out with an 8 unit cycle target followed by 2 more cycles. On roulette (betting red or black), I recommend going for at least 5 or 6 consecutive wins with this strategy or it loses most of it's power. Once you have some profit locked in, you can let your cycles run longer or let the table decide when the color is going to change next. You might be very pleasantly surprised!

The day after I lost $2000 playing roulette in Las Vegas, my friends were telling a guy at the pool about my horror story. He replied “That's nothing! I was at a table last night that hit 23 red in a row! Everyone was betting black against it and losing their asses!” Now imagine if that guy had been using this system! He would have been buying everyone drinks at the pool that day.

Oh, and to finish my Vegas story, we did have our rooms comped at the end of our stay, and then again on our next trip too. I must have had MARTINGALE SUCKER written on my forehead because they rolled out the red carpet for me on our next trip but I never gambled another dime until I had developed this system, despite many more trips to Las Vegas.

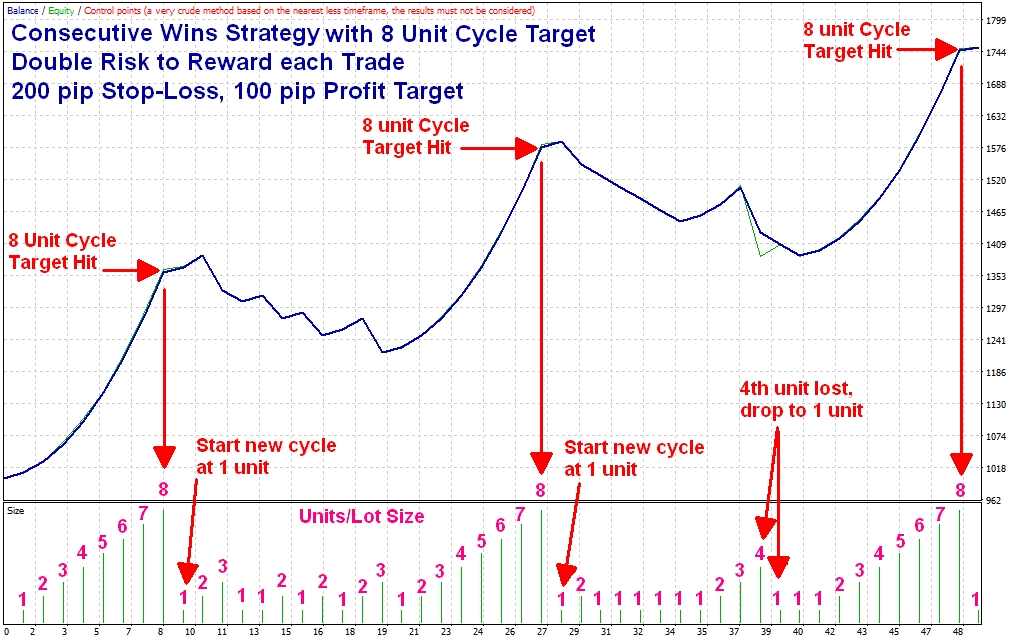

APPLYING THE CONSECUTIVE WINS SYSTEM TO FOREX TRADING

The illustration below shows how you would apply the Consecutive Wins Money Management system to FOREX Trading and is easily applied to any other form of financial trading like stocks, options, indices, etc. Simply replace the word “lots” with “contracts” or “shares” for other markets.

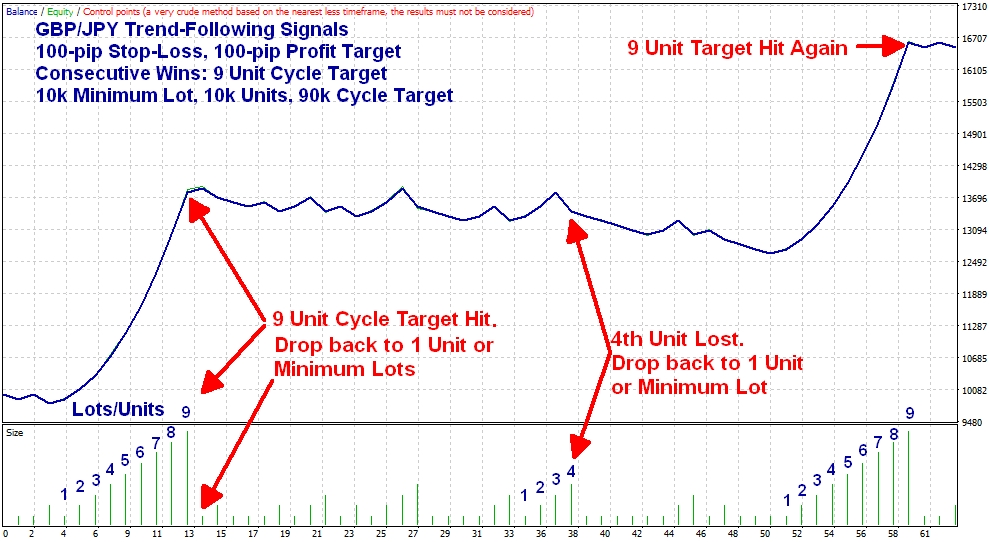

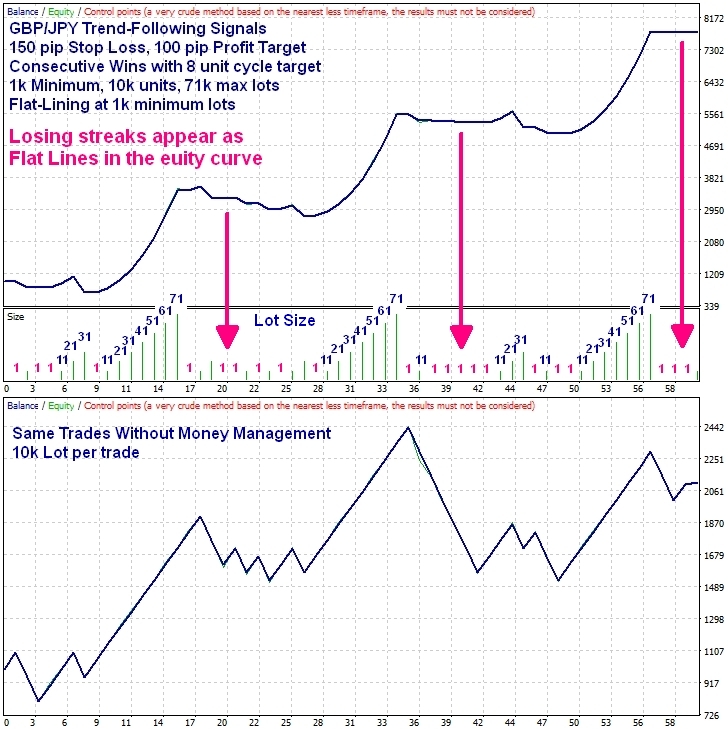

This is an equity curve created by my Trend-Following Trading Robot, which naturally generates winning streaks during trends. This illustration uses 0.10 lots (10k volume) as units with a 9 unit (0.90 lot) cycle target. The vertical green bars at the bottom of the image show the size of the lots. These also represent the number of units we are trading.

In this example, the stop-loss and profit target are equal at 100 pips each, like betting red or black on Roulette. When using the Consecutive Wins strategy, you always drop leverage to the minimum lots (1 unit) after ANY loss or after you have a win at the cycle profit target, whichever occurs first. In this example, there were 2 wins at the 9 unit cycle target, locking in a lot of profit.

EQUAL Risk/Reward

CUMULATIVE Wins Strategy

2. CUMULATIVE WINS Strategy Betting RED & BLACK (Equal Risk/Reward):

Here's another way to do it, which I really like because you get a lot more winning cycles but it comes with the risk of slightly larger draw-downs. Sometimes you get a few random losses during a trend or a cluster of wins, so why let a single loss or two set you back to 1 unit when you could take a nice profit from just a few more wins? So, instead of going back to 1 unit after a loss, simply subtract 1 unit after a loss and add 1 unit after a win until you have a win at your cycle target.

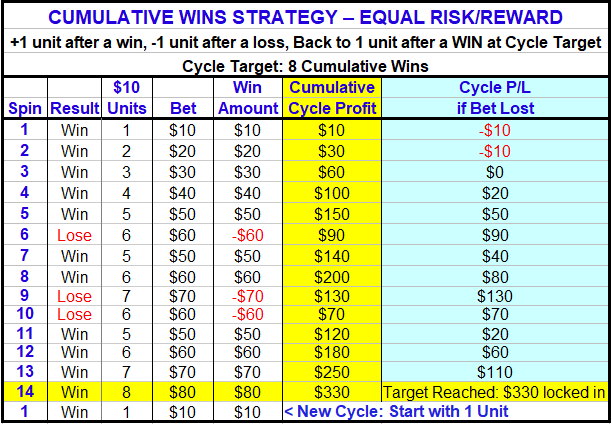

If you want to use this method on Roulette while betting Red & Black, I suggest starting with the Consecutive Wins strategy first, then switch to this method after your 4th consecutive win because you won't have much farther to go to hit your cycle target. This will reduce your draw-downs. You must also consider the size of your wins vs losses when using this method. For betting Red & Black, your potential risk and reward are equal on each bet so adding and subtracting 1 unit keeps things balanced. When applied to trading, this is comparable having an equal profit target and stop-loss on each trade. Here's how a target of 8 cumulative wins would play out with 3 losses mixed in.

I know it can be a little confusing when looking at these charts but all you really need to remember is +1 unit after a win and -1 unit after a loss. You do not need a calculator or spreadsheet to calculate what you need to do next, so this can easily be used in a casino and nobody will have any idea that you're actually using a powerful money management system.

I love the “cumulative wins” strategy because you're not requiring anything extraordinary to happen. Just a few more wins than losses and you've got yourself a very nice profit locked in. Without money management, a $10 bet per spin would put you at only $80 profit in this same scenario. Instead, you've made over 4 times that with about the same risk to your beginning capital.

The downside to this strategy is if your cycle target of cumulative wins is too high and you go a long time without reaching your target, it will work against you periodically and cause larger draw-downs than the “consecutive wins” strategy. However, the larger draw-downs are usually more than offset by completing more winning cycles, as long as your target isn't too high. You need to balance it out for the smoothest equity curve. Don't be too greedy or too conservative either.

When trading, your cycle target should be determined by your rate of wins vs. losses and how well your wins are clustered together. You can get a good estimate of the most appropriate goal simply by back-testing your trade signals on historical price data, but be careful not to over-optimize your signals or the same patterns will not repeat in live trading. You want loosely optimized signals that trade often and catch very frequent trends or whatever pattern the signals were designed for.

The following illustration shows how the Cumulative Wins strategy is applied to forex trading when using Equal Risk to Reward trades (equal stop-loss and profit target). You simply add 1 unit to your lot size following wins, and subtract 1 unit from your lot size following losses. Return to 1 unit (or minimum lots) when you have a win at your cycle profit target.

In Forex trading, if 1 unit = 0.01 lot, then 2 units = 0.02 lots, and 3 units = 0.03 lots, and so on. Likewise, if 1 unit = 0.05 lots, then 2 units = 0.10 lots, and 3 units = 0.15 lots, and so on, up until a win at your cycle target.

CUMULATIVE WINS STRATEGY - EQUAL RISK to REWARD

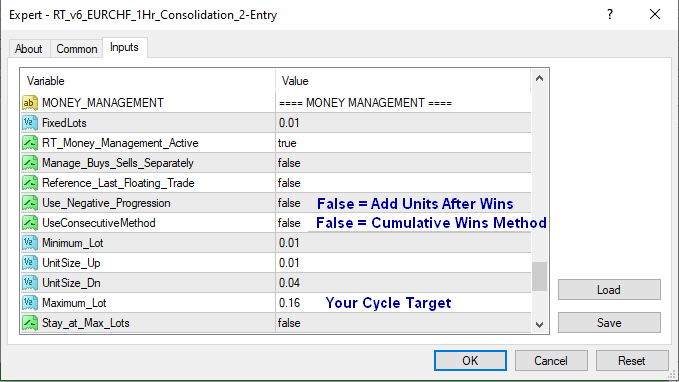

See this video demonstration of the Cumulative Wins strategy using one of my trading robots on EUR/CHF.

Please turn up your volume!

DOUBLE Risk to Reward

CONSECUTIVE Wins Strategy

"Doubling the Risk for MORE Wins"

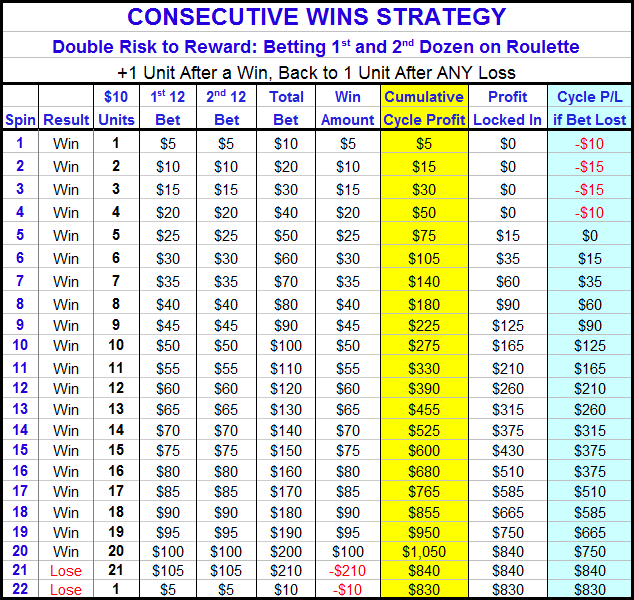

3. CONSECUTIVE WINS Strategy Betting The Dozens on Roulette:

In financial trading, double risk to reward means having a stop-loss twice the size of your profit target. To use this strategy playing Roulette, you'd place equal bets on 2 of the 3 dozens. A win on one bet pays 2:1 while the other bet loses so your net is +1 if one wins but a loss on both bets results in -2. Your risk is DOUBLE your potential reward but you will win more often than an equal risk/reward bet. This statistically puts your win ratio at 64.8% on a double zero roulette table so winning streaks are frequent and that's the most important thing.

To be sure that you catch a trends, follow the results of the previous 2 dozens hit when using a real table at a casino. I've had my table hit the same number 2 and 3 times in a row on multiple occasions so how likely is it that it will hit the same two-thirds of the table 10 or 20 times in a row? It happens more often than you'd think and that's the same concept as my trend-following trading strategies. You're just following the current trend.

For Roulette, you'll need to divide your total bet and units between 2 of the dozens (1st 12 and 2nd 12). They work as a team. So for clarity, when I say “units” here, I am referring to your total bet (the 2 bets combined). Simply increase your total bet by 1 unit if one of them wins, and return your total bet to 1 unit after any loss. The downside to this is that you'll need to win 4 consecutive spins (or trades) before you are risk-free on any cycle.

Here's an example using $10 units on a run of 20 consecutive wins to show how the profit accumulates on winning streaks. To keep it simple, ignore the columns for the 1st and 2nd 12 bets. It's the Total Bet column that matters when it comes to Financial trading.

Notice that the worst you can possibly do on any cycle is lose $15. However, it can take up to 4 spins to lose a cycle and 5 to break even. This gives you tremendous staying power. Statistically, you will obviously lose many more cycles than you win but your average profitable cycle will be much more than $12.50 with occasional runs well into the hundreds. It just depends on how long your winning streaks are, which is impossible to predict. However, you can really smooth your equity curve by setting a cycle target and ending your cycles on a win rather than waiting for a loss. This will lock in healthy profits on a more consistent basis.

In the graph above, compare the yellow “Cumulative” profit column to the blue “PL if lost column” on the right. Let's assume you have a win on the 8th spin and now have $180 cumulative cycle profit but you continue the cycle and lose on the 9th spin, which ends your cycle with a $90 profit that you had locked in. Now if you had ended your cycle after your 8th win, your cycle would have ended with $180 profit (double the money). The yellow column represents profit that you can walk away with at any time and it's about 3.5 spins ahead of the blue column so ending your cycle on a win is equivalent to winning an additional 3.5 bets without actually taking the risk on those next bets - another bonus to an already winning system!

I have tested this system on video Roulette at an online casino and, although there are occasional good winning streaks of 10-12 consecutive wins, they are not that common due to the unnatural randomness of their RNG software. A real roulette table will give you much better results when you follow the previous 2 dozens hit. From my testing, the system that seems to work the best at online casinos is to place your bets on the 2 dozens that did NOT hit last, although I do not recommend gambling at any online casino because we have no way of knowing if they are cheating or not. It's also not necessary when you have such an advantage trading financial markets where trends and winning streaks are so frequent and you can automate the entire process with one of my trading robots.

This illustration shows the equity curve using signals with double the risk to potential reward (200 pip stop-loss with a 100 pip profit target). Winning streaks are frequent and occur every time the market trends. These trades are from trend-following signals so the losing streaks are caused by choppy market conditions.

DOUBLE Risk to Reward

CUMULATIVE Wins Strategy

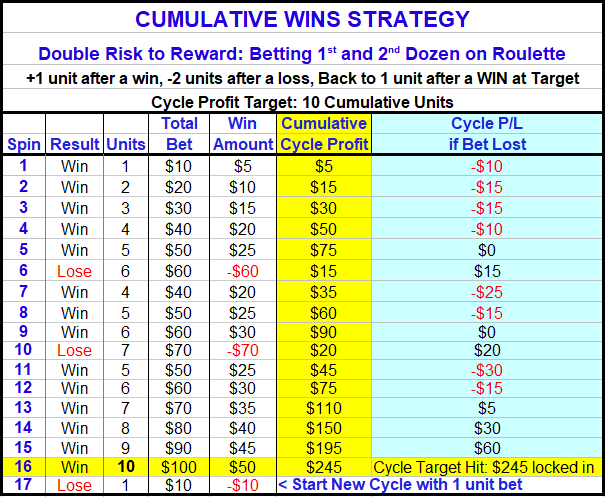

4. CUMULATIVE WINS Strategy betting 2 of the 3 dozens on Roulette (double risk to reward):

Previously in the cumulative wins strategy for equal risk/reward (betting red or black on Roulette), we subtracted 1 unit after a loss and added 1 unit after a win until we hit our cycle target. Now your losses are double the size of your wins so you should now subtract 2 units after each loss to keep the math balanced, because if you happen to get a run of losses in the middle of your cycle, you want to get back to 1 unit ASAP to protect your starting capital.

If you only subtracted 1 unit, then it would take less than half the number of losses to lose all of your accumulated profits and quickly dip into your starting capital. By the term “starting capital”, I mean your capital at the beginning of each cycle. We treat each cycle like an entirely new game.

Here's how it looks when played out with a couple of losses and a target of 10 cumulative wins (or a win at 10 units, since that would be a more accurate statement now). Follow the "units" column to see how the units are adjusted following wins & losses. In summary, this strategy is: +1 unit after a win, -2 units after a loss, back to 1 unit after a win at the cycle target. That's all you really need to remember and this will be included in the Strategy Summaries near the end of this ebook for easy reference.

If you ended your cycle after the 10th cumulative win (spin 16 at 10 units) as in the example above, then you would have ended this cycle with $245 profit. If this had been the “consecutive win” strategy, then you would have 3 separate cycles by the 16th spin. The first would have ended with $15 profit on the 6th spin. The second with -$10 on the 10th spin, and the third with $105 profit on the 16th spin for a total of $110 profit. Instead, with this cumulative wins system, you have $245 profit (over double the profit and your best run was only 6 consecutive wins).

Once again, the downside to this strategy is that it can generate larger draw-downs, especially if you set too high of a target to end your cycle because profit is never locked in until you have a win at your cycle target. The lower your “cumulative wins” target, the more often you will hit it but with less profit. Over the long run, it's usually much more profitable to go for larger cumulative wins (like 10 or more) but there will be some wild equity swings in the process so you'll need more patients and a strong stomach to go for the big cycle targets but they can really pay off big time!

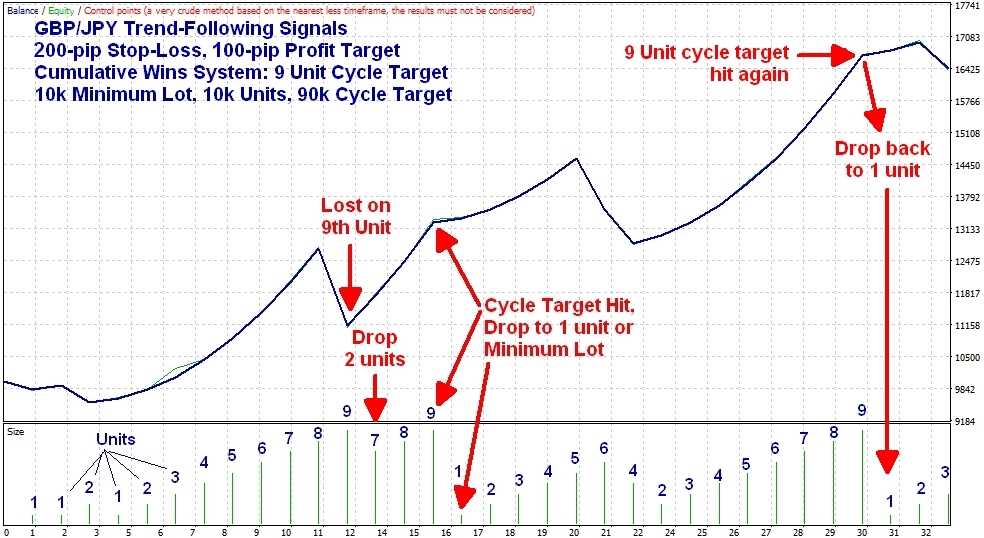

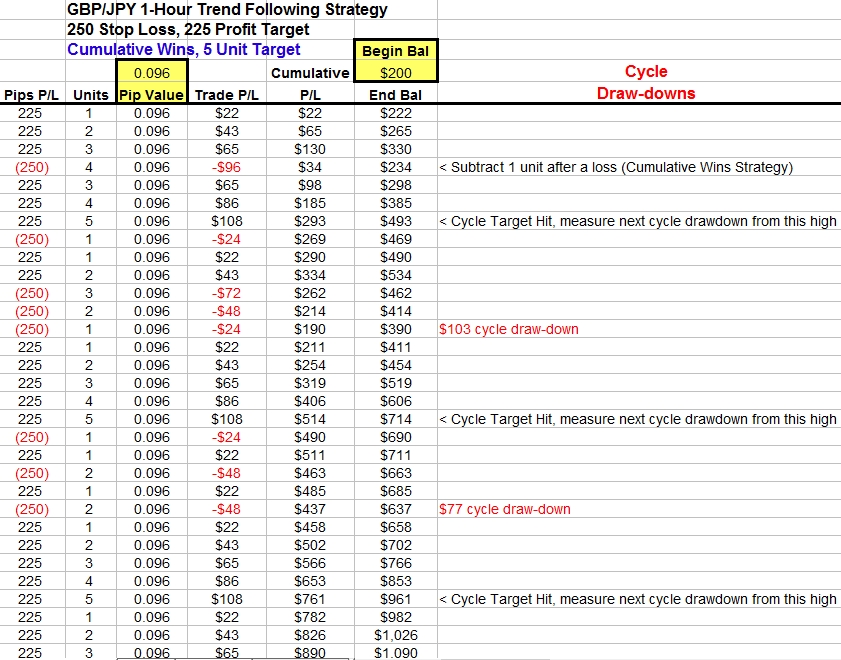

APPLYING THE CUMULATIVE WINS SYSTEM TO FOREX TRADING WITH DOUBLE RISK TO REWARD

The following illustration shows the Cumulative Wins system using 10k units (0.10 lots) with a 9 unit cycle target (90k or 0.90 lots). The stop-loss is double the size of the profit target (200 pips to 100 pips) so it adds 1 unit after a win and subtracts 2 units after a loss. Drop to 1 unit after a win at the cycle target to lock in the profits. The green bars at the bottom of the represent the lot size, which I labeled as units for this example...

So What's The Secret?

Please understand that these strategies do not make any win/lose sequence profitable. It is NOT a one-size-fits-all system. Instead, it capitalizes on patterns of winning streaks or clusters of wins, and the good news is that these clusters tend to occur naturally even in a random game like Roulette but especially when trading financial markets that frequently repeat patterns of trends & consolidation.

While the outcome may not always be profitable, these strategies will give you the most profit potential for any given number of bets (or trades). But due to the randomness and built-in disadvantage on a casino game like Roulette, there can still be long periods where you do not get a single good winning streak so I really do not recommend using it, or any other system, for gambling unless it is just for entertainment purposes. I merely used the game of Roulette as a testing ground for my strategies and these strategies greatly outperformed all the others I tested over tens of thousands of bets.

However, it is very easy to get long and frequent winning streaks in financial markets because you can specifically design your trading system to exploit the most common and repetitive market patterns (trends & consolidation), which will give you many winning streaks and a statistical advantage no casino would dream of giving you.

So rather than bust your brain trying to develop trade signals that are consistently profitable, you only need to develop trade signals that generate frequent winning streaks or clusters of wins (a MUCH easier task) and not worry about losing streaks because the money management will quickly drop the lot sizes to suck the power out of them! But let's just focus on the game of roulette for now (a random game of chance).

On a roulette table, or any other game with nearly-equal odds, these would statistically be a net zero system (or worse) if you never got a good winning streak or never locked in any profit when you did get one because it would cause every cycle to end with a large loss. But locking in your profit at a cycle target essentially robs statistics (and the casino or broker) the opportunity to win most of those cycle profits back from you with a final big loss at the end of every cycle and that's where traditional money management strategies fail.

The traditional money management strategy of risking a small fixed percent of your account per trade never locks in a dime of profit at any time and ultimately, it works against you! When profits increase, so does leverage to no end and it actually requires fewer losses to lose all of your accumulated profits than it took to originally gain it. It's counter-productive unless you have holy grail trade signals that never have a losing streak, which rarely happens in the real world, if ever, and you certainly can't count on it! Yet every trading book out there tells you to do exactly that and then they tell you that 95% of all traders fail. Hmm... do you see a common denominator here?

With the Consecutive Wins strategy, it's not as important to have a cycle target that's frequently hit because it's good at automatically locking in profit as you go. As long as you're staying ahead of the game, you can always let fate decide and you might get a grand slam, although I prefer using a cycle profit target to lock in profit more often to smooth the equity curve. As you may have noticed, the equity curves in my screenshots tend to look like steps. Each step typically represents a cycle target hit, which locked in the profit for that cycle.

On Roulette, my suggestion is to play the double risk to reward bets (2 of the 3 dozens) using the Consecutive Wins strategy. This should give you a 64.8% average win rate on a single-zero wheel. To begin with, go for a cycle target of 6 consecutive wins and once you have some profits to play with, you can let the next cycles run wild with no cycle target (Sky's the Limit). A run of 20 consecutive wins using $10 units ($5 per bet) would put $1050 profit in your pocket (with $750 profit locked in), which grew from a mere $10 starting bet. A run like that would cover the next 84 losing cycles (several hundred spins) and you're likely to get more big winning streaks before you lose 84 cycles in a row. In other words, you'd probably never be in the red ever again! Look at my “Sky's The Limit” illustrations further below to get a visual of what this would look like on a trading chart.

CASINOS & RANDOM NUMBER GENERATORS

Perhaps the reason these strategies work is for the same reason I so quickly got my butt kicked TWICE in the same night using the Martingale system, and then a THIRD time when I tried to use it trading FOREX. The Martingale system requires randomness without any unusually long runs of losses beyond 6 or 7 consecutive losses. It is usually the 6th consecutive loss that destroys every gambler ($630 down at that point starting with only a $10 bet) and the 7th bet would put you over the $1000 table limit so the 6th consecutive loss for a Martingale gambler is essentially the Casino's Cycle Target, which allows them to lock in your $630 loss. If this system didn't work, the casinos would not have table limits. Hint hint... Table limits are NOT for your protection. It's for THEIRS!

Online casinos use different types of Random Number Generators (RNG) and most Random Number Generators are artificially random so they do not generate the types of trends you will find in natural randomness. That is why these strategies will work better on a physical roulette table than in an online casino using RNG. And that's not even considering that online casinos are probably rigged to begin with. They only win when you lose, and I'm quite certain they have the technology to know, and shift the odds against you, when it's a good time for you to lose.

There is now software that generates True Random Numbers (TRNG) but they are very slow to generate numbers because they require natural signals from the physical world (outside the computer) like white noise, the sound of rain drops, birds chirping, or other sounds of nature that can be imported into the computer. The process is slow, expensive, and may give patterns that can be exploited by everyone reading this ebook, so they are simply not used by online casinos.

In the real world, one spin has no influence on any other spin. A physical roulette wheel could hit red 50 or 100 times in a row but you'd never see that in video roulette because statistics say it shouldn't happen and so it's programmed not to. I've played around 50,000 spins of online roulette (recording most of it) and never had a run of red or black longer than 12, and even 10 is very rare, while runs of 6-8 occur just often enough to wipe out anyone using the Martingale system. Hmmm, do you think that might be by design?

In real life, trends outside of the statistical norm just happen to occur quite frequently and for no apparent reason. If they didn't, then we'd all be millionaires using Martingale's “double your losing bet” system but that happens to be the best system in the world to lose everything you own fast! With the Martingale system, when losing streaks veer outside of the statistical norm (which occurs quite frequently), you lose too much money to stay in the game (or you exceed the table limit) and your losses get locked in. All we did is turn the table, make it a bit less aggressive, and added a profit-locking, save-as-you-go mechanism to it.

No gambler or trader has any problem with massive spikes of profit, but if those are losses, then it's game over! In order to win the game, you need to stay in it and these money management strategies keep you in the game even when it's not going very well. It only takes one moderate winning streak to launch you into profit quickly! My profit-locking strategies will keep you in the game long enough to catch some whoppers. It sometimes requires a little patience, but as I'll show you below, PATIENCE PAYS!

TRADING FINANCIAL MARKETS

When I think about this, it reminds me of a magic trick where the magician diverts your attention to his right hand while he slips the card out of his sleeve in his left hand. If you want to know where the real magic happens, you need to look where nobody else is looking.

It seems EVERY trading system relies on trade signals alone to exploit price patterns in the market, while completely ignoring money management and the frequent patterns of wins and losses generated by their signal strategies. With proper money management, you can make great money just by exploiting occasional winning streaks even if the sum of the underlying signals aren't very profitable.

As I mentioned a few pages back, it's SO MUCH EASIER to design trade signals with well clustered winning & losing streaks than it is to create trade signals that are consistently profitable, which you could never depend on anyway. The markets naturally form periods of trends and consolidation, and they are usually doing one or the other and most trading systems either do well in one condition or the other, but rarely both, so profits made in one market condition are quickly lost in the other if you are not using any money management strategy that exploits and locks in profits from the winning streaks.

Using Roulette TRADER Money Management, if you want to profit in both market conditions (without giving it all back), all you need is two different signal strategies; one designed to do well in trends and one designed to do well in a consolidating (choppy & sideways) market, so that one is snowballing profits at increasingly larger lot sizes during a winning streak while the other is preserving capital at small lot sizes during losing streaks.

As I'll show you below, it's possible trade identically opposite signals and make a profit on both. That's not always the case but trading opposite signals with the same money management applied to both is usually quite profitable when you combine the two results, as long as your wins and losses typically occur in clusters. A consistent win-lose-win-lose-win-lose system will not work. But the good news is that the most basic trading systems should generate well clustered wins & losses quite frequently just from natural market conditions alone so it's important not to over optimize your trade signals. Some of my best signal strategies are as simple as “Price above Moving Average X = Buy, Price below Moving Average X = Sell” and when I apply my money management strategies to it, the results often blow away the most sophisticated trading systems out there!

A GREAT TEST

Trading Opposite Directions Simultaneously

To illustrate the effectiveness of this betting strategy, I took an average trend-following trading system on the GBP/JPY currency pair and then back-tested the signals in OPPOSITE directions. These particular trade signals had a 75 pip stop-loss and 75 pip profit target so it was nearly equal odds on both sides (like betting red or black on roulette). I say “nearly” equal odds because the dealer's spread works against us in each direction just like the green zeros on roulette a roulette table. Here's the results of the two OPPOSITE trade signals BEFORE applying my money management strategy. A $314 profit in one direction and an -$879 loss in the opposite direction.

Now Let's Apply

Roulette TRADER Money Management

to the SAME "Opposite" Trade Signals!

Here's the identical trade signals from the example above but this time with the Cumulative Wins Strategy applied to each with a cycle target of 5 units. Remember... the 2 graphs below are OPPOSITE trade signals EACH with money management applied so you can compare their winning and losing streaks.

Top Equity Curves (above & below): The first trade signals went from a mere $314 profit (top graph above) to a whopping $2356 profit (top graph below) while starting with the same contract size and risk per trade. That's a 650% improvement with a much better profit to draw-down ratio too!

Bottom Equity Curves (above & below): The OPPOSITE trade signals in the bottom graph went from an -$879 loss (bottom graph above) to a $540 profit (bottom graph below). That's a +$1319 improvement! It actually turned a horrible losing trading scenario into a nice profit! And not only that, the max draw-down was reduced by half! This example had worse statistics than a Roulette table on a bad run, and yet it cleared $540 in profit!

As these are opposite trade signals, notice that one shoots into profit while the other preserves capital by taking very small losses. Before applying my money management strategy, the net total for the two opposite trading signals combined was -$565. After applying money management, the combined net profit was +$2896. To put this into perspective, you could have simultaneously traded these two “opposite” trade signals from a single $1500 account, which would be 193% profit in just 2.8 months, all while trading in opposite directions simultaneously on every trade! How cool is that? And what better way to diversify your portfolio? When one is losing a little, the other is making A LOT! With a hedging system like this, you don't need to predict the next market move. You just need to be in it!

TURNING LOSERS INTO BIG WINNERS!

The trade signals I use in these next few examples are not good trade signals and I would never consider trading them with real money. I have much better signals for real trading and I'll show you some of those further below. But things don't always go your way, especially when it comes to gambling and trading. So it's nice to know that you have a money management system that can save your back when things aren't going well, and can even pad your pockets at the same time.

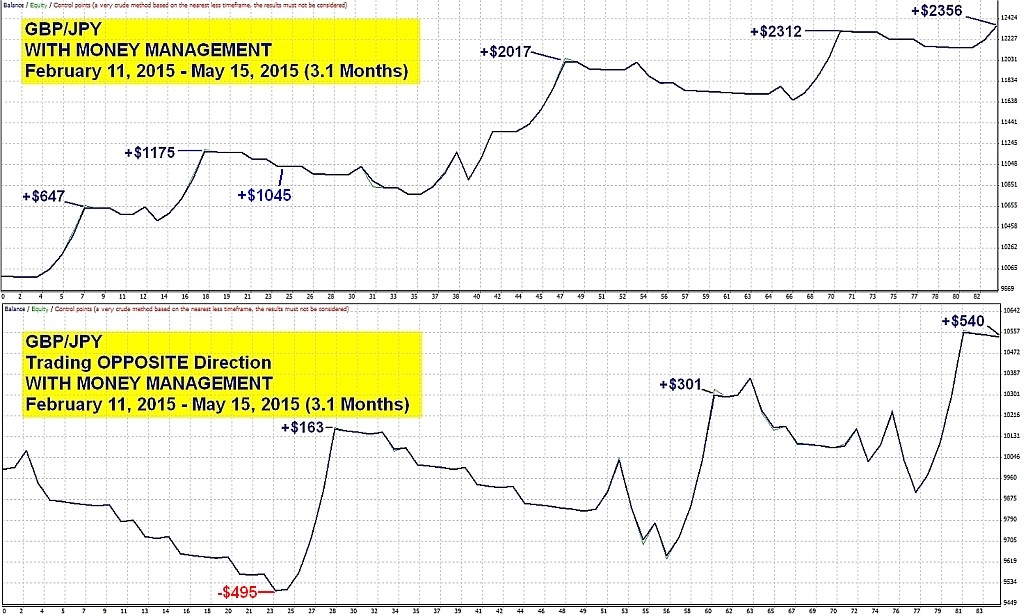

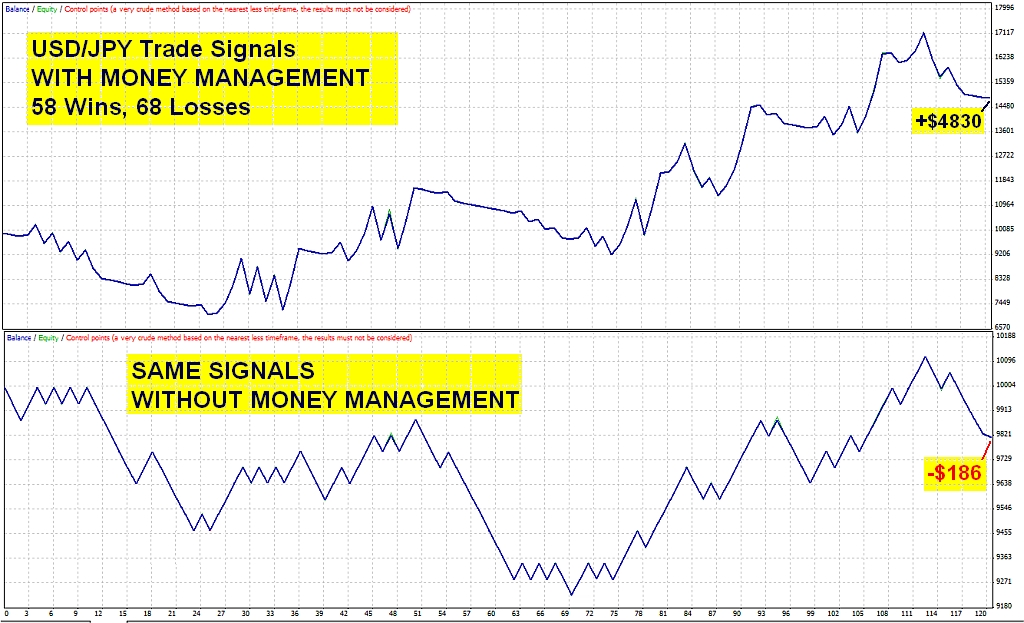

From -$186 to $4,830 Profit!

Here are some pretty bad trade signals on the USD/JPY currency pair with a 70 pip stop loss and 70 pip profit target with 46% wins (slightly worse odds than betting red or black on roulette). Here I used the Cumulative Wins strategy with a 5 unit cycle target and Flat-Lining (explained later). The settings were: 0.01 Minimum Lot, 0.10 Unit Size, 0.41 Max Lot/Cycle Target. The beginning balance was $10,000 and the period shown is over 3 months.

Top Graph: WITH Money Management Applied, it made $4830 (+48.3%).

Bottom Graph: WITHOUT Money Management, it LOST $186 (about -200 pips).

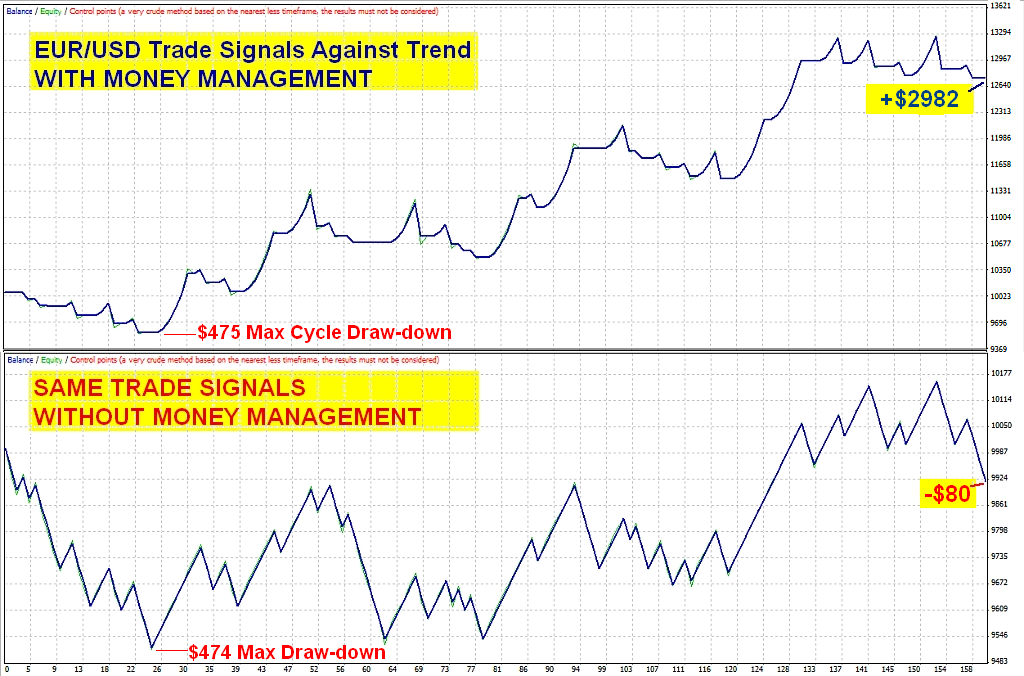

From -$80 to $2982 Profit!

Here are some EUR/USD trade signals, trading against the trend with a 50 pip Stop Loss and 30 pip Profit Target. In the top graph, I used the Consecutive Wins strategy with a 5 unit cycle target. The period shown is from Dec 18, 2014 - May 20, 2015 (5 months). If you started trading this scenario on a $1,000 account balance, the return would be 298% while most other traders would have ended with a loss despite having the same maximum draw-down.

Top Graph: WITH Money Management, it made $2982 profit.

Bottom Graph: WITHOUT Money Management, it LOST $80 (-80 pips).

From $72 to $1764 profit!

Here's another example on the EUR/USD currency pair but this time these are breakout trade signals using Cumulative Wins money management The period is from Feb 17, 2015 - May 29, 2015 (3.3 months). These signals perform MUCH better with a smaller profit target but I wanted to give you another example similar to betting red or black on Roulette.

For this example, the Stop-Loss and Profit Target are each 70 pips (equal risk/reward). There were 49 wins and 47 losses in this example. In the top graph, I used the Cumulative Wins strategy with a 5 unit cycle target and flat-lined the losing streaks (explained on page 47). In this example I had trouble getting the max draw-downs equal in size but I got it close. One thing you should notice is that the max draw-down in the top equity curve is still well into profitable territory while the bottom one is in negative territory (below the starting balance).

Top Graph: WITH my Money Management strategy applied, it made $1764 profit.

Bottom Graph: WITHOUT Money Management, it only made $72 trading 0.10 Fixed Lotts per trade.

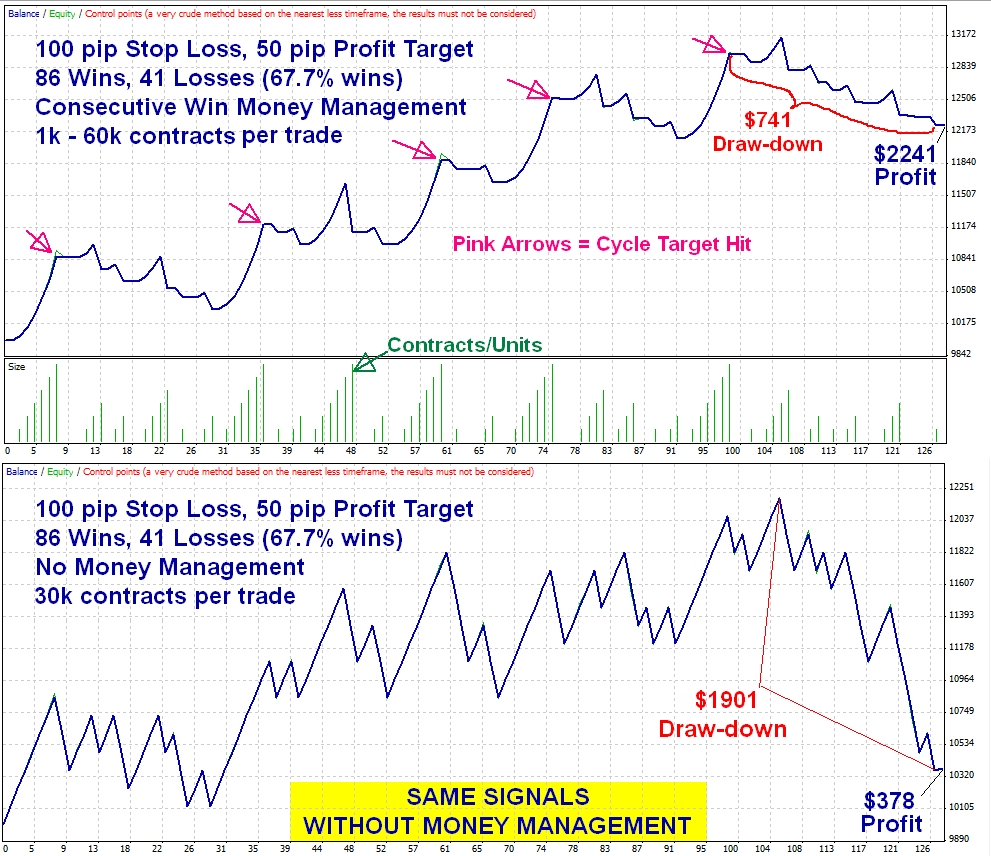

(Double Risk to Reward Bets)

Here are some random signals I made up to replicate my preferred Roulette strategy for betting on 2 of the 3 dozens on roulette (double risk to reward). It has a 100 pip Stop Loss and 50 pip profit target so the losses are double the size of the wins. By adding the Consecutive Wins money management strategy with a 7 unit target, it made almost 6 times the profit with only 39% of the max draw-down. There's nothing special about these signals. They are almost perfectly statistically balanced with a 67.7% win ratio. I also used low leverage in the top graph. The beginning balance was $10,000, the starting lot size was #1k (0.01 Lot in MT4), and the largest contract was $60k (0.60 lot in MT4). With only a $741 max cycle draw-down, I could have easily increased the lot sizes and results by 5 times.

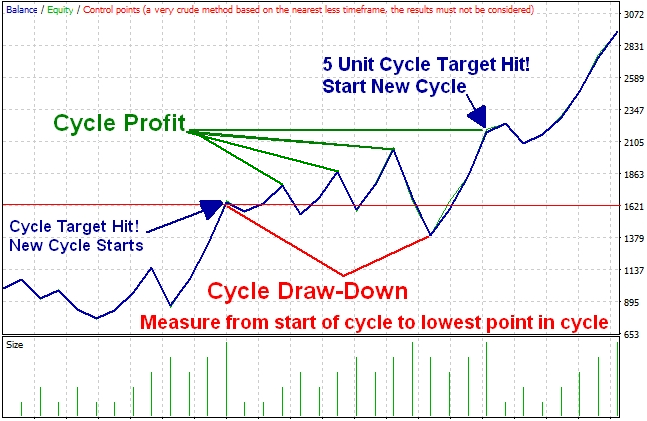

How to Measure Cycle Draw-Downs

This is very important to understand because the size of your draw-downs determines how aggressively you can leverage the size of your trades. When measuring draw-downs with these money management strategies, DO NOT measure from the mid cycle profit highs because that is the house's money and is not locked in and claimed as ours yet. It's money we are willing to lose in an effort to leverage ourselves to reach an even larger profit point (our cycle target). Mid cycle profits can be lost very quickly and it's a necessary part of the game. Therefore, we ignore mid-cycle profits and we only measure dips below our cycle's starting capital (the cycle starting point), which are the only losses that pose a threat to our principal capital.

The illustration below shows 3 cycles but let's focus on the one in the middle for this example. The thin red horizontal line represents the cycle's starting equity, which was also the ending point of the previous cycle. Every dip below the red line is a cycle draw-down and should be measured from the cycle's starting point and NOT the high equity points (mid cycle profit) that occurred before it. This shows your potential risk to principal when backtesting. Of course, it could always exceed that in the future but it gives you a good idea of what you can expect as normal if you have a large period of data to test. But when you back-test strategies like this, you will need to calculate your cycle draw-downs manually because trading platforms (like MT4) only calculate peak-to-valley draw-downs (highs to lows). Placing your mouse over the equity curve will show the account balance at each trade and you can calculate it from there.

How to Handle Big Cycle Draw-Downs

In the next few examples, I'm going to show you how each

Money Management Strategy effects the same trade signals with different Cycle Targets...

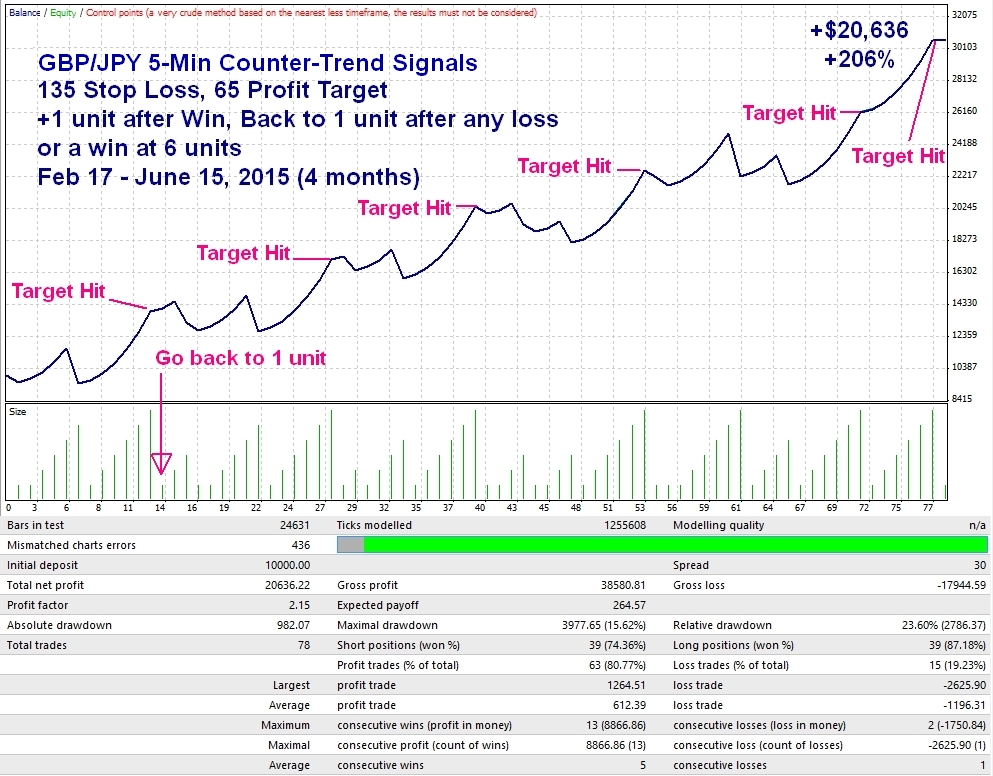

Using "Consecutive Wins" with a 6 unit Target

Here's are GBP/JPY Counter-Trend signals using the Consecutive Wins Money Management strategy with a cycle target of 6 units. You can see that a 6 unit cycle target is hit quite frequently and provides a consistent equity curve. FYI... A cycle target of 5 units here would have generated $19,496 profit. Not a big difference because it hit it's target 1 additional time.

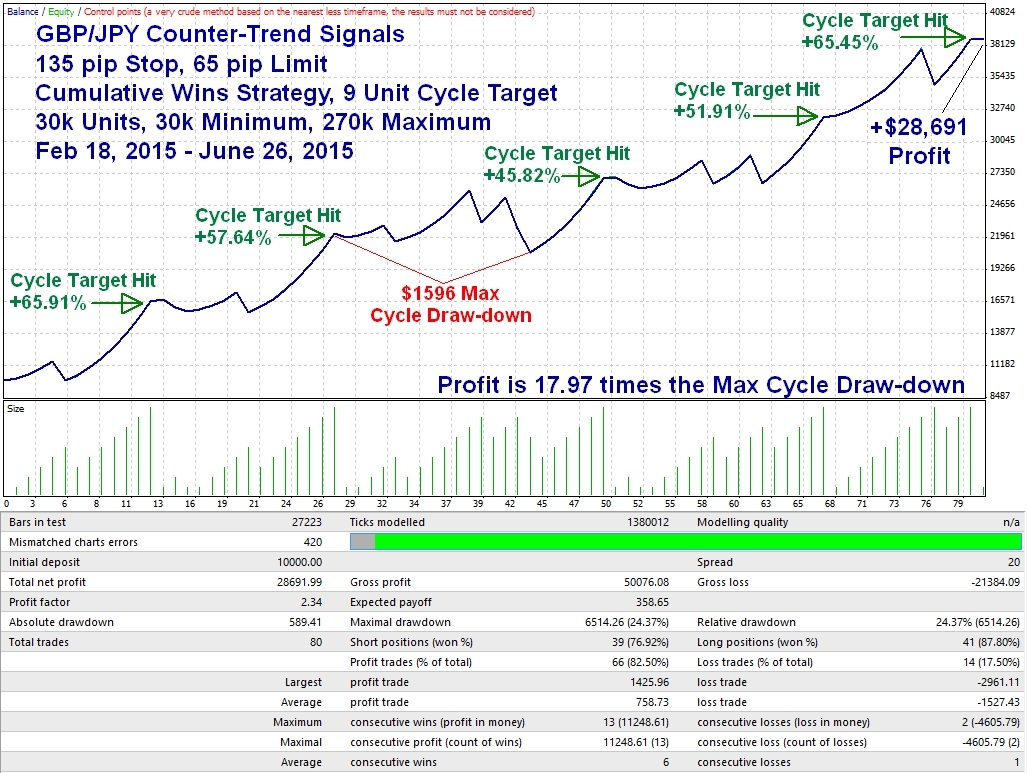

using the "Cumulative Wins" with a 9 Unit Target

Here's the same GBP/JPY signals using the Cumulative Wins strategy but this time I increased the target to 9 units (a 3 unit increase from the previous example). This added an extra $8000 profit to the same signals (plus 11 extra days), even though we were using 25% smaller units so we could stay within the broker's maximum allowed leverage. Despite the larger equity swings, we still had a small max cycle draw-down of only $1596 here. That would be 15.96% if you were compounding after each cycle.

And speaking of compounding... keep in mind that you can compound your profits by re-adjusting your money management settings after each profitable cycle. I included the cycle-to-cycle % gain each time the target was hit below so you could do the compounding math yourself. We started with a $10,000 balance here so +65.91% at the first cycle target was a $6,591 profit. The cycle target was only hit 5 times in this example, but they are much larger profits so when you compound them, you end up with $85,853 profit (858.5%), which is $30,353 more than the example above using a 6 unit target. At this rate, you could turn $2000 into $1.28 Million in a year!! Of course, this is speaking hypothetically, but you can see how it's quite possible since you're compounding by an average of 57% each time, and sometimes twice per month.

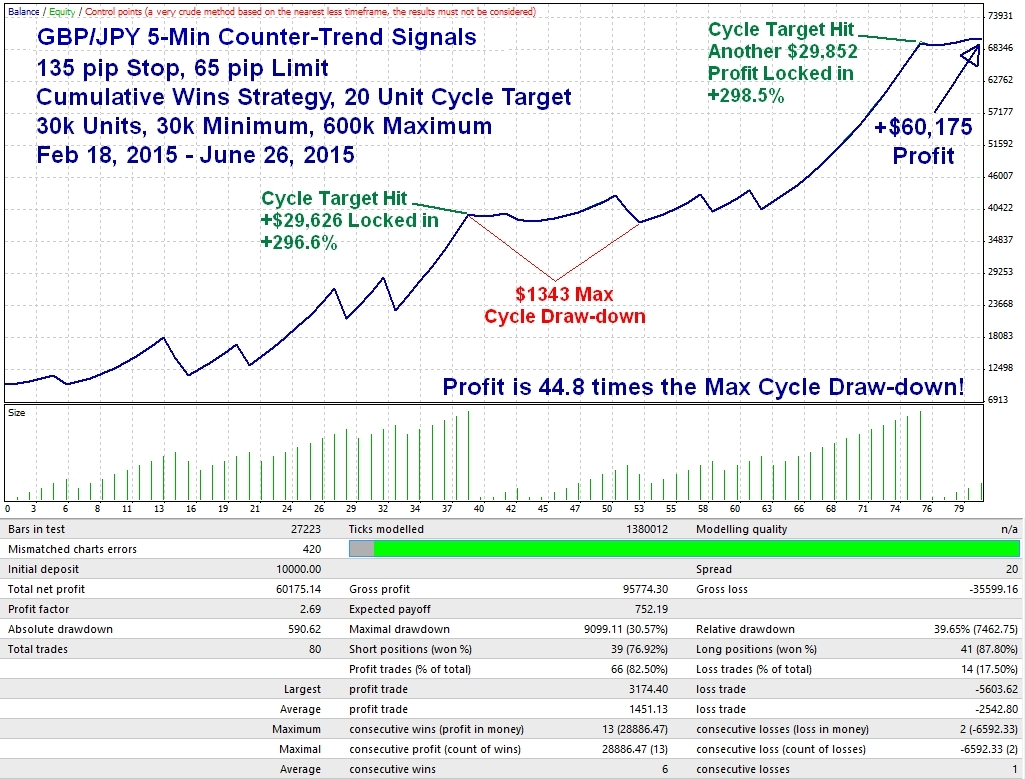

The Same GBP/JPY Counter-Trend Signals

using the "Cumulative Wins" Strategy with a 20 Unit Target

Ok, it's time to crank things up a bit! Here are the same GBP/JPY signals once again using the Cumulative Wins strategy but now with a 20 unit cycle target. As I mentioned earlier, it is much more profitable to go for larger profit targets and this is a great example of that. The unit size is the same size as the previous illustration (30k or 0.30 lot) and since the required margin for the large trade volume was self-funding, the leverage never exceeded 19:1. It only hit it's cycle target twice here but each time was almost a 300% gain (that quadruples the account). If compounding at each cycle target, a $10,000 beginning balance would have turned into about $168,000 at the end of the 2nd cycle with your profits locked in!

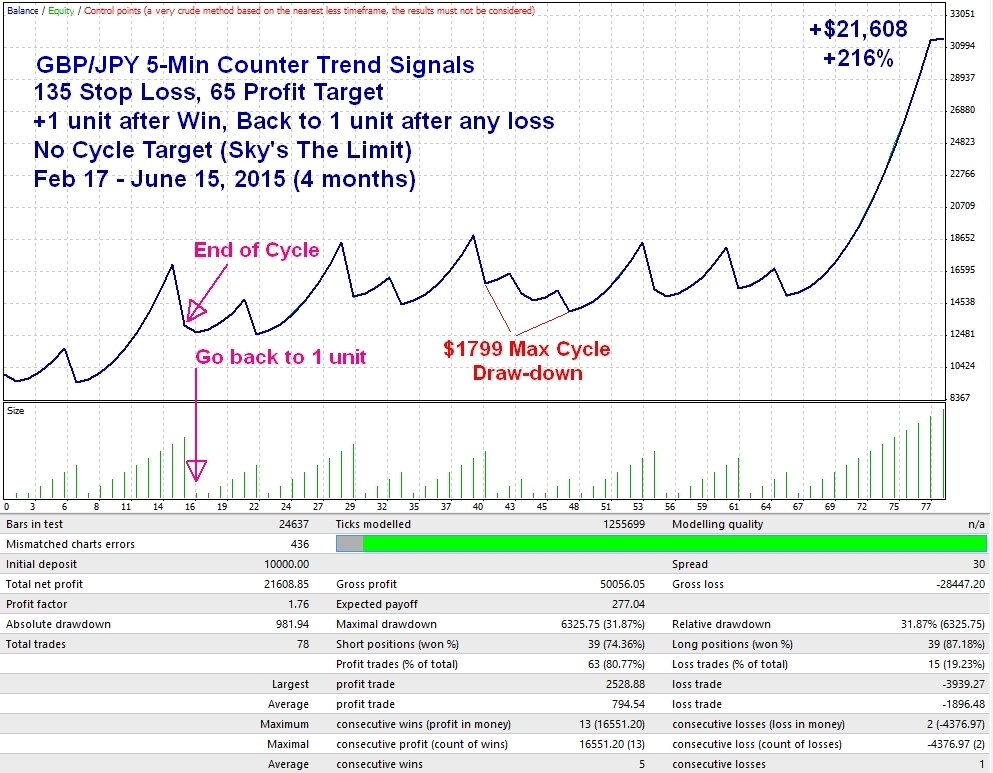

Sky's The Limit! - Going for HUGE Profits FAST!

The Same GBP/JPY Counter-Trend Signals

Consecutive Win Money Management with No Cycle Target

"Sky's The Limit" Strategy

Have you ever wanted to get rich quick? It's possible with the "Sky's The Limit" strategy. All you need to do is remove the cycle target in the Consecutive Win's strategy and you only end your cycle when you have a loss. It keeps your risk low but there's no limit to how much you can make in a single winning streak. As you can see, profits grow extremely FAST and it automatically locks in profit as you go.

Here's an example of the “Sky's the Limit” strategy using the Consecutive Wins strategy using Consecutive Wins Money Management with No Cycle Profit Target (Sky's The limit). It adds 1 unit after each win until a loss occurs, then goes back to 1 unit to lock in all remaining accumulated profits. It's not the most ideal equity curve but the statistics are great with profit 12 times the max draw-down with the last cycle still going with 12 consecutive wins completed. The green bars below the equity curve show the size of the contracts on each trade and makes it easy to count the units.

The Max Draw-down: In the example above, the stats below the chart show a max peak-to-valley draw-down of $6325 but over half of that was from a single loss at the end of a profitable cycle (trade #41). It was merely profit that we had to give back, and yet we still had some profit locked in. The remaining $1799 of the draw-down is what could have dipped into our starting capital, and that's the only number that really matters to us.

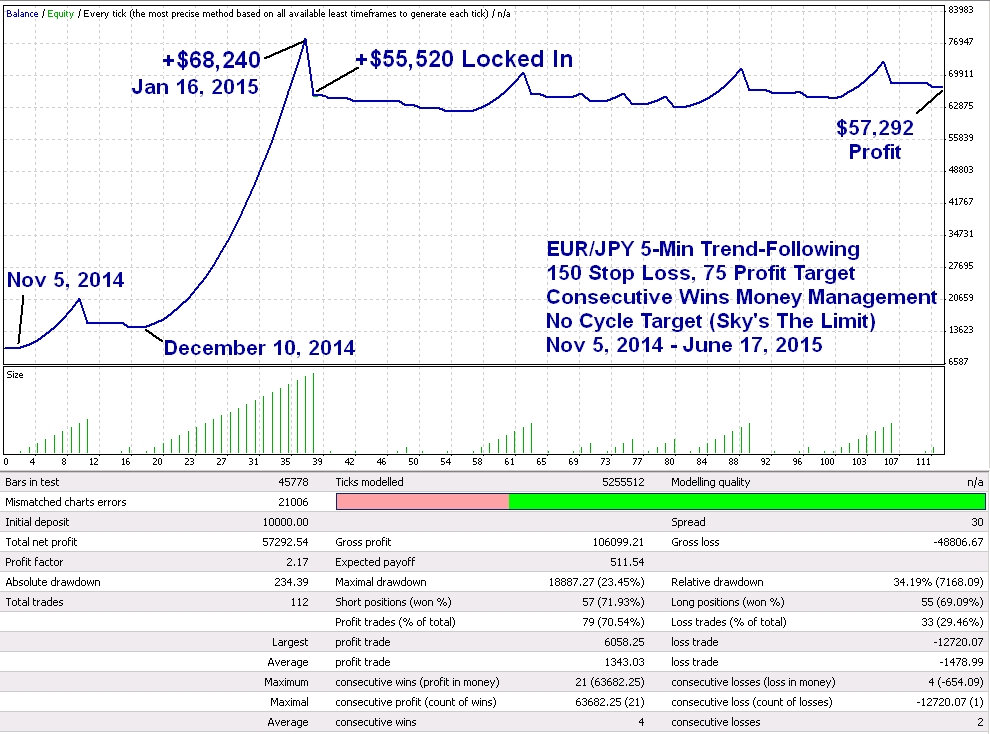

EUR/JPY Trend-Following Signals using

Sky's The Limit!

The comparison below is using trend-following signals on EUR/JPY. The top equity curve is using the Consecutive Wins strategy with NO cycle target (Sky's The Limit) using a 2:1 Risk/Reward ratio (the stop-loss is 2x the profit target resulting in a 70% win rate). Here I started with a Minimum Lot of 0.01 (Flat-Lining) and used 0.50 Unit Size but the max leverage never exceeded 22:1 because accumulated profits helped fund the next trades. Starting with a $10,000 balance, it spiked to $68,240 profit (682%) during a run of 21 consecutive wins then quickly locked in over $55,520 profit (555%) following a loss. It has since added another $1772 profit, while it waits quietly for the next rocket launch!

Depending on your win rate, it can take a long time to get a really big winning streak. Therefore, I prefer to use Cycle Targets to lock in profit as I go and compound profits between cycles. I just wanted to show you what was possible with this strategy if you just let it run on a winning streak.

And here's a comparison of the same trade signals with and without money management...

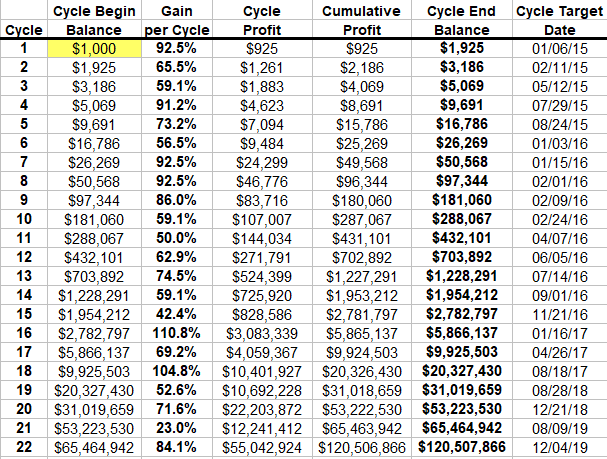

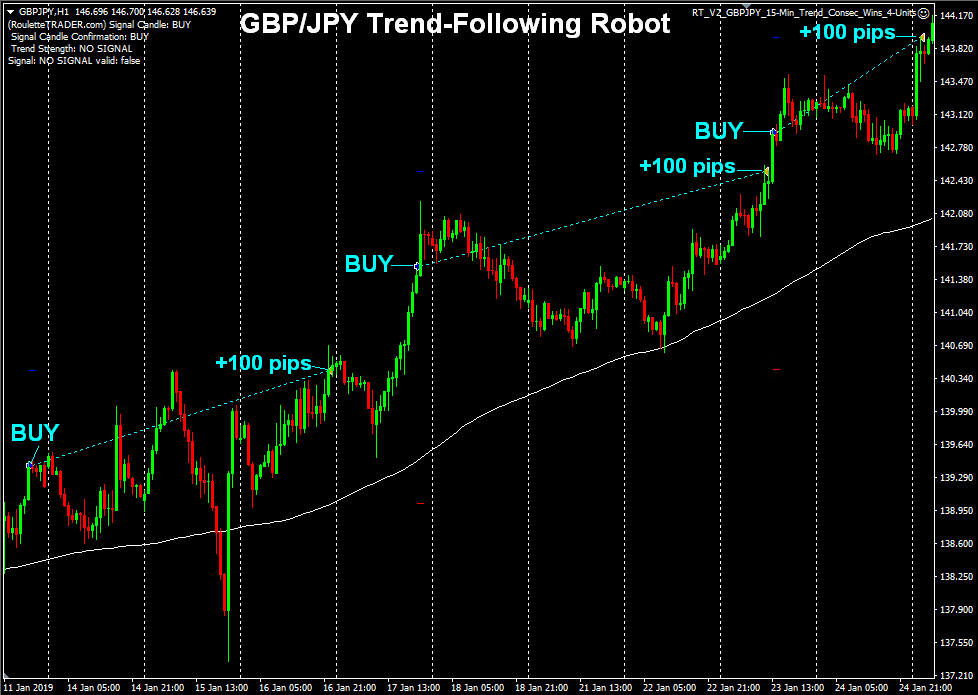

How to Compound Cycle Profits

To compound profits using the Roulette Trader Money Management System, simply adjust your lot settings after each cycle target is hit (a successfully completed cycle). Since cycle profits are usually significant, the compounding effect from cycle to cycle can be quite significant over the course of a few years. Here is an example with data taken from my Trend-Following robot on the GBP/JPY 15-min chart.

* A hypothetical compounding model.

* A hypothetical compounding model.

Past performance is not indicative of future results.

This model is based on trading at 0.01 unit size per $350 balance, which is aggressive for this particular strategy, considering some cycle draw-downs reached nearly 50%. I don't recommend trading this aggressively long-term due to unforeseen extended draw-downs but it's certainly a good way to grow a small account quickly when you're not risking much to begin with. Nobody needs to make over $1 million per month so once you get to a comfortable income, reduce leverage for longer-term trading.

Compounding Tip: For the purpose of compounding cycle-to-cycle profits, it is much easier to manage and properly calculate each new cycle's appropriate leverage when you trade only 1 robot per MT4 account. This will also allow you to clearly see the performance of each robot or signals you may be trading manually. Otherwise, your balance will reflect a combination of every system trading on that account. The alternative is to manually record every trade from each robot or trading system into a spreadsheet so you can track each system's individual performance. I provide a spreadsheet for this in my members area.

Note: The spreadsheet I used to create the compounding graph above is available for FREE download on your "My Account" page and is called "Spreadsheet for Manual Back-testing".

Now Let's Apply Money Management to

some Much Better Trade Signals

EUR/CHF Consolidation Trade Signals

Cumulative Wins Money Management

8 Unit Cycle Target

The following backtest is on the EUR/CHF 4-Hour chart using Cumulative Wins Money Management with an 8 unit cycle target through June 1st, 2024. This backtest does not include compounding of profits between money management cycles. To compound your profits between cycles, you should increase the unit/lot sizes after each 8 unit cycle is completed (a win at 8 units).

Consolidation Signals on EUR/CHF 4-Hour Chart

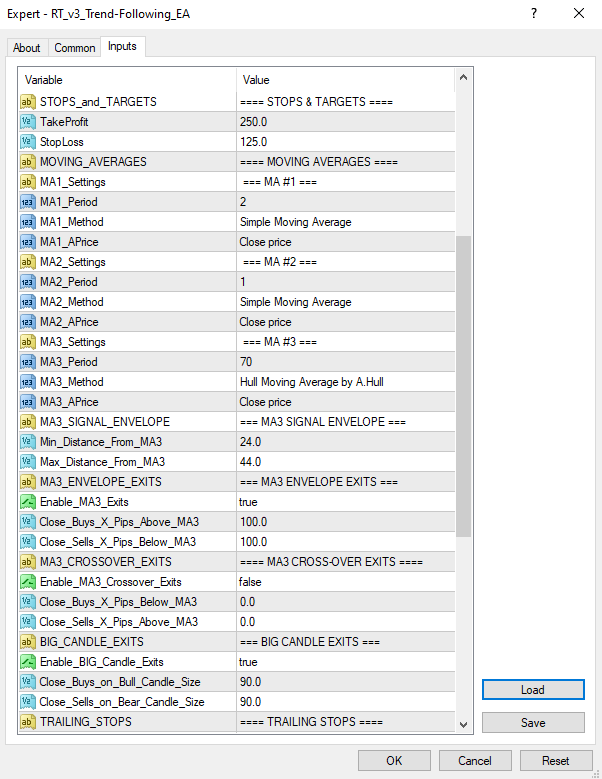

GBP/JPY Trend-Following Trade Signals

Cumulative Wins Money Management

11 Unit Cycle Target

This example uses GBP/JPY Trend-Following signals with the Cumulative Wins Wins Money Management with an 11-Unit Cycle Profit Target. Each 11 unit cycle target averaged 58.6% profit if allocating $450 per 0.01 unit size.

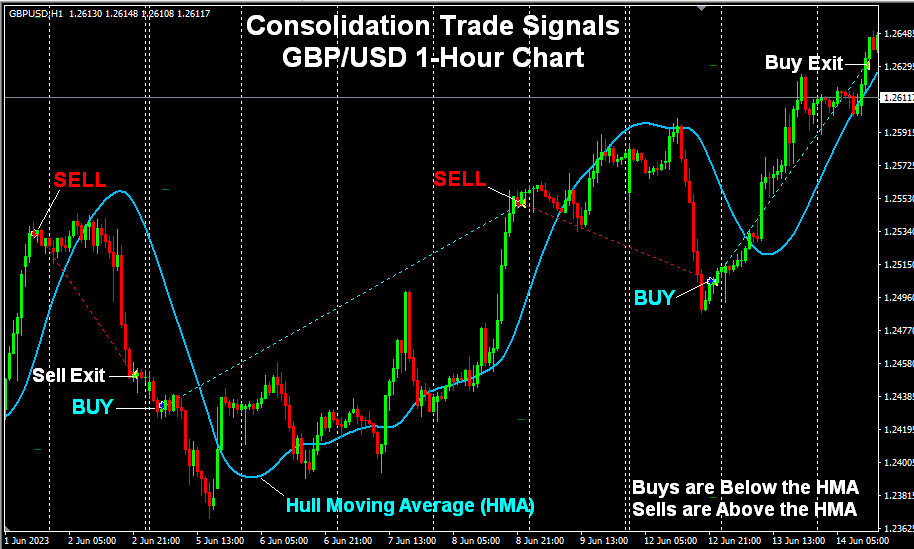

Consolidation Trade Signals

Cumulative Wins Money Management

12 Unit Cycle Target

This example uses Consolidation Trade Signals on a GBP/USD 1-hour chart applying the Cumulative Wins Money Management with a 12 unit cycle target. Each 12 unit cycle target averaged $1031 profit (+344%) when allocating $300 balance per 0.01 lot unit size.

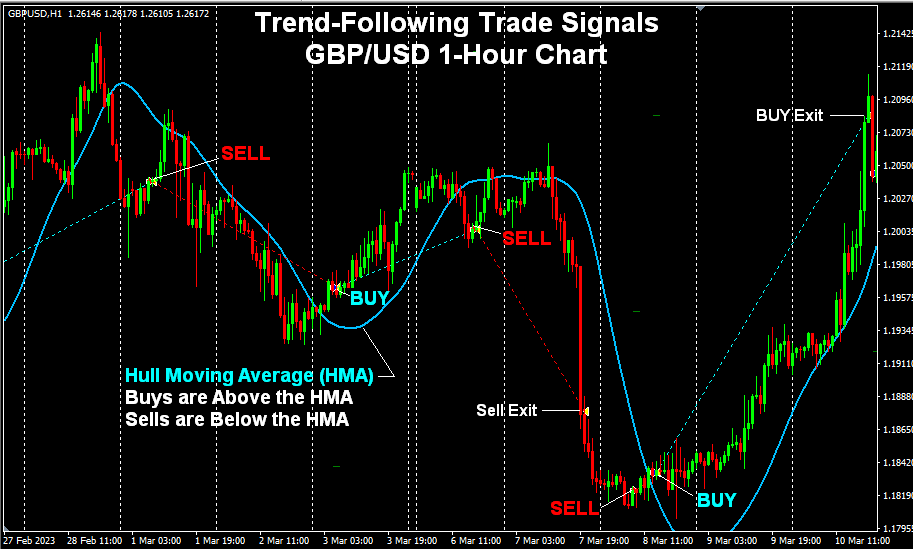

TRADE SIGNALS

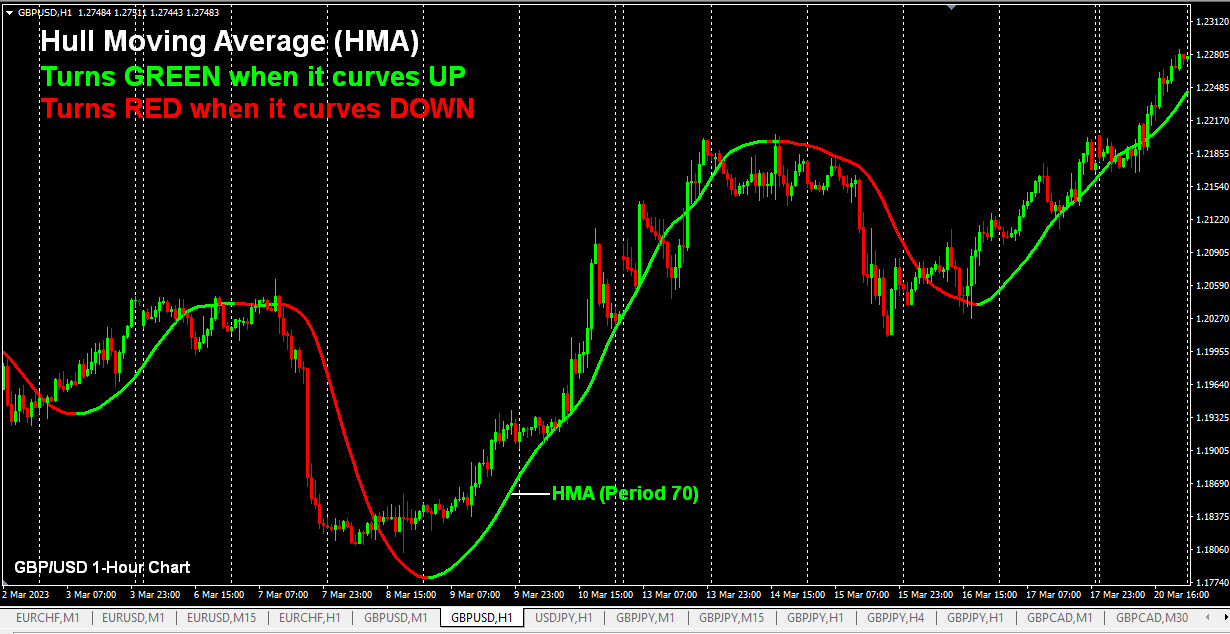

Up until now we have only discussed money management strategies when applied to different types of trade signals. To give you a visual, here is what these trade signals look like on a chart. These signals were auto generated by the same Trend-Following and Consolidation Trading Robots used in the previous two GBP/USD examples.

Notice the opposite signal logic. One BUYS above the HMA Moving Average and the other SELLS above the HMA, although you could choose from 5 different types of moving averages. You will learn more about this unique "HMA" moving average later in this book and how you can download it FREE!

TESTIMONIALS

I'm not the only one who has great results using my trading robots. I receive the most testimonials from clients using my Trend-Following Robot shown on the previous page but here's a couple that included screenshots of their LIVE ACCOUNTS:

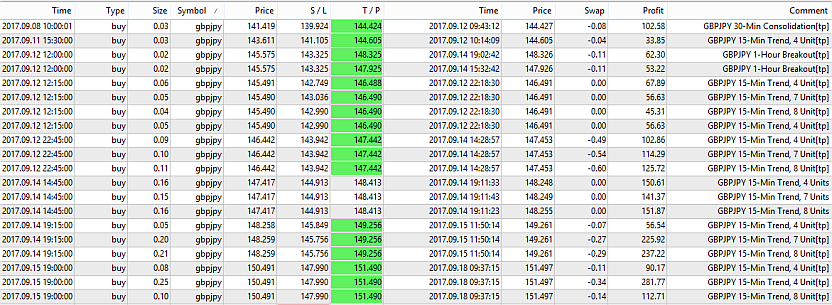

"Dear Don, How are you? I hope everything goes well. I'm very happy with the performance of your trend following robot. Look the performance this year! Best Regards,"

J. Cruz

"Hi Don, Just wanted to thank you for the 2,234 pips that I managed to bag since I connected your GBPJPY robots from Sept 9. I wanted to convey my gratitude now, before Sep 23. Warm regards,"

LM

How to ___FLAT-LINE___ Your Losing Streaks

You may notice that in many of my illustrations, some of the draw-downs appear very flat during a run of consecutive losses. This is from my Flat-Lining technique and it's done by using a minimum lot size that is much smaller than your units. For example, if you are using 0.10 unit size (10k units), then start your cycles with 0.01 Minimum Lot and simply add 0.10 Unit Size after each win so your lot sizes would progress like this on a run of 8 consecutive wins: 0.01, 0.11, 0.21, 0.31, 0.41, 0.51, 0.61, 0.71. Your 0.01 beginning lot counts as one of your units so don't forget to include it as one of your units in your cycle target. This is illustrated in the following example:

Here's another example over a longer period using 0.01 (1k) Minimum Lot and 0.10 lot (10k) unit size. The unit size is 10x the size of the Minimum Lot so it can Flat-Line the losing streaks.

Flat-Lining can be very effective at preserving profits because on a run of consecutive losses, you end up trading 0.01 lots, which is peanuts compared to the much larger lots used in a winning streak. It's the next best thing to not taking the trade at all. By comparison, these losing streaks appear as flat lines between your spikes of profit. To use this technique, you should have an account balance of at least $750 but it depends on your trading strategy. The larger your account, the larger your unit size can be vs. your minimum lot size and the more effective this technique will be. But of course, everything has it's price...

If you use this technique, then it will require one additional consecutive win before your cycle is risk-free (assuming you are using the Consecutive Wins strategy). And during periods of win-lose-win-lose, you will take larger losses than normal. However, over the long run, I have found that this technique usually improves the overall profit to draw-down ratio because, eventually, you will have long runs of consecutive losses and that's where this will really make a big difference, especially if your wins and losses are well grouped together.

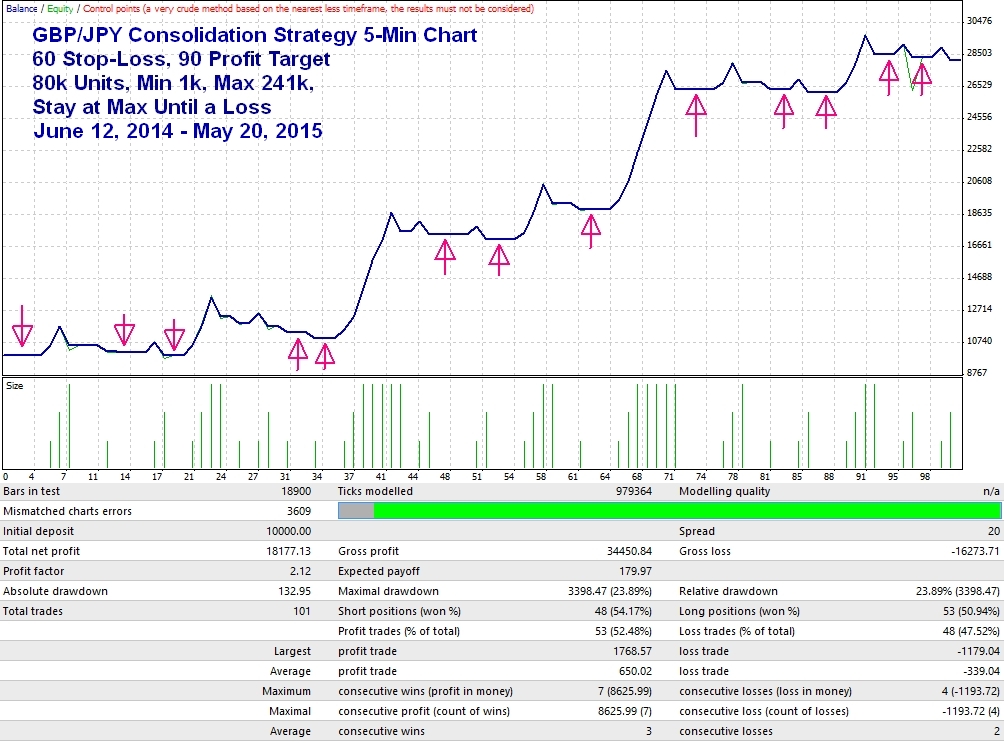

Below is a screenshot of a GBP/JPY equity curve over an 11 month period where flat-lining did an excellent job of preserving the profits, and quite frequently too. The signals were only 52.48% wins but look at how well the wins and losses occurred in groups. The equity curve actually looks like steps. In this example, I also used my "Stay at Max" technique, where I stay at the max units until a loss occurs. The primary reason for doing this is so you can trade aggressively but also stay within the broker's leverage restrictions, which is much lower on GBP/JPY at my US broker. If you purchase one of my automated trading robots, I will explain how to adjust the code so you can use this technique too.

_____EXTREME__FLAT-LINING_____

Below is a GBP/JPY equity curve over an 11 month period where flat-lining did an excellent job of preserving the profits, and quite frequently too. I consider this EXTREME flat-lining because the unit size is 80 TIMES the size of the minimum lot in this example (0.01 Minimum Lot, 0.80 Unit Size and 2.41 lot Cycle Target). In fact, the difference is so large that the green bars at the bottom of the chart, which show the size of the lots, doesn't even appear. When using extreme flat-lining, it's important to have a stop-loss close to, or even less than, the size of your profit target. In this example, the stop-loss is 30 pips smaller than the profit target (60 pip stop-loss and 90 pip profit target).

STAY AT MAX LOTS

I used another trick in the previous example that I also used in the illustration below. I don't use it often because I find that a cycle target usually works better. However, it can come in very useful at brokers with high margin requirements (like US brokers) so you do not exceed your margin requirements during winning streaks.

Instead of dropping back to 1 unit after your cycle target is hit, you STAY AT MAX lots until a loss occurs. The vertical green bars at the bottom of the chart represent the lot size of each trade. Notice that the largest green bars are the same size. This shows that the lot size is staying the same size once it reaches the maximum lot size you have chosen for your cycles. In the backtest shown below, the Unit Size is 0.01 with a Max Lot setting is 0.05 (5 units) with “Stay At Max = True” in the robot settings.

Since this example is using the Consecutive Wins strategy, each cycle ends whenever a loss occurs with an ending profit higher than the end of the previous profitable cycle (as marked below). Failed cycles should be included as part of the next cycle.

Varying Sized Wins & Losses

When you have varying sized wins and losses, the important thing to remember is to keep the math balanced on each side (positive & negative) or in your favor (profits larger than losses), but this is only applicable when you are using the Cumulative Wins money management strategy since the Consecutive Wins strategy always defaults back to 1 unit after any loss.

In our previous examples of Double Risk to Reward trades using the Cumulative Wins system, we add 1 unit after a win but subtract 2 units after each loss because the losses are always twice the size of our wins. My trading robots will do this for you automatically but for manual traders who have varying sized wins and losses, you will need to work out the math yourself on a trade-by-trade basis.

To do so, first determine what your average size win will be (in pips) and make that your benchmark for each unit to add or subtract. So if your average win is 40 pips, then only add 1 unit after each 40 pips profit since your last lot adjustment. If you have a 60 pip loss, then subtract 1.5 units on the next trade. If you have an 80 pip loss, subtract 2 units. If you have a 20 pip loss, wait until you lose another 20 pips (40 total) before your next lot adjustment and then subtract 1 unit. Many FOREX platforms have a 0.01 lot minimum so so the larger your account, the easier it will be to use balanced money management but you could also use larger benchmarks to make things a little smoother with fewer adjustments needed.

For example, if your average win is 40 pips but you sometimes get wins of just 10-20 pips, you could set a benchmark of 60 pips so if you have a win or loss of say 50 pips, you do NOT change lot size until you reach or exceed the 60-pip benchmark in either direction. Always calculate your pips P/L from your last lot adjustment so the pips gained or lost between benchmarks are cumulative. If you happen to get a single 120 pip win with a 60 pip benchmark, then you can add 2 units to the next trade. You should record your trades to keep track of the math but the main objective is to keep the math balanced or leaning to the positive side so you are not increasing lots after a 10 pip win then getting a 60 pip loss. Keep in mind that you are actually using negative progression (the Martingale System) against yourself so it is going to gradually work against you until you have a winning streak and that's when the switch will flip to your favor in a big way.

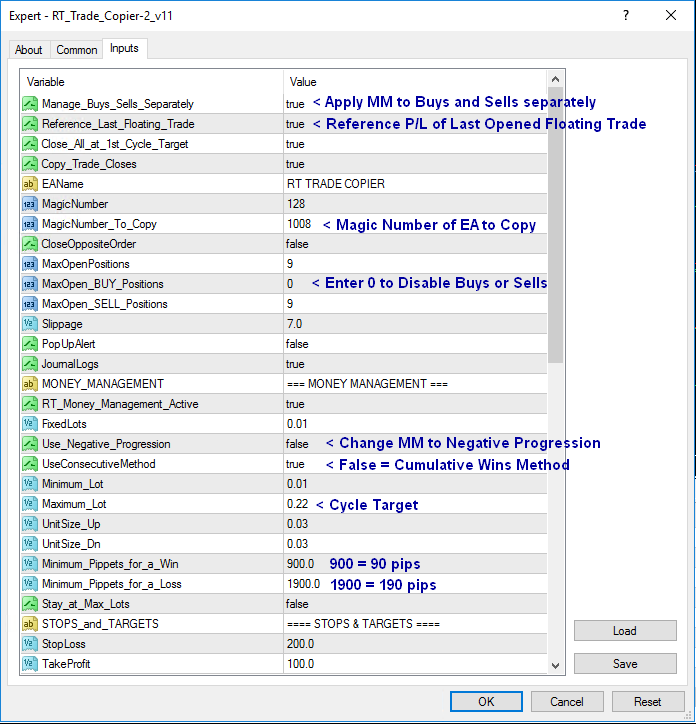

My Money Management Script (for MT4 Expert Advisors) has 2 settings to handle wins and losses that vary in size: “Minimum Pips for a Win” and “Minimum Pips for a Loss”. If the win or loss is not large enough (according to these settings) then no lot adjustment is made on the next trade. This gives you a lot of flexibility with the money management and it can handle varying sized wins and losses very well on autopilot. This script is 200 lines of code you can paste into the source code of Expert Advisors you have either developed yourself of purchased somewhere else. You can find this money management script here: https://RouletteTrader.com/script

Negative Progression Money Management

Up until this point, we have been covering Roulette Trader's POSITIVE PROGRESSION money management systems. Positive progression simply means increasing units after wins and these systems offer the highest profit potential since you are using accumulated profits during a cycle to leverage yourself to even larger profits. It's like compounding on steroids.