EUR/CHF Trend-Following STACKER Robot

with Automated Roulette TRADER Lot Sizing

PLUS Multi-Position Sizing

An Automated Expert Advisor (EA)

for the MetaTrader4 Trading Platform

1-Year License for All Brokers

Only $29 Annual Renewal Fee.

Only $77 for current Robot customers!

Log in to show the $77 buy button.

Contact Don to pay by Crypto, Skrill or Neteller

EUR/CHF Trend-Following STACKER EA

With New 3-D Money Management

Lot Sizing

+ Multi-Position Sizing

+ Stacking (1-10 Entry Points in Each Direction)

This new "V9" EA incorporates a 3rd dimension of money management into the pre-existing 2-dimensional Roulette TRADER strategies that you may already be familiar with. In addition to stacking positions at different entry points and adjusting lot sizes, it can ALSO adjust the number of positions opened at each entry point, giving more weight to the latest entries and drawing the floating profit target closer to the current market price. This makes it easier to exit trades with a net profit, which results in a high win rate. 3-D Money Management is explained in more detail near the bottom of this page. Nearly all trades are closed with a market order so your actual stop and profit target remain hidden from your broker but a more distant hard stop and TP are also set as a backup.

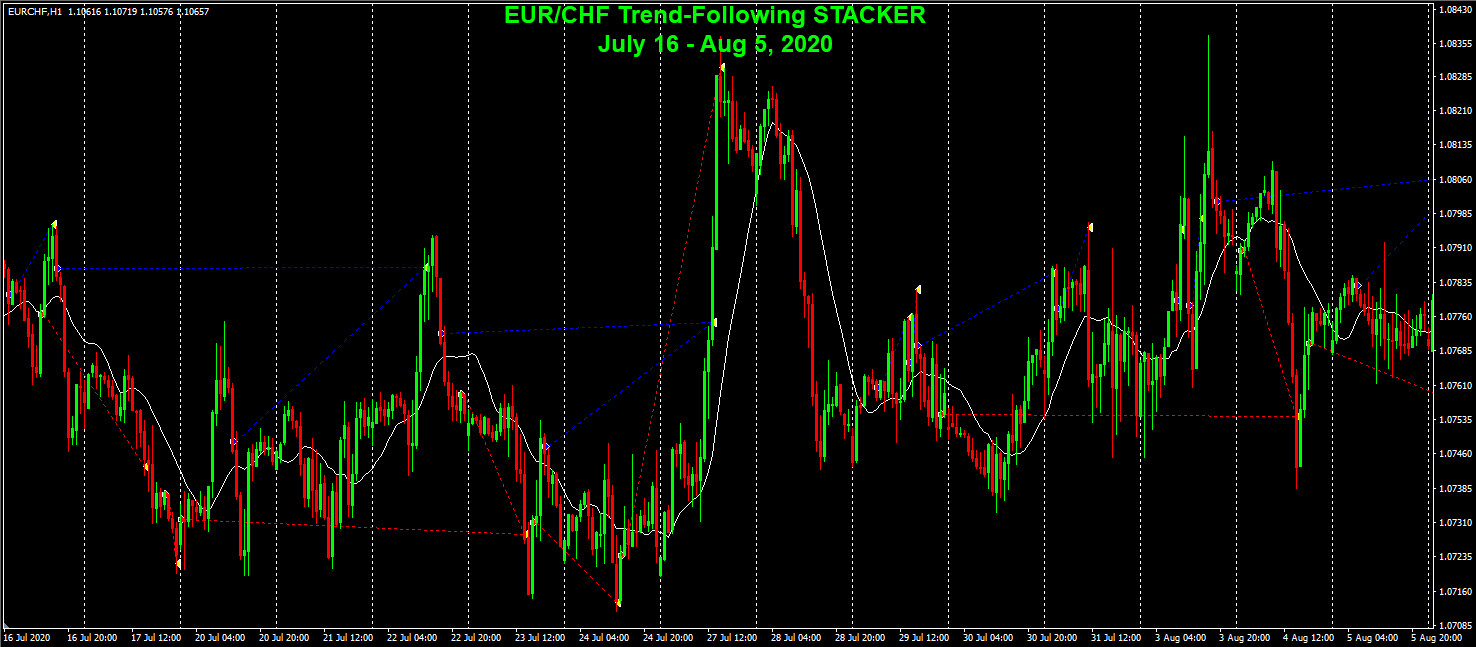

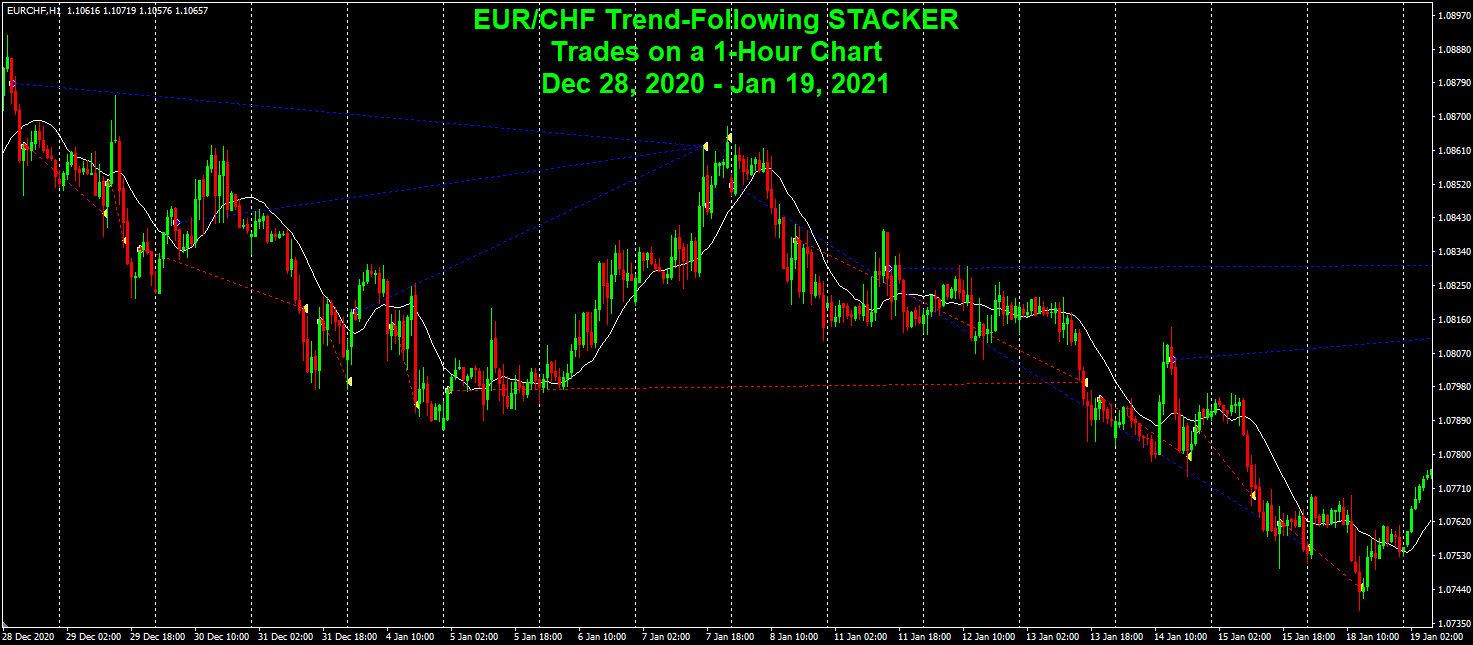

This robot trades A LOT! It is almost always in a trade, usually multiple trades (as you can see in the screenshots below) so if you like a lot of trade action, this is the EA for you!

The overall signal strategy of this EA is Trend-Following. It will buy on a bearish candle above MA3 and sell on a bullish candle below MA3 (entering on pullbacks in the trend) and it hedges often (buys and sells held open simultaneously). When a trade loses, there are usually multiple winning trades in the opposite direction that hedge the loss. And if a trade is losing, it can open additional positions at specified Min/Max distance from the previous entry, assuming the other signal conditions are met. The EA is capable of opening up to 10 positions in each direction (10 different entry points) but most of the preset files included with the EA are limited to 2 or 3 entry points in each direction to limit the risk. Here's how the trades look on a chart...

PRESET FILES: This EA includes many different preset files for different settings and due to the high trade volume, you should use a broker with the smallest spread possible. At brokers with an average spread larger than 2.5 pips on EUR/CHF, you should use a preset file that opens fewer positions, for example Preset 6a, which opens only 1 position per entry point. The preset files that open fewer positions typically have a higher average profit per trade but also fewer trades. See the "Backtests" folder included with the EA for screenshots of the various backtest results using different preset files.

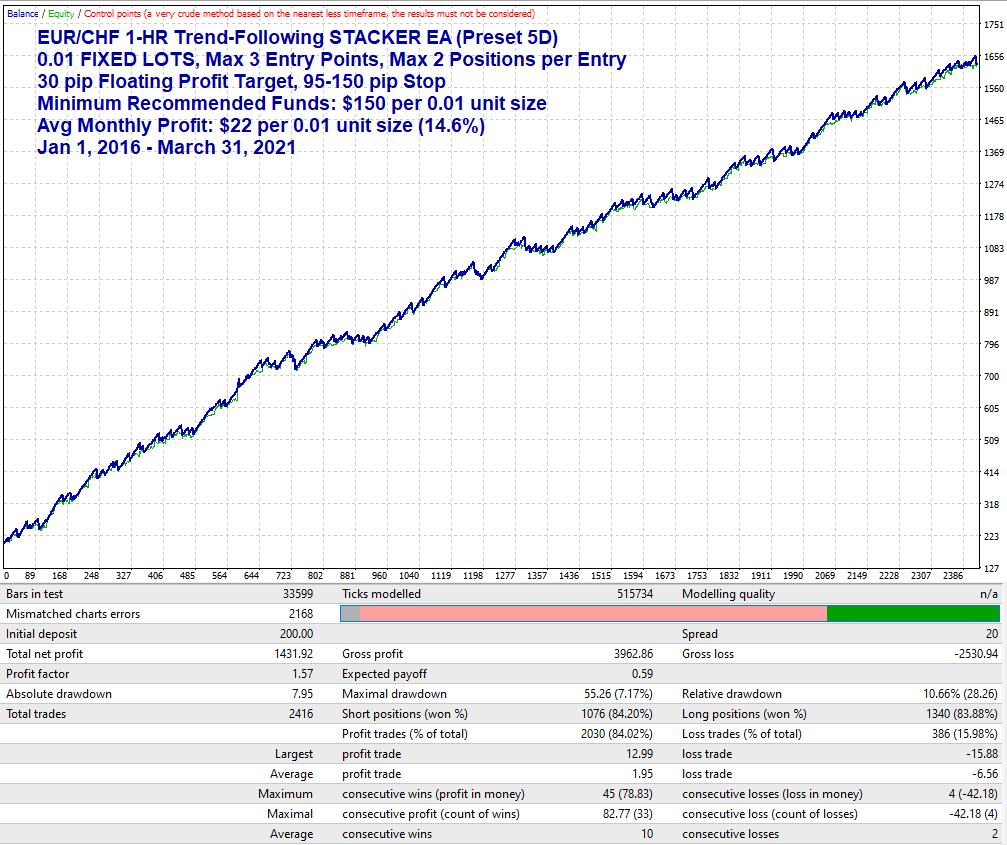

EUR/CHF TF STACKER (Preset 5D)

0.01 FIXED LOTS

Positive Progression Position Sizing

+ Negative Progression Stacking (1-3 Entry Points in Each Direction)

In this model (Preset 5D), the EA is using only 2 of the 3 dimensions of money management with the lot sizing feature disabled (using 0.01 Fixed Lots). This shows the performance of the signals without the benefit of lot sizing. This is a good option for those who want to withdraw profits monthly. Only $150+ balance is recommended per 0.01 Fixed Lot for a 14.6% monthly average. Keep in mind that this model can still open up to 6 positions in each direction (up to 3 entry points x 1 or 2 positions per entry point).

5-Year Equity Curve (Preset 5D, 0.01 Fixed Lots)

LOT SIZING Settings (Preset 5D):

$150+ balance is recommended per 0.01 Fixed Lot for a 14.6% monthly average. To compound profits monthly, or scale this model up to a larger account balance, simply increase your "FixedLots" setting according to your account equity.

RT LOT SIZING MANAGEMENT

FixedLots: 0.01 (Allocate $150+ per 0.01 lot w/100:1 max leverage, or $400+ per 0.01 w/30:1 max leverage)

RT_Lot_Sizing_Active: False

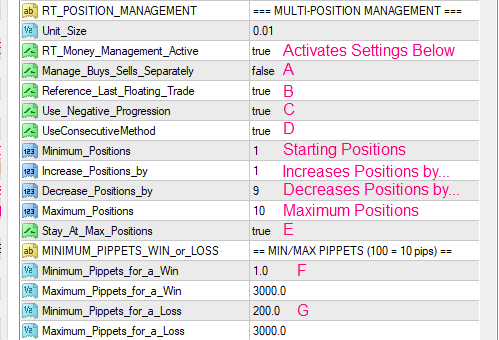

MULTI-POSITION MANAGEMENT:

There is no need to change these settings for different account balances. Use the Lot Sizing settings above to adjust for larger balances. You may also load a Preset file included with the EA.

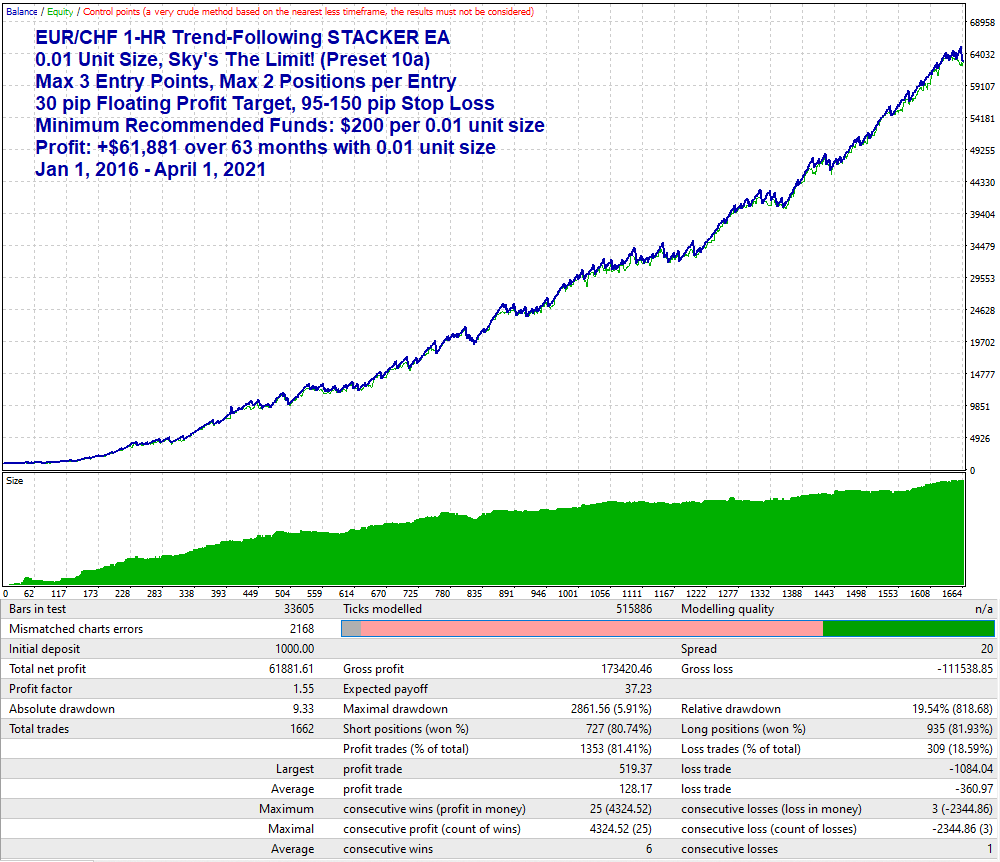

EUR/CHF TF STACKER (Preset 10a)

Cumulative Wins Lot Sizing, Sky's The Limit!

This model (Preset 10a) uses all 3 dimensions of money management. In addition to the Fixed Lot model shown above (preset 5D), the Lot Sizing mechanism is using the Cumulative Wins Money Management System with NO cycle target (Sky's The Limit!), as taught in my Roulette TRADER Ebook. It is difficult to calculate the profitability since there are no specific points at which you would compound your profits but, with this model, you can compound profits any time you'd like. Just try to refrain from compounding profits too often. For example, it is actually more profitable to compound profits every 400% gain than every 100% or 200% gain. It's safer too because as your profits grow, it provides cushion to help protect your principal. The green graph at the bottom of the chart shows the lot sizes, which started at 0.01 and grew to 0.92 at the end of the backtest, increasing and decreasing by 0.01 lot following qualified wins and losses.

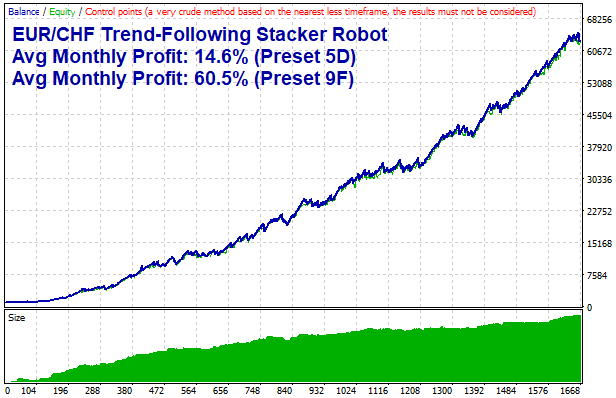

5-Year Equity Curve (Preset 10a, 0.01 Unit Size)

NOTE: The equity curve above does NOT include compounding of profits at any particular interval. To compound your profits, simply increase your lot sizes at each 400% - 1000% profit or greater.

LOT SIZING MANAGEMENT (Preset 10a):

$200+ balance is recommended per 0.01 unit size. You may allocate more than $200 per 0.01 unit size for more cushion. When increasing lot sizes for larger balances, keep all lot settings below relative. Follow the instructions in the notes next to each setting below. You may also load a Preset file included with the EA for larger unit sizes. The $200 minimum margin per 0.01 unit size is for accounts with 200:1 max leverage or greater. Allocate $350+ per 0.01 unit size if your max leverage is 100:1 and $1200 per 0.01 unit size with 30:1 max leverage at UK brokers. When there is insufficient margin, the EA will open the largest trade possible by default. Trade at Blueberry Markets for up to 500:1 max leverage and you can also get this EA FREE! Your broker MUST also allow hedging!

Minimum_Lot: 0.01 (Minimum $200 balance per 0.01 with 200:1 max leverage or greater. )

UnitSize_Up: 0.01 (Set equal to your Minimum_Lot setting above)

UnitSize_Dn: 0.01 (Set equal to your Minimum_Lot Setting above)

Maximum_Lot: 0.99 (Set to 99x your Minimum_Lot setting or greater, Sky's The Limit)

Stay_At_Max_Lots: False

Important Note on Money Management: If you're trading aggressively and ever lose more than 50% of the starting balance of a money management "cycle" (known as a "cycle draw-down" in my ebook), decrease your lot sizes according to your current account equity to avoid a blow-out. Doubling and quadrupling your account with this model is relatively easy so don't worry about it too much, but you must be diligent to decrease your lot sizes at the 50% threshold to make sure you stay in the game. Record your starting balance at the beginning of each money management cycle so you don't forget. For the record... The worst cycle draw-down that I could generate in backtesting using Preset 10a (by starting the EA at the worst possible time) was only $79 since Jan 2016 using 0.01 unit size, which is why I chose this model. It had the highest profitability relative to the risk to principal. This is also true for Preset 9F in the model shown further below.

MULTI-POSITION MANAGEMENT Settings:

Enter whole numbers in the settings below EXCEPT for the Unit_Size setting. There is no need to change these settings for different account balances. Use the Lot Sizing settings above to adjust for larger balances. Follow the instructions in the notes next to each setting. You may also load a Preset file included with the EA.

Unit_Size: 0.01 (This setting is only used when the Lot Sizing settings (above) are disabled)

Minimum_Positions: 1 (Keep this setting at 1 regardless of your balance)

Increase_Positions_By: 1 (Set equal to your Minimum_Positions setting above)

Decrease_Positions_By: 1 (Set equal to your Minimum_Positions setting above)

Maximum_Positions: 2 (Set to 2x your Minimum_Positions setting above)

Stay_At_Max_Positions: True

Trading Hours (GMT+2 March - Nov, GMT+3 Nov - March):

Start Time: 00:45

End Time: 23:45

The Trading Hours settings are set to prevent the robot from trading at the "End of Day" rollover time when the spreads are typically much larger. Adjust the Start Time and End Time time settings according to the time zone of your broker's price feed so the EA does not attempt to trade at the "End of Day" rollover time. The settings above exclude the 00:00 candle opening time. Contact Don if you need help determining these settings.

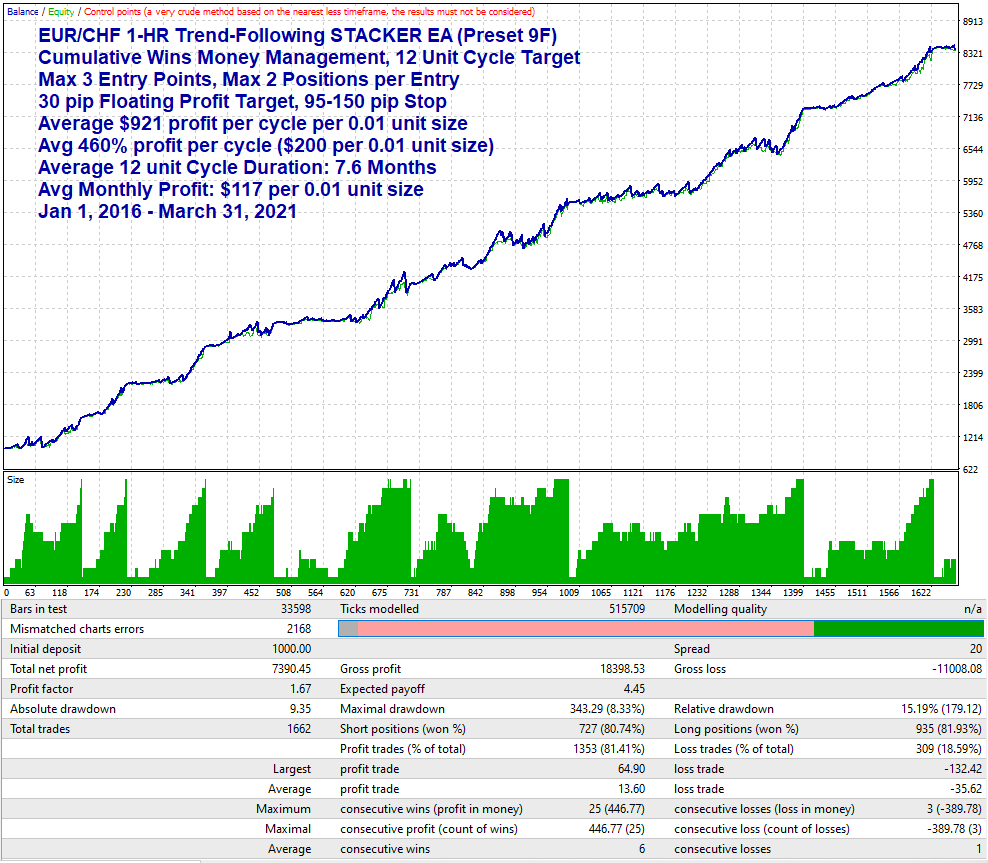

EUR/CHF TF STACKER (Preset 9F)

Cumulative Wins Lot Sizing with a 12-Unit Cycle Target

Positive Progression Lot Sizing

+ Positive Progression Position Sizing

+ Negative Progression Stacking (1-3 Entry Points in Each Direction)

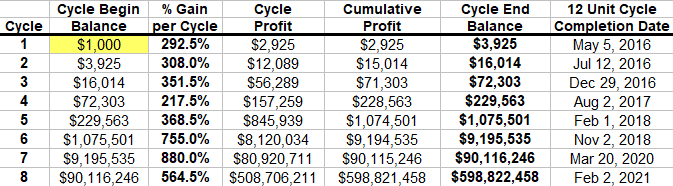

This model (Preset 9F) also uses all 3 dimensions of money management and is also using the Cumulative Wins Money Management Strategy (same as 10a shown above). The only difference is that it is using a 12 Unit Cycle Target, as taught in my Roulette TRADER Ebook. After a qualified win at the 12 unit lot size, it automatically drops back to 1 unit (Minimum Lot size) to lock in the profit from the successfully completed cycle. By using cycle targets, we can pinpoint the beginning and ending of each money management cycle. In this model, each 12 unit cycle averages 460% profit and lasts 7.6 months on average. The green graph at the bottom of the chart represents the lot sizes, ranging from 0.01 to 0.12 (0.12 being the cycle target). Each drop from 0.12 lots back to 0.01 completes a cycle at an average of 460% profit since the end of the previous cycle. This is assuming you allocated $200 per 0.01 unit size at the beginning of each cycle to compound your profits.

5-Year Equity Curve (Preset 9F, 0.01 Unit Size)

NOTE: The equity curve above does NOT include compounding of profits between cycles. To compound profits at the end of each cycle, simply increase your lot sizes each time the EA drops from 12 units down to 1 unit indicating that the cycle has successfully completed. The chart below shows the power of compounding profits between cycles since Jan 1, 2016 using Preset 9F...

12 Unit Cycle-to-Cycle Compounding Model (Preset 9F)

allocating $200 per 0.01 unit size at the beginning of each cycle  * This is a hypothetical compounding model to show system potential.

* This is a hypothetical compounding model to show system potential.

Past performance is not indicative of future results. Individual results will vary.

LOT SIZING MANAGEMENT (Preset 9F):

$200+ balance is recommended per 0.01 unit size. Allocate more than $200 per 0.01 unit size for additional cushion. When increasing lot sizes for larger balances, keep all lot settings below relative. Follow the instructions in the notes next to each setting below. You may also load a Preset file included with the EA for larger unit sizes. The $200 minimum margin per 0.01 unit size is for accounts with 200:1 max leverage or greater. Allocate $350+ per 0.01 unit size if your max leverage is 100:1 and $1200 per 0.01 unit size with 30:1 max leverage at UK brokers. If there is insufficient margin, the EA will open the largest trade possible by default. Move to Blueberry Markets for up to 500:1 max leverage and you can also get this EA FREE! Your broker MUST also allow hedging!

Minimum_Lot: 0.01 (Minimum $200 balance per 0.01 with 200:1 max leverage or greater. )

UnitSize_Up: 0.01 (Set equal to your Minimum_Lot setting above)

UnitSize_Dn: 0.01 (Set equal to your Minimum_Lot Setting above)

Maximum_Lot: 0.12 (Set to 12x your Minimum_Lot setting above)

Stay_At_Max_Lots: False

Important Note on Money Management: If you're trading aggressively and ever lose more than 50% of the starting balance of a money management "cycle" (known as a "cycle draw-down" in my book), decrease your lot sizes according to your current account equity to avoid a blow-out. Doubling your account with this model is relatively easy so don't worry about it too much, but you must be diligent to decrease your lot sizes at the 50% threshold to make sure you stay in the game. Record your starting balance at the beginning of each money management cycle so you don't forget. For the record... the worst cycle draw-down that I could generate in backtesting with Preset 9F (by starting the EA at the worst possible time) was only $79 since Jan 2016 using 0.01 unit size but it's always possible to have larger cycle draw-downs in the future.

MULTI-POSITION MANAGEMENT Settings:

Enter whole numbers in the settings below EXCEPT for the Unit_Size setting. There is no need to change these settings for different account balances. Use the Lot Sizing settings above to adjust for larger balances. Follow the instructions in the notes next to each setting. You may also load a Preset file included with the EA.

Unit_Size: 0.01 (This setting is only used when the Lot Sizing settings (above) are disabled)

Minimum_Positions: 1 (Keep this setting at 1 regardless of your balance)

Increase_Positions_By: 1 (Set equal to your Minimum_Positions setting above)

Decrease_Positions_By: 1 (Set equal to your Minimum_Positions setting above)

Maximum_Positions: 2 (Set to 2x your Minimum_Positions setting above)

Stay_At_Max_Positions: False

Trading Hours (GMT+2 March - Nov, GMT+3 Nov - March):

Start Time: 00:45

End Time: 23:45

The Trading Hours settings are set to prevent the robot from trading at the "End of Day" rollover time when the spreads are typically much larger. Adjust the Start Time and End Time time settings according to the time zone of your broker's price feed so the EA does not attempt to trade at the "End of Day" rollover time. The settings above exclude the 00:00 candle opening time. Contact Don if you need help determining these settings.

3-D MONEY MANAGEMENT

Explained in More Detail...

This new V9 EA includes, what I call, 3-D Money Management. In addition to stacking positions at different prices and applying the standard Roulette TRADER Lot Sizing strategies taught in Roulette TRADER book, this EA ALSO includes Multi-Position abilities.

This allows the EA to increase or decrease the number of positions opened at each entry point AND adjust the lot sizes of those multiple new positions. Both types of money management can follow their own strategy independent of the other. This means it can use Positive Progression lot sizing while also using Negative Progression Position Sizing, or the other way around, or they can both follow the same strategy - one using lots and one using positions.

Opening multiple positions at different entry prices is called STACKING and Negative Progression Stacking (as this EA does) makes it easier to achieve a profitable outcome since your profit target follows your average entry price. Usually, some positions will close at a small loss while others close at a profit that is larger than the losing positions. This results in a net profit on the series of trades.

Here's an example of Positive Progression Lot Sizing combined with Positive Progression Position Sizing (2 position Stay at Max). It is too difficult to include the 3rd dimension of Stacking positions at different entry prices, so we will leave that out of this example...

Positions: 0.01 > Lose (Stay at 1 position and 0.01 lot until a win)

Positions: 0.01 > Lose

Positions: 0.01 > Win (Increase to 2 positions and 0.02 lots)

Positions: 0.02 + 0.02 > Win (Stay at Max 2 positions until a loss)

Positions: 0.03 + 0.03 > Win (Stay at 2 positions. Increase lots to 0.04)

Positions: 0.04 + 0.04 > Win (Stay at 2 positions. Increase lots to 0.05)

Positions: 0.05 + 0.05 > Win (Stay at 2 positions. Increase lots to 0.06)

Positions: 0.06 + 0.06 > Lose (Decrease to 1 position and 0.05 lots)

Positions: 0.05 > Lose (Stay at 1 position and decrease to 0.04 lots)

Positions: 0.04 > Win (Increase to 2 positions and 0.05 lots)

Positions: 0.05 + 0.05 > Win (Stay at 2 positions and increase to 0.06 lots)

Positions: 0.06 + 0.06 > Win (Stay at 2 positions and increase to 0.07 lots)

Positions: 0.07 + 0.07 > Win

Continue this pattern until a win at 0.12 lots (if using a 12 unit cycle target) then drop back to 0.01 lot to lock in the profit from the previous cycle. You can then compound profits by increasing the unit size to scale it up.

The EA can reference the P/L of the last CLOSED trade OR the current P/L of the last opened FLOATING trade that is still open. You decide in the settings. The EA also allows you to determine how large or small a win or loss must be in order to qualify for a change in lot size or number of positions on the next trade. If a win or loss is not large enough in pips (according to your settings), it will resume the same lot size or position size on the next trade.

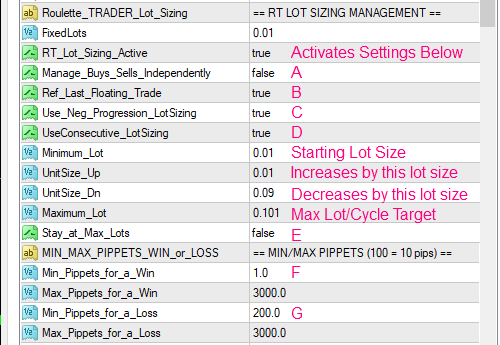

Money Management Settings...

- A. The Roulette Trader Money Management system in this EA can manage lot sizes AND number of positions for Buys and Sells separately (see "A" in screenshot below) so each can follow their own money management cycle independently.

- B. Since the EA can have multiple open positions, you can also choose to have the EA reference the P/L of the last opened "Floating" trade to determine the next lot size AND number of positions instead of referencing the last "closed" trade. You decide with a True/False switch (B) in each section of the settings shown below.

- C. Negative Progression: Change the Money Management to Negative Progression with a True/False switch. Negative Progression increases lots or positions following losses and decreases lots or positions following wins.

- D. Change Money Management strategy from Consecutive Wins to Cumulative Wins with a True/False switch. Read my ebook to learn about these Money Management strategies.

- E. Enable the "Stay At Max" strategy with a True/False switch. If True, the lot size (or number of positions) will Stay at the Max setting on a winning streak when using Positive Progression (Negative Progression disabled), or it will Stay at the Max setting during a losing streak when the Negative Progression setting is enabled.

Lot Sizing Settings

Multi-Position Settings

The settings shown are for illustration only. Don't copy them.

- F & G. Minimum Pippets for a Win/Loss: The next trade's lot size (or number of positions) will not change unless the previous trade's win or loss is at least this large and also must not exceed the "Maximum Pippets" settings. 10 pippets = 1 pip.

- It is OK to restart MT4 without interrupting the money management: This EA calculates the next lot size at the opening of each trade by referencing the result of the last relevant trade in the history even if it occurred during a previous MT4 session. Therefore, you may restart MT4 as often as you want as long as you don't detach the EA from the chart during a money management cycle. Detaching and re-attaching the EA to your chart will re-initialize the EA and start a new money management cycle at the Minimum Lot setting.

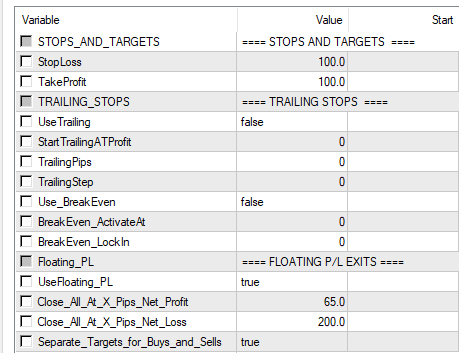

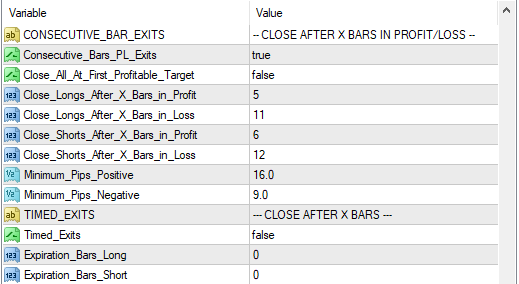

EXIT STRATEGIES

This EA includes multiple types of exit strategies. Most are not used in the default EUR/CHF strategy (backtest shown on this page above) but you may enable them to test different types of exits. The following exit strategies are included in this EA and you may customize them in the EA properties...

- Hard Stop-Loss and Profit Target

- Step Trailing Stop: Adjusts the stop-loss in steps every X pips into profit

- Break Even Trailing Stop: Adjusts the stop-loss one time at X pips profit

- Big Move Exits using MA4: Closes trades when MA1 is X pips distance from MA4 (not shown in settings below).

- Floating P/L Exits: Combines the Profit and Loss (in pips) of all open floating positions. With a True/False setting, you can make it count the P/L of Buys and Sells separately or combined. Closes trades with a market order, which keeps your real targets hidden from your broker.

- Consecutive Bar Exits: Closes trades after X consecutive profitable bars (candles) or X consecutive losing bars that meet the minimum pip requirement.

- Timed Exits: Closes trades after any specified number of bars. This allows the EA to be used for Binary Options.

The settings shown are for illustration purposes only.

Don't copy them.

EUR/CHF

Trend-Following STACKER EA

Only $29 Annual Renewal Fee.

Only $77 for current Robot customers!

Log in to show the $77 buy button.

Risk Disclosure: This website does not guarantee income at any time, nor success of the product beyond the specific 60-day performance guarantees for each product. There are many factors that can effect each person's individual results. Examples shown in this presentation do not represent an indication of future success or earnings but merely hypothetical historical performance based on specific trading models. Past performance is not indicative of future results. The company declares the information shared is true and accurate.

U.S. Government Required Disclaimer - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN