GBP/JPY 4-Entry Stacking Robot

with Automated Roulette TRADER Money Management

2 Versions Included: Hedging & Non-Hedging

An Automated Expert Advisor (EA)

for the MetaTrader4 Trading Platform

1-Year License for All Brokers

Only $29 annual renewal fee!

Only $77 for current Robot customers!

Log in to show the $77 buy button.

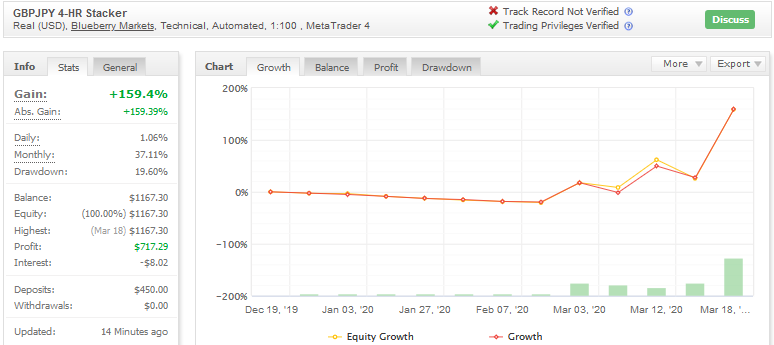

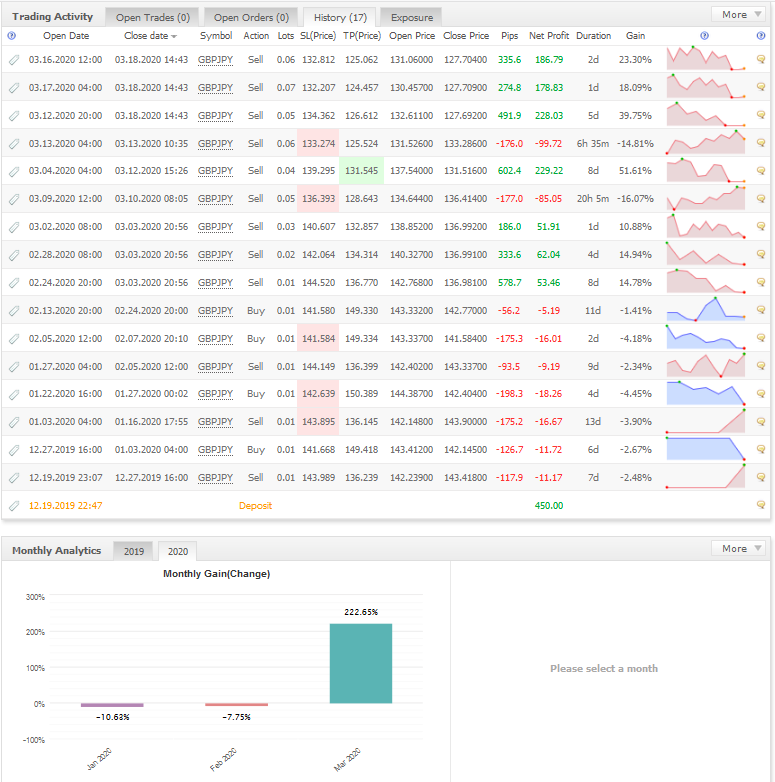

RECENT LIVE TRADES ON 4-HOUR VERSION...

CLICK HERE to see LIVE results (updated every few minutes).

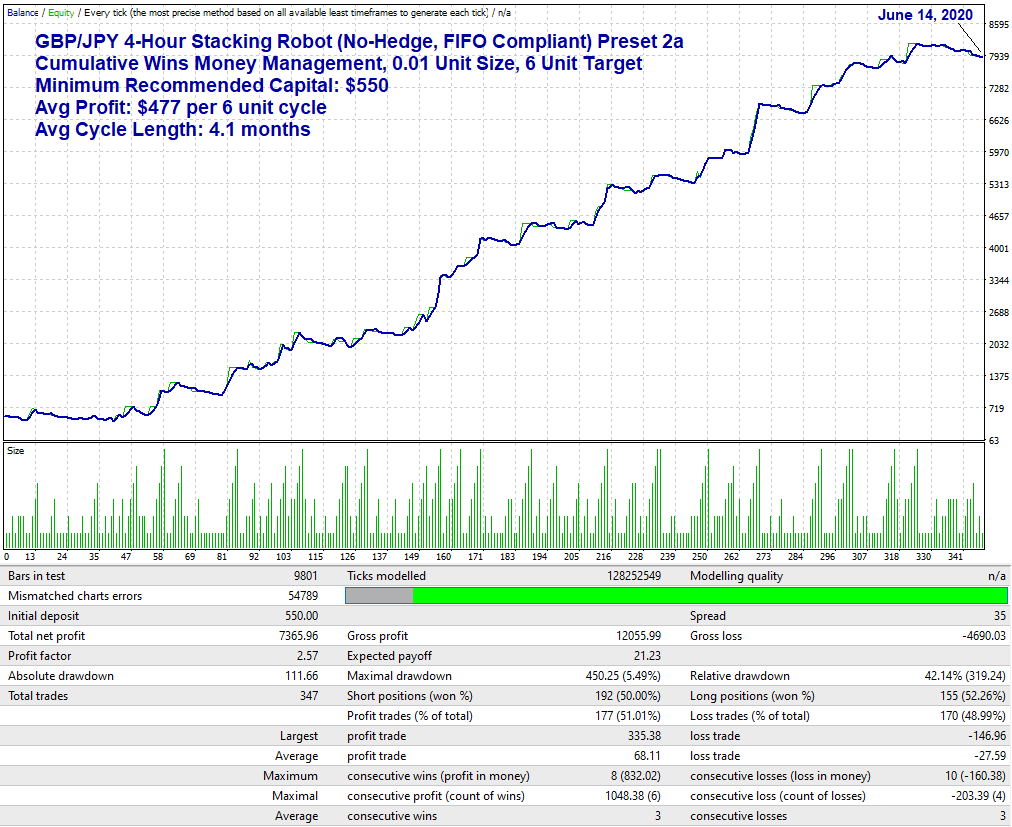

4-HOUR Non-Hedging Version...

FIFO & US BROKER OANDA COMPLIANT

Cumulative Wins Money Mgmt, 6 Unit Cycle Target

This version of the EA stacks up to 4 positions in the SAME direction (unlike the 15-Min version below that reverses the 4th position as a hedge). That is the primary difference between the 2 versions. However, with the settings used in the 4-Hour version shown in the backtest directly below, the EA is compliant for all US brokers. It does NOT hedge and it closes the oldest trades first to comply with FIFO rules at US regulated brokers. In addition, every position will also be a different size when using the money management system (Preset files 2a or 2b), which are included in your download.

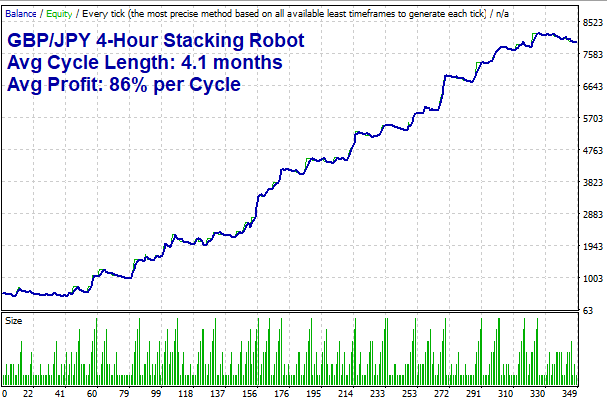

The model shown below (Preset file 2a) is using Cumulative Wins Money Management on stacked positions so it combines 2 forms of Positive Progression money management, which adds positions and increases the lot size on new positions only when the previously opened position is in profit. Due to this double Positive Progression strategy, profits are explosive whenever a trend develops and it is showing a strong run of profit since May, 2019.

A 5.5-Year Backtest (Preset 2a)

NOTE: This model averages $477 per 6 unit cycle per 0.01 Minimum Lot and 0.01 Unit Size. At $550 capital per 0.01 Minimum Lot, the average return is approximately 86% profit per 6 unit cycle. You may scale this model up according to your balance and compound profits by increasing your lot sizes after each 6 unit cycle target.

MONEY MANAGEMENT SETTINGS:

To copy the model above, use the following money management settings ($550 minimum balance per 0.01 Minimum Lot & Unit Size Up setting). $550 is the minimum capital I recommend to trade these settings:

PRESET FILE 2a:

RT Money Management: True

Manage Buys_Sells Separately: False

Reference Last Floating Trade: True

Use Negative Progression: False (When false, increases lots following a qualified win)

Use Consecutive Method: False

Minimum Lot: 0.01 (Minimum $550 capital per 0.01 Lot)

Unit Size Up: 0.01 (Set equal to your Minimum Lot setting above)

Unit Size Dn: 0.03 (Set to 3x your Unit Size Up setting)

Maximum Lot: 0.06 (Set to 6x your Unit Size Up setting)

Stay At Max Lots: False

NOTE: The money management setting of 0.01 Minimum Lot and Unit Size Up per $550 balance are my MAXIMUM recommended leverage settings. For reduced risk, allocate more than $550 per 0.01 Minimum Lot and adjust the other lot settings accordingly.

Trading Hours (GMT+2):

Start Time: 0:30

End Time: 23:30

These time settings are to prevent the robot from trading at "End of Day" rollover time when the spreads are typically much larger. However, the Max Spread setting in the EA properties will automatically skip trades when the spread is larger than your maximum allowed setting.

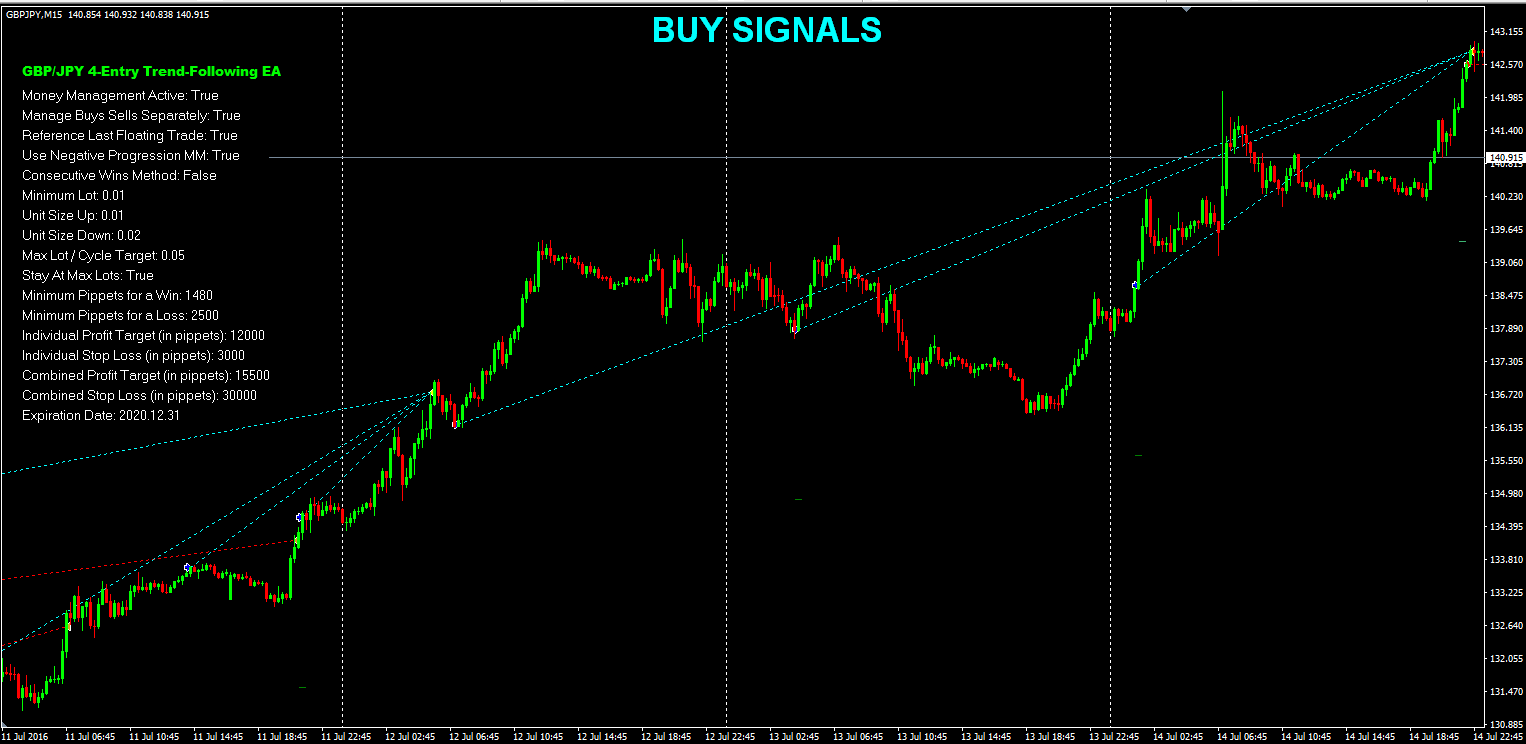

15-Min Candle Hedging Version...

This 15-Min version of the EA is a hedging strategy that opens up to 4 positions in each direction simultaneously. Both versions of the EA (15-Min and 4-Hour) are very unique in that they can combine both Positive and Negative Progression Money Management strategies so we can use them both to our advantage (yes, the BEST of Both Worlds!).

The Positive Progression comes from opening up to 4 spaced positions in the direction of the trend as price moves progressively in your favor. This is called "Stacking" and you decide how far apart (in pips) each trade is to be spaced in the EA settings.

For example, let's say your settings are 50, 100, 250 for the trade spacing. The EA will open 1 BUY position above SMA 100. If it reaches 50 pips profit, the EA will open a 2nd BUY position. If the 2nd trade reaches 100 pips profit, the EA will open a 3rd BUY position so it layers on positions when the previous position reaches "X" pips profit. This is a great way to double and triple down on a winning trade without adding much risk to principal since your previous trades are already in profit.

Now, here's the twist with this "15-Min version" of the EA...

After the 3rd trade is deep in profit (250 pips using the settings above) the 4th position can open AGAINST the trend as a hedge against your other 3 winning positions which are DEEP in profit at this point. This is assuming all other conditions are met. If the trend reverses at that point, you might lose the other 3 trades but you would make a bundle on the hedged position. If price continued with the trend against your 4th position, you would hit the ultimate profit target on the 3 trend-following trades and may or may not lose the 4th hedged trade. Due to the large stop-losses used in the settings used below, you often win both because trends never last forever. If you don't want the 4th hedged trade to open, simply enter a minimum spacing requirement of "99999" pips between the 3rd and 4th trade and the 4th trade will never be triggered.

GBP/JPY 4-Entry Stacking Signals on a chart...

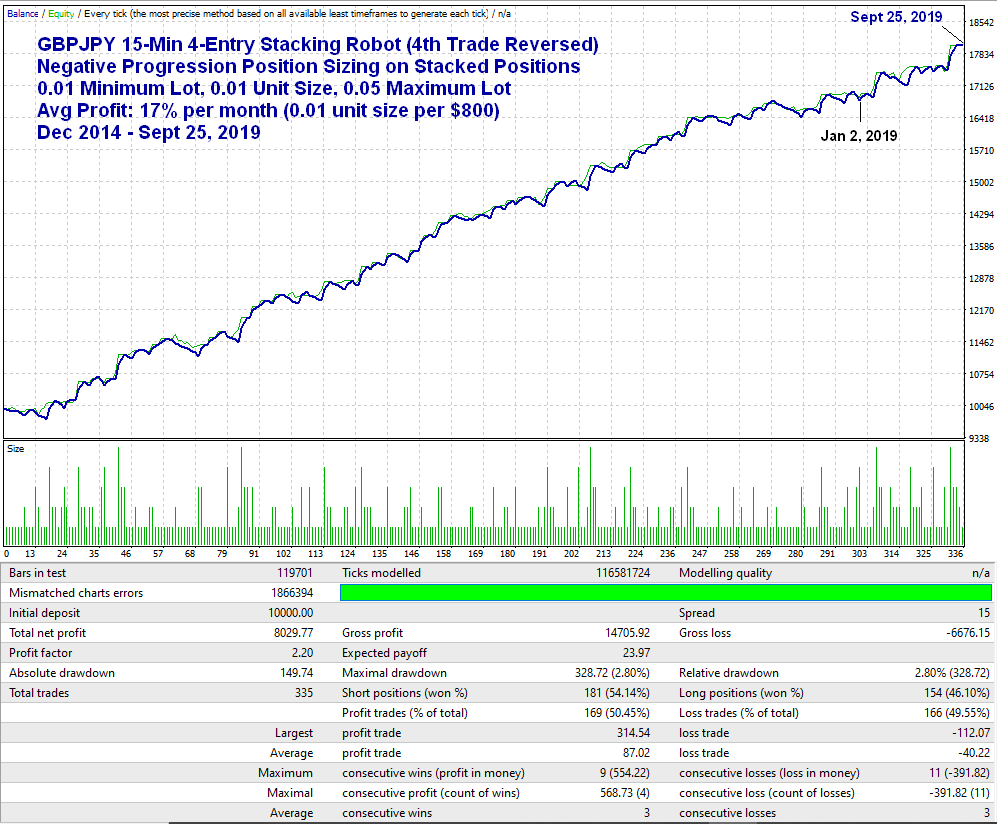

A 57 Month Backtest using 0.01 Unit Size

NOTE: You only need $800 minimum balance to get the same profit generated in the backtest report above (not $10,000 as used in the starting balance of the backtest). The average profit is $140 per month per 0.01 Minimum Lot divided by $800 beginning monthly balance gives you a 17% monthly average. You may compound profits by increasing your Minimum Lot setting by 0.01 each $800 in new profit. Adjust all other lot settings accordingly.

MONEY MANAGEMENT SETTINGS:

To copy the model above and average 17% per month, use the following money management settings ($800 minimum balance per 0.01 unit size). $800 is the minimum margin I recommend to trade this EA and these are also the default settings:

RT Money Management: True

Manage Buys_Sells Separately: True

Reference Last Floating Trade: True

Use Negative Progression: True (increases lots following a qualified loss)

Use Consecutive Method: False

Minimum Lot: 0.01 (Minimum $800 capital per 0.01 Lot)

Unit Size Up: 0.01 (Set equal to your Minimum Lot setting above)

Unit Size Dn: 0.02 (Set to 2x your Unit Size Up setting)

Maximum Lot: 0.05 (Set to 5x your Unit Size Up setting)

Stay At Max Lots: True (You may set to False for reduced risk but lower potential returns)

NOTE: The money management setting of 0.01 Minimum Lot and Unit Size Up per $800 balance are my MAXIMUM recommended leverage settings. The maximum peak-to-valley draw-down in this model was $328.72 prior to interest rollover credits and fees. This is a 41% potential draw-down on an $800 balance but it is always possible to have larger draw-downs in the future. For reduced risk, allocate more than $800 for the same settings.

Trading Hours (GMT+2):

Start Time: 0:30

End Time: 23:45

These time settings are to prevent the robot from trading at "End of Day" rollover time when the spreads are typically much larger. However, the Max Spread setting in the EA properties will automatically skip trades when the spread is larger than your maximum allowed setting.

NEW FEATURES

This EA includes many new features. Here's a few...

- Can open and manage up to 4 positions in each direction.

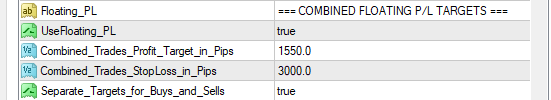

- Hidden Combined Trades P/L Targets: This awesome new feature will close trades when the combined open positions reach X pips net Profit or Loss and can also separate the floating P/L between Buys and Sells with a True/False switch. These Stop Losses and Profit Targets are hidden from your broker since they are calculated in real time and the trades are closed with a market order at the moment the P/L is reached and it can be used in combination with a hard stop loss and profit target.

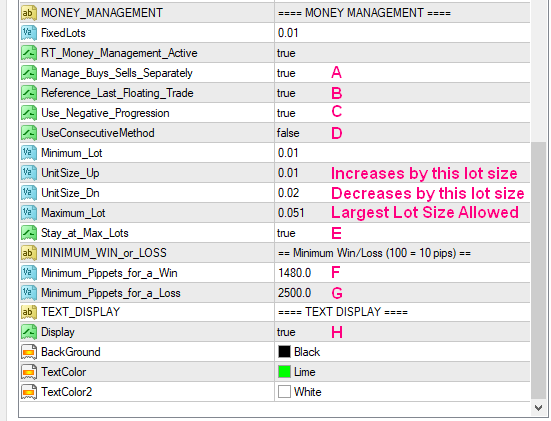

- Manage_Buys_Sells_Separately (A in screenshot below): The Roulette Trader Money Management system can now manage lot sizes for Buys and Sells separately so each can follow their own money management cycle.

- Reference_Last_Floating_Position (B): Since there can be multiple open positions simultaneously, you can choose to have the EA reference the P/L of the last opened "Floating" trade to determine the next lot size instead of the last "closed" trade. You decide with a True/False switch.

If you were to simply run this EA in "Fixed Lot" mode (RT_Money_Management_Active = False), it would be a Positive Progression Money Management System since you are increasing trade volume during winning positions by merely adding more positions in the same direction. However, when you activate "RT Money Management" in the EA settings, you add a whole new dimension to the money management and you can choose between Positive and Negative Progression "position sizing" with a True/False switch, as explained below...

- Use_Negative_Progression = True: (C)

A True setting will use Negative Progression Money Management. It will increase lot size following a qualified loss and decreas lot size following a qualified win. The "Minimum Pippets for a Win/Loss" settings determine if a trade qualifies.

A True setting will use Negative Progression Money Management. It will increase lot size following a qualified loss and decreas lot size following a qualified win. The "Minimum Pippets for a Win/Loss" settings determine if a trade qualifies.

- Use_Negative_Progression = False: (C)

A False setting will use Positive Progression Money Management. It will increase the lot size following a qualified win and decrease lot size following a qualified loss. The "Minimum Pippets for a Win/Loss" settings determine if a trade qualifies.

A False setting will use Positive Progression Money Management. It will increase the lot size following a qualified win and decrease lot size following a qualified loss. The "Minimum Pippets for a Win/Loss" settings determine if a trade qualifies.

- (D) Change Money Management strategy from Consecutive Wins to Cumulative Wins with a True/False switch. Read my ebook to learn each strategy.

- (E) Enable the "Stay At Max Lots" strategy with a True/False switch. If True, the lot size will Stay at the Max lot setting on a winning streak when using Positive Progression, or Stay at Max Lots during a losing streak when using Negative Progression.

- (F/G) Minimum Pippets for a Win/Loss: The next trade's lot size will not change unless the previous trade's win or loss is at least this large. 1480 pippets = 148 pips.

- (H) Text Display: For easy reference, you can display the Money Management settings on the chart with a True/False switch. You may also choose your own text colors.

As you can imagine, these new features give you incredible flexibility and control over the EA's money management strategy, which opens the door to many new possibilities.

In order to fully understand these position sizing strategies, please read the Roulette Trader ebook, which is included FREE with the purchase of any robot. See details below...

Have you learned my Money Management system yet?

CLICK HERE to download my eBook so you have a complete understanding of the Roulette TRADER money management system. You'll need to know it to properly use the trading robots. PLEASE CONTACT ME if you have any questions.

GBP/JPY

4-Entry Stacking Robot

Only $77/year for current Robot customers!

Log in to show the $77 buy button.

Risk Disclosure

This website does not guarantee income or success of the product beyond the specific 60-day performance guarantees for each product. There are many factors that can effect each person's individual results. Examples shown in this presentation do not represent an indication of future success or earnings but merely historical performance based on specific trading models, some of which is hypothetical. Past performance is not indicative of future results. The company declares the information shared is true and accurate.

U.S. Government Required Disclaimer - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.