Portfolio #4

(3-Robot Combination)

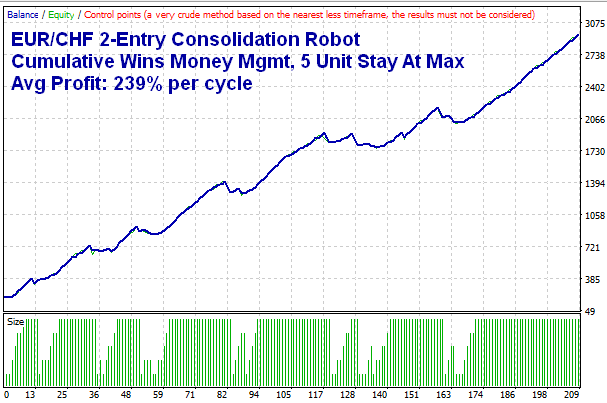

EUR/CHF 2-Entry Consolidation Trading Robot

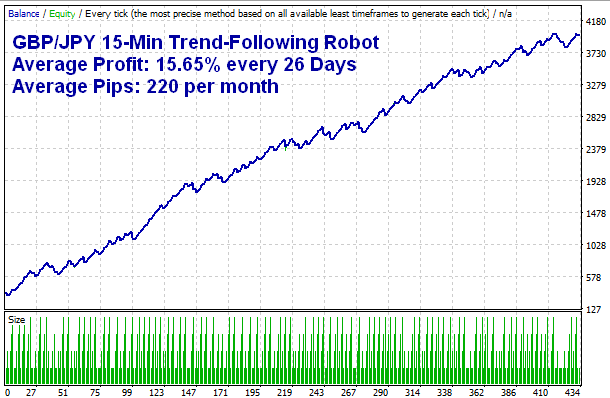

+ GBP/JPY Trend-Following Trading Robot

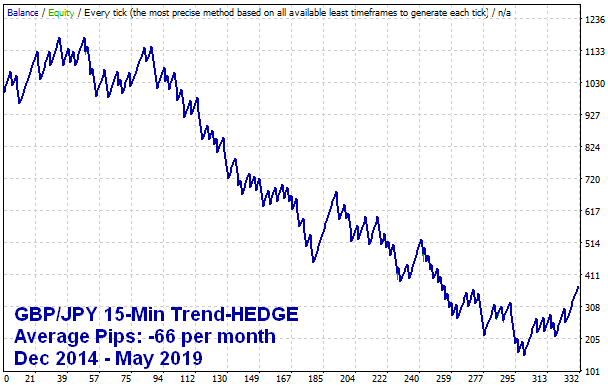

+ GBP/JPY Trend-HEDGE Trading Robot

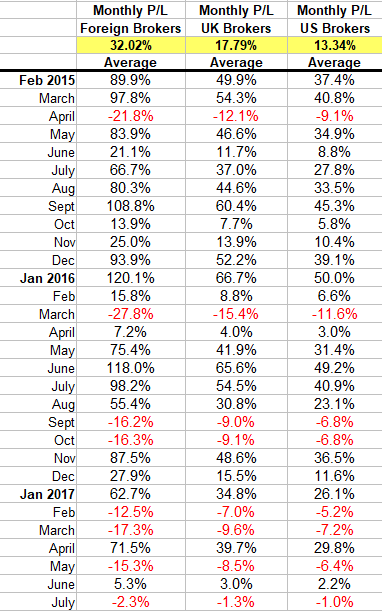

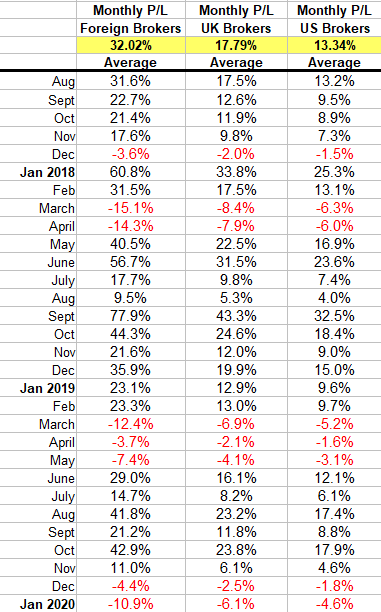

Up to 32% Average Monthly Return with 1:100+ Max Leverage w/Broker Hedging Allowed

Up to 17.79% Average Monthly Return at UK Forex Brokers (Hedging Allowed)

Up to 13.34% Average Monthly Return at US Forex Brokers (No Hedging Allowed)

Non-compounded growth curve

Special Bundle Price... Save $114!

Unlimited MT4 Accounts!

- Only $29 Annual Renewal Fee per Robot -

Get big discounts on future purchases!

EUR/CHF

2-Entry Consolidation Robot See Details

See Details

GBP/JPY

15-Min Trend-HEDGE Robot This EA is Not Sold Separately

This EA is Not Sold Separately

It is only to smooth draw-downs

GBP/JPY

15-Min Trend-Following Robot See Details

See Details

This 3-Robot combination averages about 254 pips per month and offers very high profit potential due to low draw-downs, thanks to each robot's uncorrelated (and opposite correlation) performance.

Notice that the Trend-HEDGE Robot's performance is actually negative. Yes, overall it's a losing strategy, but don't let the negative equity curve of the Trend-HEDGE robot fool you! On average, the Trend-HEDGE robot only loses 66 pips per month, while the Trend-Following robot averages +220 pips per month but it's a necessary evil that gives this portfolio it's small draw-downs by coming to the rescue when the Trend-Following robot is most likely to take losses (one does well when the other loses). In addition, the Trend-Following robot increases lot sizes following wins (snowballing profits) to exploit winning streaks during trends.

The EUR/CHF Consolidation robot has no correlation to the GBP/JPY robots. It trades completely different currencies in high volatility and it also increases lot sizes following wins to snowball profits during favorable market conditions. This combination of uncorrelated performances and position sizing strategies provides a smooth equity curve with relatively very small draw-downs. However, your broker's trading restrictions will influence your potential profitability.

For example, at forex brokers who allow hedging with 1:100 max leverage (or greater), this portfolio averages 32% profit per month with a maximum 32.5% month-end draw-down in the past 58 months when allocating my minimum recommended capital (details further below). You can reduce the draw-downs by simply allocating more funds to the same lot sizes.

At UK Regulated brokers who allow hedging with 1:30 max leverage, the average return is 17.79% per month with a max month-end draw-down of 18.08% when allocating my minimum recommended capital (details further below).

At US Regulated brokers who do NOT allow hedging with 1:20 to 1:50 max leverage, the average return 13.34% per month with a max month-end draw-down of 13.56% when allocating my minimum recommended capital. The lower returns are due to the lower maximum leverage restrictions and additional capital required to fund 2 separate MT4 accounts. The 2 GBP/JPY robots must be traded on separate MT4 accounts to avoid hedging conflicts at US brokers. NOTE: You can open multiple MT4 accounts under a single primary account and you can easily transfer funds between them with a click.

Monthly P/L

2015

Feb: $224.69

March: $244.57

April: -$54.47

May: $209.64

June: $52.69

July: $166.64

Aug: $200.81

Sept: $272.02

Oct: $34.79

Nov: $62.52

Dec: $234.85

: $0

2020

Jan: -$27.36

----------------

Total: $4803.95

2016

Jan: $300.13

Feb: $39.49

March: -$69.51

April: $17.98

May: $188.54

June: $295.05

July: $245.47

Aug: $138.41

Sept: -$40.61

Oct: -$40.78

Nov: $218.87

Dec: $69.82

2017

Jan: $156.70

Feb: -$31.33

March: -$43.29

April: $178.65

May: -$38.19

June: $13.29

July: -$5.80

Aug: $78.97

Sept: $56.78

Oct: $53.41

Nov: $43.97

Dec: -$9.10

2018

Jan: $152.07

Feb: $78.86

March: -$37.77

April: -$35.75

May: $101.18

June: $141.81

July: $44.24

Aug: $23.86

Sept: $194.84

Oct: $110.64

Nov: $53.89

Dec: $89.71

2019

Jan: $57.84

Feb: $58.29

Mar: -$31.08

April: -$9.31

May: -$18.42

June: $72.58

July: $36.78

Aug: $104.62

Sept: $53.00

Oct: $107.24

Nov: $27.56

Dec: -$11.05

How To Set Up Portfolio-4 at Brokers Who Allow Hedging...

(Only 1 MT4 Account Needed)

If your forex broker (outside the USA) allows hedging, as most do, then you may run all 3 robots in the same MT4 account, as follows...

1). Open a GBP/JPY 15-Min chart and Attach the GBPJPY 15-Min Trend-Following 4-Unit EA to the chart. Refer to the EA Setup Tutorial if you need help. This EA uses Consecutive Wins Money Management with a 4 unit cycle target.

2). Open a 2nd GBP/JPY 15-Min chart in the same MT4 account and attach the GBPJPY 15-Min Trend-HEDGE EA to that chart. This EA should run in Fixed Lot mode with RT Money Management disabled.

3). Open a EUR/CHF 1-Hour chart in the same MT4 account and attach the EURCHF 1-Hr 2-Entry Consolidation EA to the chart. You may load Preset files from 5a - 5i included with your purchase. These settings use Cumulative Wins 5-unit Stay At Max money management.

4a). At forex brokers who allow hedging with at least 1:100 max leverage, use the following settings for EACH $250+ balance for a 32% average monthly return and 32.5% max month-end draw-down since December 2014...

4b). At forex brokers who allow hedging with 1:30 max leverage (UK brokers), use the following settings for EACH $450+ balance for a 17.79% average monthly return and 18% max month-end draw-down since December 2014...

Portfolio-4 Setup at Brokers who Allow Hedging

(Run ALL 3 EAs in the SAME MT4 Account)

GBPJPY 15-Min Trend-Following 4-Unit EA

RT Money Management Active:True

Use Negative Progression: False

Use Consecutive Method: True

Minimum Lot: 0.01

Unit Size: 0.01

Max Lot/Cycle Target: 0.04 (4 unit target)

Stay At Max Lots: False

GBPJPY 15-Min Trend-HEDGE EA

Fixed Lots: 0.02

RT Money Management Active: False

BreakEven TrailStop Activate at: 95

BreakEven TrailStop Pips to Lock In: 75

EURCHF 1-HR 2-Entry Consolidation EA

(Preset file 5a)

RT Money Management Active: True

Manage Buys_Sells Separately: False

Reference Last Floating Trade: False

Use Negative Progression: False

Use Consecutive Method: False

Minimum Lot: 0.01

Unit Size Up: 0.01

Unit Size Dn: 0.04

Max Lot/Cycle Target: 0.05

Stay At Max Lots: True

5). When opening hedged GBP/JPY positions on the same MT4 account, your used margin will be based on a sum of the hedged positions (ie. 0.03 lots long -0.02 lots short = 0.01 lot long). However, it's possible for both GBPJPY EAs to trade in the same direction for short periods of time. Therefore, you must still have enough margin to open up to 0.11 lots of between the 3 EAs combined (0.04 + 0.02 +0.05 = 0.11). If you ever find that you could exceed your minimum margin requirement at any time, either decrease your lot sizes or deposit more funds so you do not miss any trades due to insufficient margin.

6). How to Scale Up: If your broker falls under #4a above (1:100+ max leverage), then divide your total portfolio balance by $250 and multiply all the lot sizes shown above by that number. For example, if your balance is $3200, divide by $250 and you get 12.8. Round down to 12 so you are not over-leveraged and multiply all the lot sizes for each EA above by 12 to keep their lot ratios relative to each other. To trade less aggressively, divide your balance by more than $250.

If your broker falls under #4b above (1:30 max leverage), divide your portfolio balance by $450 or more and multiply the lot sizes above by that number. For example, if your portfolio balance is $3000, divide by $450 and you get 6.6. Round down to 6 so you are not over leveraged and multiply all lot sizes shown above by 6 to keep their lot ratios relative to each other. To trade less aggressively, divide your balance by more than $450. With 30:1 max leverage, the main reason you would allocate more funds is to make sure you always have enough margin to open all the trades at the same time at their maximum lot.

How To Set Up Portfolio-4 at Brokers Who DON'T Allow Hedging...

(2 Separate MT4 Accounts Needed at US Brokers)

Due to CFTC Regulations in the USA, all US-Regulated forex brokers cannot allow hedging in the same MT4 account and they must also enforce FIFO restrictions (First In, First Out). So, if your account is at a US regulated forex broker, or any other broker that does not allow hedging, then you must run each GBPJPY EA in a separate MT4 account. Luckily, all brokers allow you to open multiple MT4 accounts under your primary account so it is still possible to follow this portfolio model. However, it will require more total funds because you must fund 2 separate MT4 accounts. To implement, open 2 separate MT4 accounts and set them up as follows...

1). In one MT4 account, attach the GBPJPY 15-Min Trend-Following 4-Unit EA to a GBP/JPY 15-Min chart. In this account, deposit at least $300 per 0.01 unit size (0.04 Max Lot/Cycle Target). This EA will trade on this account alone. Refer to the EA Setup Tutorial if you need help. This EA uses Consecutive Wins Money Management with a 4 unit cycle target.

2). In the 2nd MT4 account, open a GBP/JPY 15-Min chart and attach the GBPJPY 15-Min Trend-HEDGE EA to that chart. Deposit at least $300 per 0.02 Fixed Lot in this account. Despite the name, this EA does NOT hedge against it's own trades. This EA should run in Fixed Lot mode with RT Money Management disabled.

3). In the SAME MT4 account used in #2 above, open a EUR/CHF 1-Hour chart and attach the EURCHF 1-Hr 2-Entry Consolidation EA to that chart. You may load Preset files from 5a - 5i included with your purchase. These settings use Cumulative Wins 5-unit Stay At Max money management.

Follow the Money Management settings in the yellow boxes below and keep their lot sizes relevant to each other. For example, if you increase the lot sizes on one EA, you should increase the lot sizes on all 3 EAs accordingly to keep them balanced...

Portfolio-4 Setup for US-Regulated NON-Hedging Brokers

(Run the 2 GBP/JPY EAs in Separate MT4 Accounts)

MT4 Account #1

GBPJPY 15-Min Trend-Following 4-Unit EA

Settings per $300+ Balance...

RT Money Management Active: True

Use Negative Progression: False

Use Consecutive Method: True

Minimum Lot: 0.01

Unit Size: 0.01

Max Lot/Cycle Target: 0.04 (4 unit target)

Stay At Max Lots: False

MT4 Account #2

GBPJPY 15-Min Trend-HEDGE EA

Settings per $300+ Balance...

Fixed Lots: 0.02

RT Money Management Active: False

BreakEven TrailStop Activate at: 95

BreakEven TrailStop Pips to Lock In: 75

MT4 Account #2

EUR/CHF 1-Hour 2-Entry No-Hedge EA

(Preset file 5a)

RT Money Management Active: True

Manage Buys_Sells Separately: False

Reference Last Floating Trade: False

Use Negative Progression: False

Use Consecutive Method: False

Minimum Lot: 0.01

Unit Size Up: 0.01

Unit Size Dn: 0.04

Max Lot/Cycle Target: 0.05

Stay At Max Lots: True

4). The minimum deposits recommended for each MT4 account above are assuming your broker does NOT allow hedging with 1:20 to 1:50 max leverage. With a combined minimum deposit of $600 between the 2 accounts and a combined average of $83.48 per month, your average monthly return is about 13.34% with an 13.56% max month-end draw-down since February 2015. You may compound profits each time your combined accounts grow by $600.

5). How to Scale Up: If your broker does not allow hedging and offers max leverage of 1:50 or less, divide your portfolio balance by $600 or more and multiply the lot sizes above by that number. For example, if your portfolio balance is $2000, divide by $600 and you get 3.3. Round down to 3 so you are not over leveraged and multiply all lot sizes shown above by 3 to keep their lot ratios relative to each other. To trade less aggressively and better stay above your margin requirements, divide your balance by more than $600. Keep in mind that while US brokers advertise 50:1 max leverage, their max leverage for GBP/JPY is usually only 20:1.

When To Compound Profits...

In this portfolio model, the 15-Min Trend-Following robot is using the automated Roulette Trader Money Management system with a 4-unit cycle target, while the Trend-HEDGE EA uses Fixed Lots and the EUR/CHF Consolidation robot uses Cumulative Wins Money Management with the "Stay At Max Lots" feature so lot sizes stay large during winning streaks. Since you do not want to interfere with the money management cycle of the Trend-Following robot, simply compound profits (increase lot sizes) on all 3 robots each time the Trend-Following robot completes a 4-unit cycle (4 consecutive wins) instead of at the end of each month. This is assuming you have enough profits to justify the lot increase (note the minimum margin requirements for your broker type). On average, a 4-unit cycle completes once every 26 days so you will sometimes have more than one compounding opportunity per month but there will also be some cycles that last much longer than a month.

When the Trend-Following robot wins it's 4th consecutive trade (completing a 4 unit cycle), your account will usually be at a new profit high point, which is a great time to compound your profits. So let your results determine when to compound profits rather than the end of each month. I will send out a newsletter each time the trend-following robot hits a 4 unit cycle target so you don't need to watch your charts so closely but be sure to open all your emails from me so you don't miss a compounding opportunity.

$139 Bundle Price Includes...

- Instant Download!

- 3 GBP/JPY Trading Robots with 1-year licenses for one low price (save $104)!

- GBP/JPY 15-Min Trend-Following Robot

- GBP/JPY 15-Min Trend-HEDGE Robot

- EUR/CHF 2-Entry Consolidation Robot

- Get a 4th CHF/JPY Bonus Robot FREE! Watch your email for details!

- Low $39 annual renewal fee per robot!

- Year-long unlimited customer support!

- Lifetime Membership to the Roulette Trader Member's area & Trading Tutorials

- Deep Discounts on additional robots that are NOT included in this package!

- Includes a FREE Copy of the Roulette TRADER eBook!

- Guaranteed 250 PIPS Profitability within 60 Days or Your Money Back! (See the Guarantee terms below)

Special Bundle Price... Save $114!

Unlimited MT4 Accounts!

- Only $29 Annual Renewal Fee per Robot -

PERFORMANCE GUARANTEE

$139 Portfolio-4 3-Robot Bundle Guarantee: My Portfolio-4 bundle guarantee is based on the combined performance of the GBP/JPY 15-Min Trend-Following Robot and the GBP/JPY 15-Min Trend-HEDGE Robot and EUR/CHF 2-Entry Consolidation Robot. If these 3 robots do not make at least 300 pips (over half the average) in combined net profit within 60 days of your purchase, I will refund 100% of your purchase price whether you were trading these robots on your own account or not. Just contact me with your receipt and a quick look at these robots' 60-day performance on my LIVE Model Accounts (tracked by MyFXBook.com) will confirm if you qualify or not. Therefore, you do not need to be trading them on your own account to qualify. However, please be aware that your robots will be permanently disabled if you receive a refund.

Risk Disclosure: This site and the products and services offered on this site are not associated, affiliated, endorsed, or sponsored by Google, ClickBetter, eBay, Amazon, Yahoo or Bing nor have they been reviewed tested or certified by Google, ClickBetter, Yahoo, eBay, Amazon, or Bing. Roulette Trader does not guarantee income or success, and examples shown in this presentation do not represent an indication of future success or earnings. The company declares the information shared is true and accurate.

U.S. Government Required Disclaimer - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN