GBP/JPY 5-Min Trend-Scalping Robot

with Roulette TRADER Money Management

- Includes FREE BONUS Counter-Trend Scalper EA -

See Bottom of Page

System Details

This GBP/JPY 5-Min Trend-Scalping Robot is optimized for the 5-minute candlestick chart. It enters on pullbacks in the direction of the current short-term trend during a 3-6 hour trading window, depending on the preset file you choose to run.

2 Custom Exits:

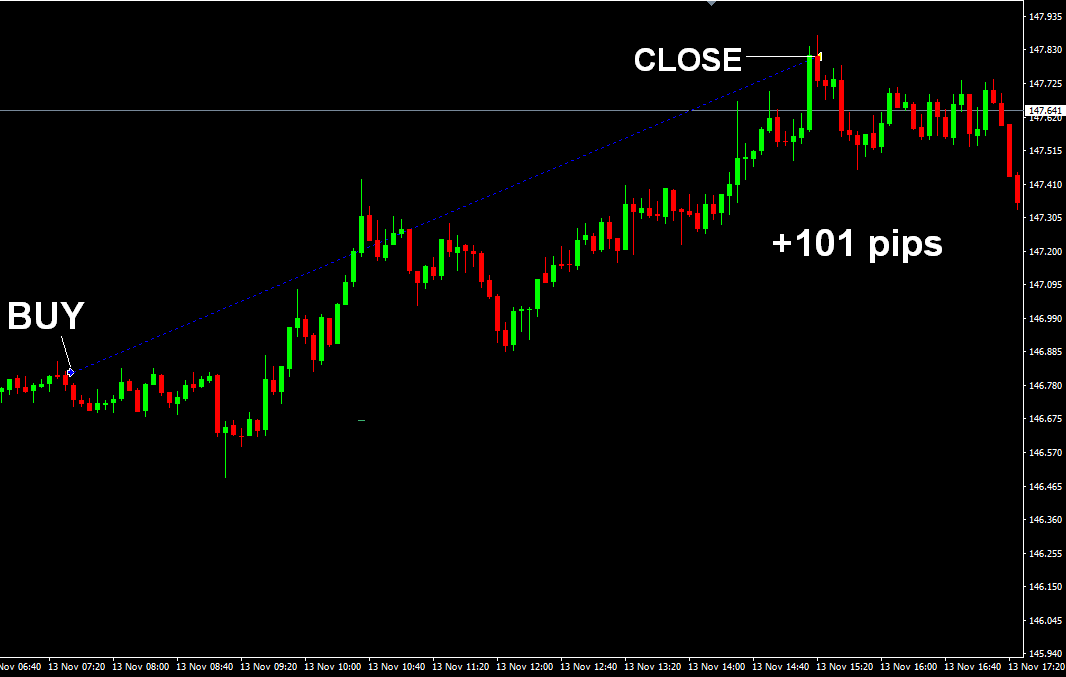

The "Scalping" feature of this EA is more about the exits than the entries since it's easier to exit following a big move in your favor than it is to predict when it will happen and this EA has 2 different types of exits following spikes into profit. One exit strategy closes the trade on large 1 to 3 candle moves in your favor and the other closes on larger moves over more candles and you can customize each of these for buys and sells. These are measured by the distance between price and certain moving averages. So, even though most of the preset files included with this robot use a 175 pip profit target, most trades are closed long before the profit target is hit. It does not discriminate where these exits occur so if price is moving against you and suddenly makes a brief spike in your favor, the trade can close with a small win or small loss, depending on where the exit is triggered. Below are 2 examples of these exit signals...

Money Management:

This EA includes the ability to use every possible Roulette Trader Money Management strategy...

- Change from Consecutive Wins to Cumulative Wins strategy with a True/False switch.

- Change from Positive Progression to Negative Progression with a True/False switch.

- Activate the "Stay At Max" technique with a True/False switch.

- Determine how large a win or loss should be in order to qualify for a lot adjustment on the next trade using Minimum_Pippets_for_a_Win and Minimum_Pippets_for_a_Loss (10 pippets = 1 pip)

Preset Files:

This EA includes preset files for many different settings. All are good but some trade more often than others (longer trading hours) and some use larger stops than others. You will need to choose the preset file that best fits your trading style and broker. For example, if your broker widens spreads on the weekend (like Oanda), then you should use the preset files with a 60 pips stop-loss instead of 40 pips.

Likewise, if you want fewer trades with a higher win rate, then use the preset files that trade fewer hours per day like 6-10 or 7-10 instead of 4-10. Preset files are included for price data on the following time zones: GMT and GMT+2 (Jerusalem time). Most forex brokers' price feed is running on one of these two time zones. This represents the time on your charts and NOT your computer's local time or the time zone of your broker's office location.

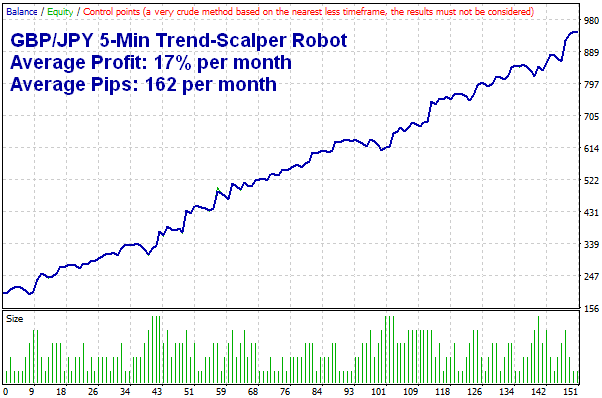

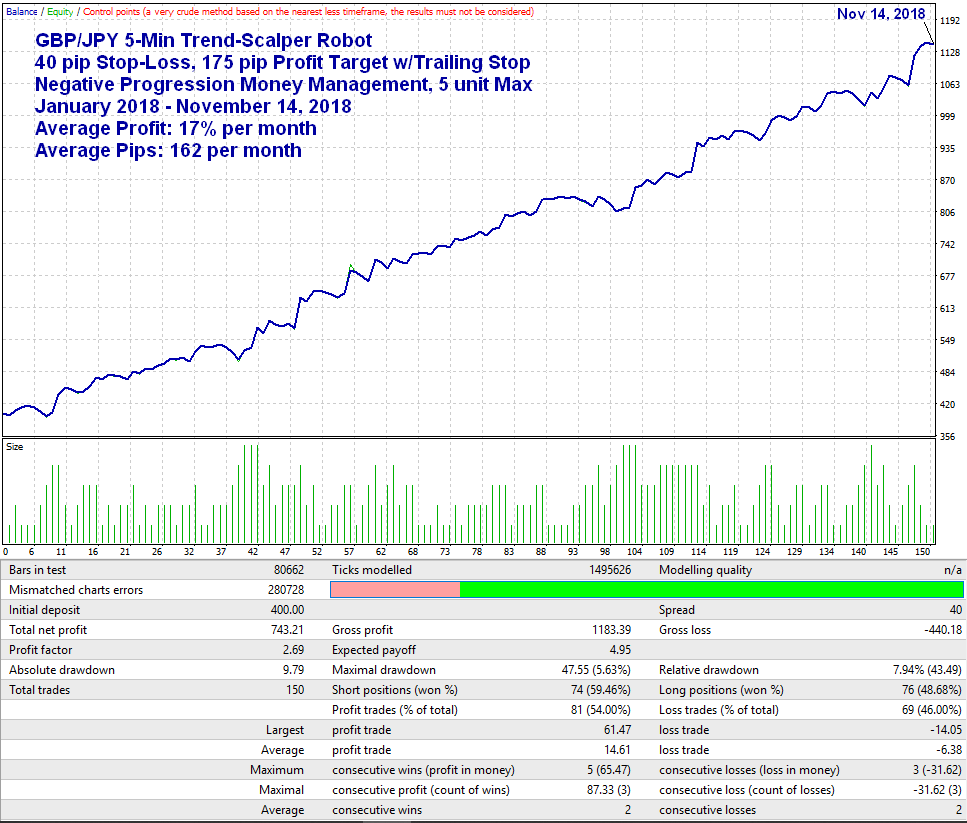

Negative Progression Money Management

40-pip Stop-Loss, 4-10 AM (GMT+2) Trading Window

This strategy uses Negative Progression Money Management with a 5-Unit Maximum lot. It increases the lot size by 1 unit following a "qualifying" loss (35 pips or greater) and decreases the lot size by 2 units following a "qualifying" win (45 pips or greater). It uses a 1-step trailing stop-loss. At 50 pips profit, it moves the stop-loss to -15 pips and does not move it again. With Money Management applied, the average win is 2.2 times the size of the average loss.

This model trades 6 hours per day and averages 162 pips and 14 trades per month. At my maximum recommended leverage, it averages 17% per month. The backtest below was made on 5-Min data from IC Markets standard spread account (not ECN data) using a 4 pip spread (a setting of 40 in the Strategy Tester). This is the default settings in the EA.

Negative Progression Money Management, 40-pip Stop, 4-10 AM Trading Window (Preset File 1c)

PRESET FILE:

Below is the name of the Preset File used for the backtest shown above. Just load it in your EA Properties.

CLICK LINK BELOW to see a LIVE ACCOUNT trading this model (1c) with a 50-pip stop-loss:

https://www.myfxbook.com/members/RouletteTrader/gbpjpy-5-min-scalper/2744589

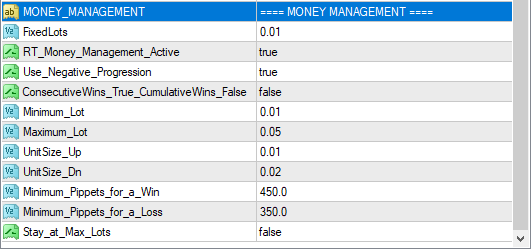

MONEY MANAGEMENT SETTINGS, 5 UNIT MAX:

Following are the Money Management Settings used in the Backtest above...

Minimum_Lot: 0.01 (Minimum $400 margin per 0.01 lot w/30:1 max broker leverage or $300 margin per 0.01 w/100:1 leverage)

Maximum_Lot: 0.05 (Set to 5x your Minimum_Lot or UnitSize_Up setting, assuming they are equal)

UnitSize_Up: 0.01 (Set equal to your Minimum Lot setting above)

UnitSize_Down: 0.02 (Set to 2x your Minimum Lot setting above)

Minimum_Pippets_for_a_Win: 450 (450 = 45 pips)

Minimum_Pippets_for_a_Loss: 350 (350 = 35 pips)

Stay_At_Max_Lots: False

NOTE: The $400 margin per 0.01 Minimum Lot recommendation is the MAXIMUM recommended leverage. This is especially important when trading at brokers that have high margin requirements for GBP/JPY like 30:1. Despite the $47 max draw-down in the backtest shown above, these settings can potentially generate peak-to-valley draw-downs over $100 per 0.01 Minimum_Lot and 0.01 UnitSize_Up setting so you should anticipate that it will eventually happen. On a $400 balance, a $100 draw-down is 25%, while average monthly profits are around 17%. Following a $100 draw-down, you should still have enough margin in your account to open a 5-unit trade and this is why I recommend a minimum of $400 per 0.01 Minimum Lot. If your goal is more than 17% per month and your broker offers AT LEAST 1:100 leverage, you should really consider using the Cumulative Wins model shown further below (preset file 4d), which uses Positive Progression Money Management. The equity curve is not as smooth but using positive progression money management makes it safer, allowing for higher leverage and higher potential returns.

Compounding Tip: You may compound profits monthly, or as often as you wish, but you should only compound profits when the next trade should open at your Minimum Lot setting to avoid interfering in the position-sizing strategy.

YOUR CHART TIME ZONE:

This EA trades in a narrow 3-6 hour window per day so it is EXTREMELY IMPORTANT that you get this right. There are preset files included for GMT and GMT+2 time zones. GMT+2 is Jerusalem time and the most commonly used time zone by forex brokers. This represents the time zone of YOUR PRICE FEED and NOT your local time or your broker's local office time. Find out the time zone of your price feed by placing the cross-hair tool over a current 1-Minute candle on your chart and the candle time will appear at the bottom of the cross-hair. Match your chart time to a time zone at: https://www.timeanddate.com/worldclock/

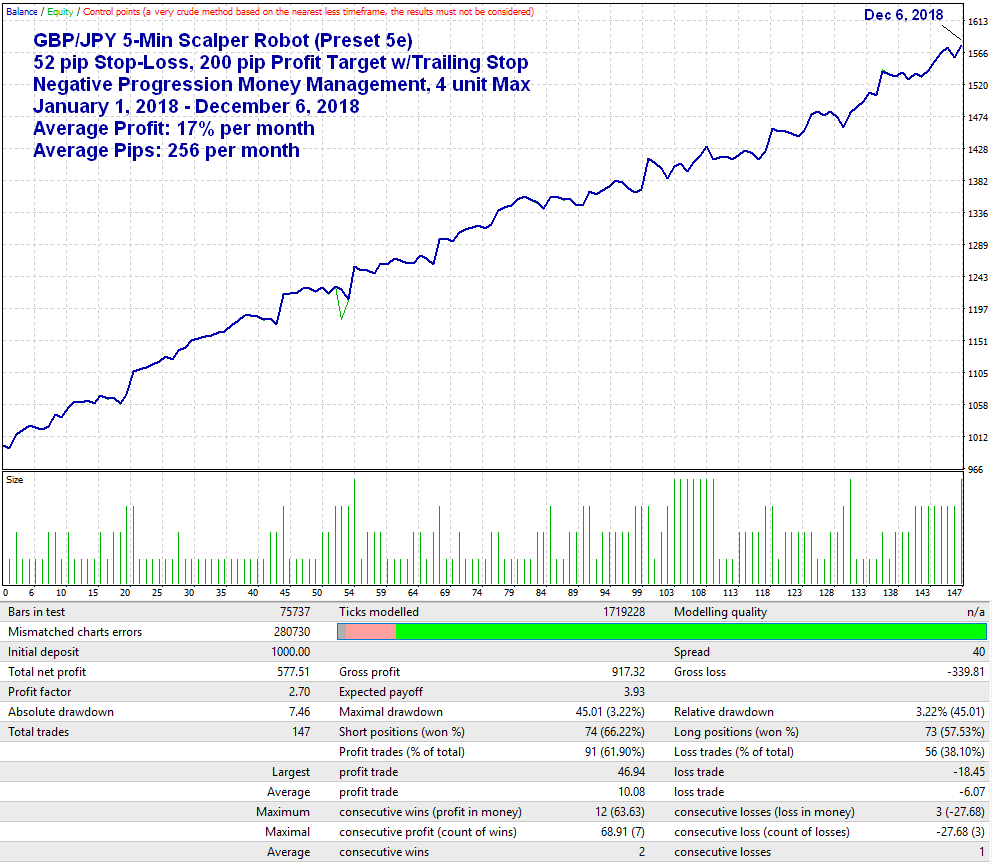

Negative Progression Money Management

Using the Hull Moving Average (HMA) Indicator

52-pip Stop, 200-pip Profit Target

This strategy uses the HMA indicator as the primary moving average and has one of the highest average pips per month of all the preset files included with this EA. Click Here for more info about the HMA indicator. This strategy (preset file 5e) uses Negative Progression Money Management with a 4-Unit Maximum lot. It increases the lot size by 1 unit following a "qualifying" loss of 39 pips or greater and decreases the lot size by 3 units following a "qualifying" win of 60 pips or greater. It uses a 1-step trailing stop-loss: at 40 pips profit, it moves the stop-loss to -20 pips and does not move it again.

This model trades in a 5-hour & 20 minute trading window per day and averages 256 pips and 13 trades per month. At my maximum recommended leverage at a broker offering max 30:1 to 50:1 Max Leverage, it averages 17% per month. The backtest below was made on 5-Min data from IC Markets standard spread account (not ECN data) using a 4 pip spread (a setting of 40 in the Strategy Tester). Using Negative Progression Money Management with this strategy does not improve the profit to draw-down ratio but it does create more frequent profit highs and a more consistent equity curve.

Negative Progression Money Management, 60-pip Stop, 5-10:20 AM Trading Window (Preset File 5e)

PRESET FILE:

Below is the name of the Preset File used for the backtest shown above. Just load it in your EA Properties.

MONEY MANAGEMENT SETTINGS (Negative Progression, 4 Unit Max):

Following are the Money Management Settings used in the Backtest above...

Minimum_Lot: 0.01 (Minimum $300 margin per 0.01 lot)

Maximum_Lot: 0.04 (Set to 4x your Minimum_Lot or UnitSize_Up setting, assuming they are equal)

UnitSize_Up: 0.01 (Set equal to your Minimum Lot setting above)

UnitSize_Down: 0.03 (Set to 3x your Minimum Lot setting above)

Minimum_Pippets_for_a_Win: 600 (600 = 60 pips)

Minimum_Pippets_for_a_Loss: 390 (390 = 39 pips)

Stay_At_Max_Lots: False

NOTE: The leverage settings shown above are my MAXIMUM recommended leverage and is doable at brokers that have high margin requirements for GBP/JPY like 30:1 or 50:1 max leverage. Despite the $45 max draw-down in the backtest shown above, these settings can potentially generate peak-to-valley draw-downs over $100 per 0.01 Minimum_Lot and 0.01 UnitSize_Up setting so you should anticipate that it will eventually happen. On a $300 balance, a $100 draw-down is 33%, while average monthly profits are around 17%. Scale this model up as your account grows but always make sure you have enough margin in your account to open a 4 unit trade following large draw-downs and adjust your lot sizes accordingly.

Compounding Tip: You may compound profits monthly, or as often as you wish, but you should only compound profits when the next trade should open at your Minimum Lot setting to avoid interfering in the position-sizing strategy.

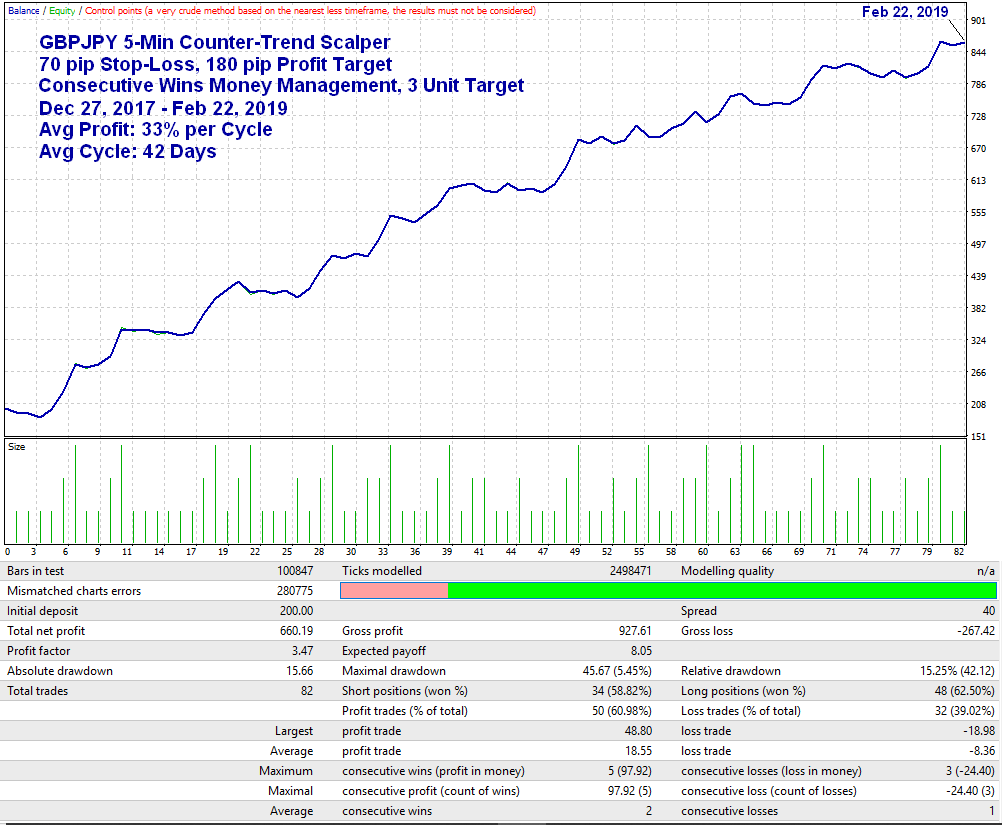

- FREE BONUS -

COUNTER-TREND SCALPER ROBOT

"Consecutive Wins" Money Management

This EA is included in your purchase as a FREE BONUS so you have a scalping strategy for all market conditions. This counter-trend scalping EA uses opposite logic as the Trend-Scalping EA detailed in the trading models shown above and trades at a different time of day.

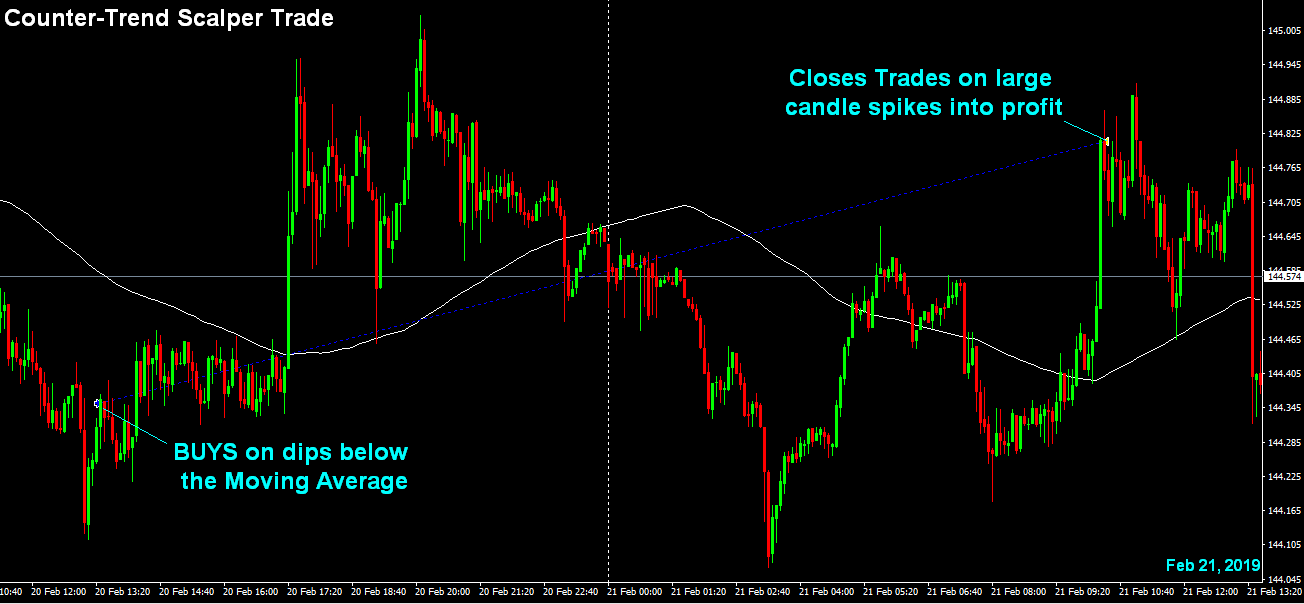

While the Trend-Scalping EA featured above buys "above" the primary moving average and sells below it, this Counter-Trend Scalping EA buys BELOW the primary moving average and sells ABOVE it. This typically gets you into trades at a better price (or on a pullback in a larger trend) since this strategy is running on a 5-min chart.

The "Scalping" feature is more about the exits than the entries since it's easier to exit following a big move in your favor than it is to predict when it will happen and this EA has 2 different types of exits following spikes into profit. One for large 1 to 3 bar spikes (as shown below) and another for larger spikes usually involving many more bars (typically strong surges in a trend). If neither of these occur, then the stop-loss, trailing stop, or profit target will ultimately close the trade.

The model shown below is using "Positive Progression" Consecutive Wins Money Management but you can change this to Negative Progression using a True/False switch in the settings. Using Positive Progression Money Management is safer and offers much higher profit potential since it snowballs lot sizes on winning streaks and quickly drops lot size following "qualifying" losses. The model shown below is the default settings and trades in a 1-hour window per day when price is usually pulling back from the previous session's move.

At my maximum recommended leverage, it can average up to 33% every 42 days (the average length of a money management cycle). The backtest below was made on 5-Min data from IC Markets standard spread account (not ECN data) using a 4 pip spread.

Counter-Trend Scalper: Consecutive Wins Money Management

PRESET FILE:

Below is the name of the Preset File used for the backtest shown above. Just load it in your EA Properties.

MONEY MANAGEMENT SETTINGS, Consecutive Wins, 3 Unit Cycle Target:

This trading model adds 1 unit after each win of 60+ pips and drops back to 1 unit (Minimum Lot) after any loss of 60+ pips. After a qualifying win of 60+ pips at your cycle target, the lots drop back to 1 unit to lock in the accumulated profit from that cycle. Following are the Money Management Settings used in the Backtest above...

Use_Negative_Progression: False

ConsecutiveWins_true_CumulativeWins_false = TRUE

Minimum_Lot: 0.01 (Minimum $200 margin per 0.01 lot doable with 1:30 max broker leverage)

Maximum_Lot: 0.03 (Set to 3x your Minimum_Lot or UnitSize_Up setting, assuming they are equal)

UnitSize_Up: 0.01 (Set equal to your Minimum Lot setting above)

UnitSize_Down: 0.01 (this setting is irrelevant when using the Consecutive Wins method)

Minimum_Pippets_for_a_Win: 600 (600 = 60 pips)

Minimum_Pippets_for_a_Loss: 300 (600 = 60 pips)

Stay_At_Max_Lots: False

Compounding Tip: You should compound profits only after a qualifying win at your cycle target. When changing lot sizes, detach and re-attach the EA (or restart MT4) to clear out the previous "Minimum Lot" setting that may be saved in memory.

Risk Disclosure: This website does not guarantee income at any time, nor success of the product beyond the specific 60-day performance guarantees for each product. There are many factors that can effect each person's individual results. Examples shown in this presentation do not represent an indication of future success or earnings but merely hypothetical historical performance based on specific trading models. Past performance is not indicative of future results and individual results will vary. The company declares the information shared is true and accurate.

U.S. Government Required Disclosure - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital.

*CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN